Walmart Continues to Execute Well

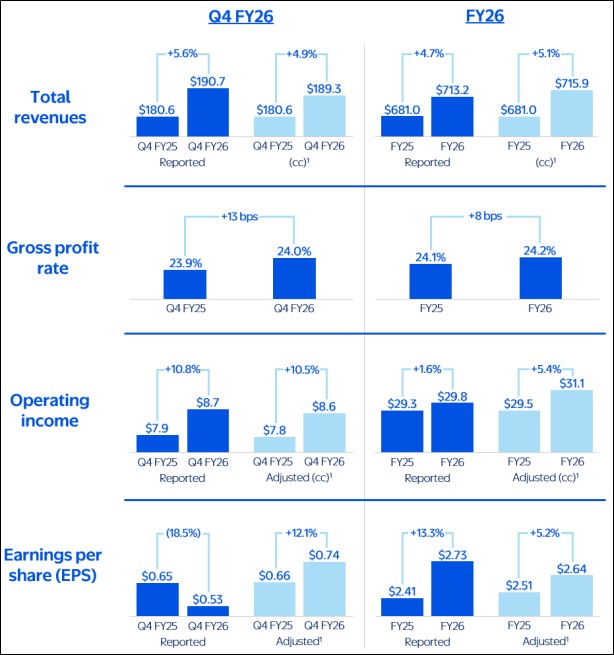

Image Source: Walmart By Brian Nelson, CFA On February 19, Walmart (WMT) reported better than expected fourth quarter fiscal 2026 results with both revenue and non-GAAP earnings per share beating the consensus forecast. Revenue increased 5.6% in the quarter and 4.9% in constant currency. Walmart U.S. comp sales increased 4.6% in the quarter. Global eCommerce sales grew 24% thanks to strength in store-fulfilled pickup & delivery and marketplace. Its global advertising business advanced 37%, including VIZIO, while Walmart Connect in the U.S. was up 41%. Membership fee revenue grew 15.1% globally. Walmart’s gross margin rate was up 13 basis points thanks to strength in Walmart U.S., while operating income was up $0.8 billion, or 10.8%, growing faster than sales. Adjusted … Read more