Alphabet Targets Capex in the Range of $175-$185 Billion in 2026

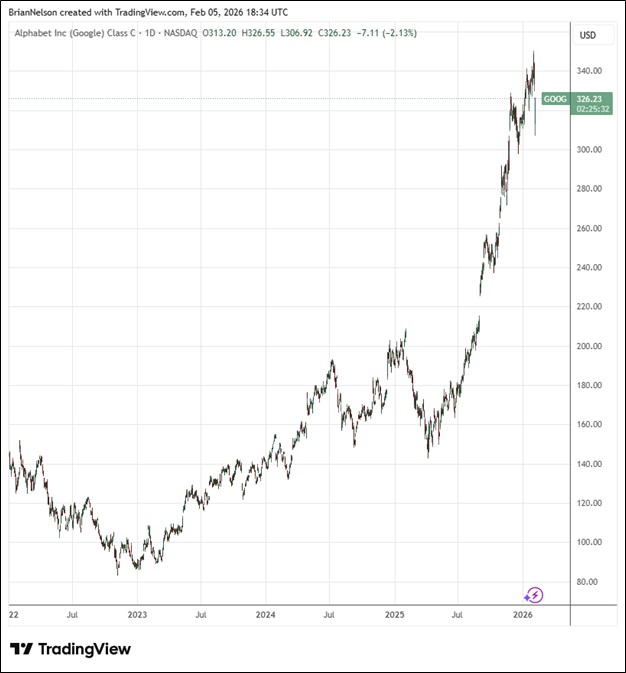

Image Source: TradingView By Brian Nelson, CFA On February 4, Alphabet (GOOG) (GOOGL) reported better than expected fourth quarter results with both revenue and non-GAAP earnings per share exceeding the consensus forecast. Consolidated Alphabet revenues increased 18%, or 17% in constant currency, to $113.8 billion. Management noted that it experienced strong momentum across the business and acceleration in growth in both Google Services and Google Cloud. Google Services revenues increased 14%, to $95.9 billion, led by 17% growth in Google Search & other, 17% in Google subscriptions, platforms, and devices, and 9% in YouTube revenue, which exceeded $60 billion for the full year 2025. Google Cloud revenue increased 48%, to $17.7 billion. Management had the following to say about the … Read more