Public Storage Boasts Investment Grade Marks

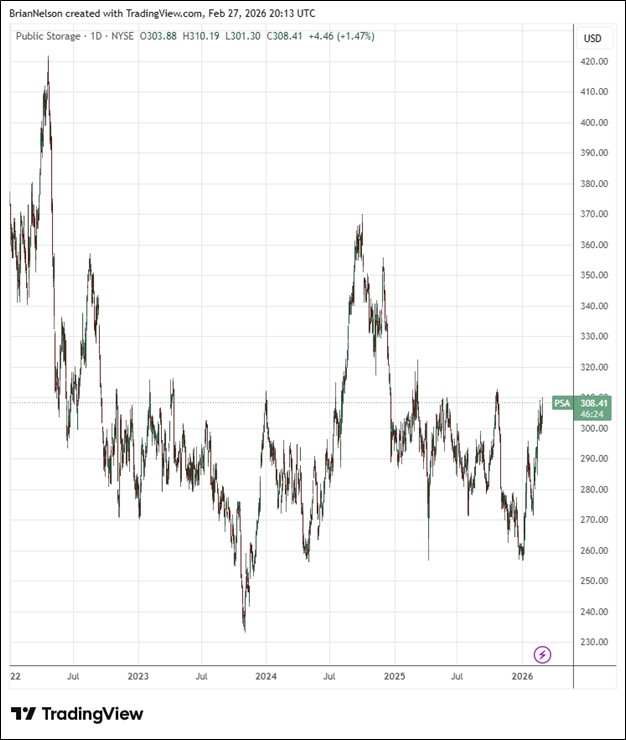

Image Source: TradingView By Brian Nelson, CFA Public Storage (PSA) recently reported better than expected fourth quarter results with revenue and funds from operations (FFO) exceeding the consensus forecast. Net income fell compared to the same period a year ago, but core FFO increased to $4.26 versus $4.21 in the year-ago period. Among the highlights in the quarter, the company achieved positive same store revenue growth in 56% of its markets, increasing from 49% during the fourth quarter of 2024. It achieved a 78.4% same store net operating income margin, while it acquired 13 self-storage facilities with 0.9 million net rentable square feet for $131 million. Public Storage delivered new developments and completed expansion projects, adding 1.0 million net rentable … Read more