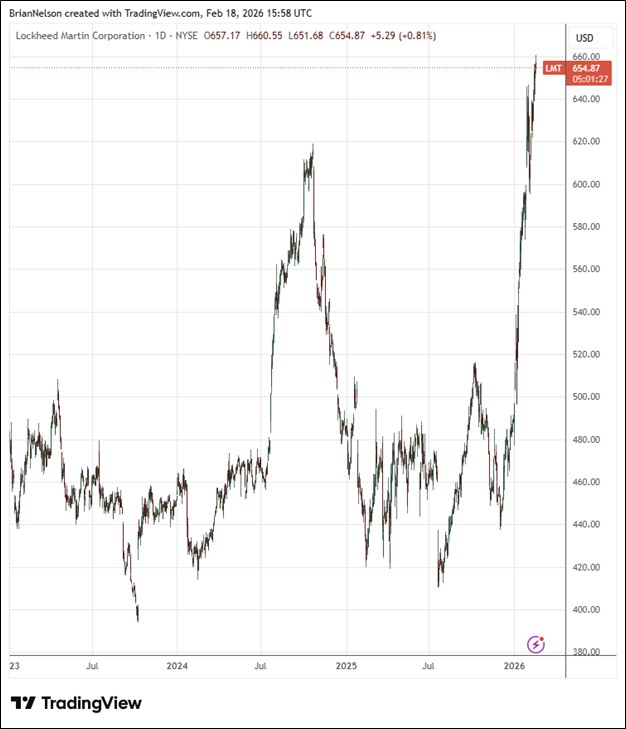

Lockheed Martin Boasts Record Backlog

Image Source: TradingView By Brian Nelson, CFA Lockheed Martin (LMT) recently reported better than expected fourth quarter results with both revenue and GAAP earnings per share exceeding the respective consensus forecasts. The company reported fourth quarter 2025 sales of $20.3 billion, compared to $18.6 billion in the fourth quarter of 2024. Net earnings in the fourth quarter of 2025 were $1.3 billion, or $5.80 per share, compared to $2.22 per share in last year’s quarter. Operating cash flow was $3.2 billion in the fourth quarter of 2025, compared to $1 billion in the year-ago quarter. Free cash flow was $2.8 billion in the fourth quarter of 2025 compared to $441 million in the fourth quarter of 2024. Management had the … Read more