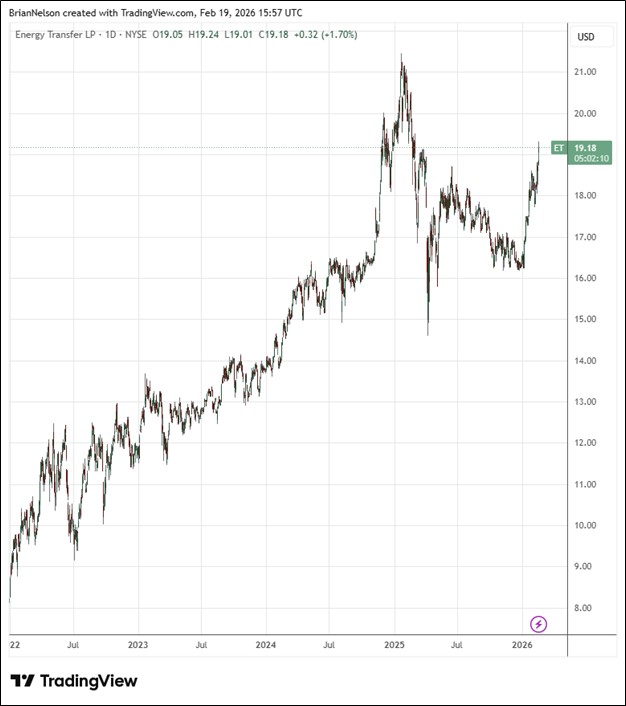

Energy Transfer Raises 2026 Adjusted EBITDA Guidance

Image Source: TradingView By Brian Nelson, CFA On February 17, Energy Transfer (ET) reported mixed fourth quarter results with revenue beating expectations, but GAAP earnings missing the consensus forecast. Net income for the three months ended December 31, 2025, was $928 million, down from $1.08 billion for the same period last year. Adjusted EBITDA for the quarter was $4.18 billion, however, up 8% from the year-ago period. Distributable cash flow for the quarter was $2.04 billion compared to $1.98 billion for the same period last year. Growth capital spending in the fourth quarter was $1.4 billion, while maintenance capital spending was $355 million. Energy Transfer’s volumes continued to expand in the fourth quarter. NGL and refined product terminals volumes were … Read more