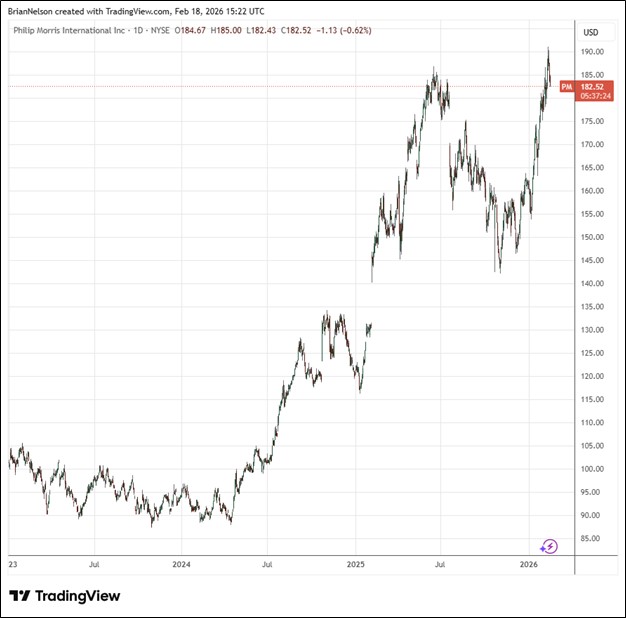

Philip Morris’ Growth Targets Are Solid

Image Source: TradingView By Brian Nelson, CFA Philip Morris (PM) recently reported fourth quarter results that were mixed with revenue missing the consensus forecast, but non-GAAP earnings per share coming in-line with estimates. In the fourth quarter, net revenues increased 6.8% led by a 12% increase in its smoke-free business. Organic growth was 3.7%. Gross profit advanced 5.1% on an organic basis, while operating income increased 4.5% on an organic basis. In the quarter, adjusted diluted earnings per share, excluding currency, came in at $1.69, up 9% year-over-year. For the full year 2025, its smoke-free business accounted for 41.5% of its total net revenues and nearly 43% of total gross profit. Management had the following to say about the … Read more