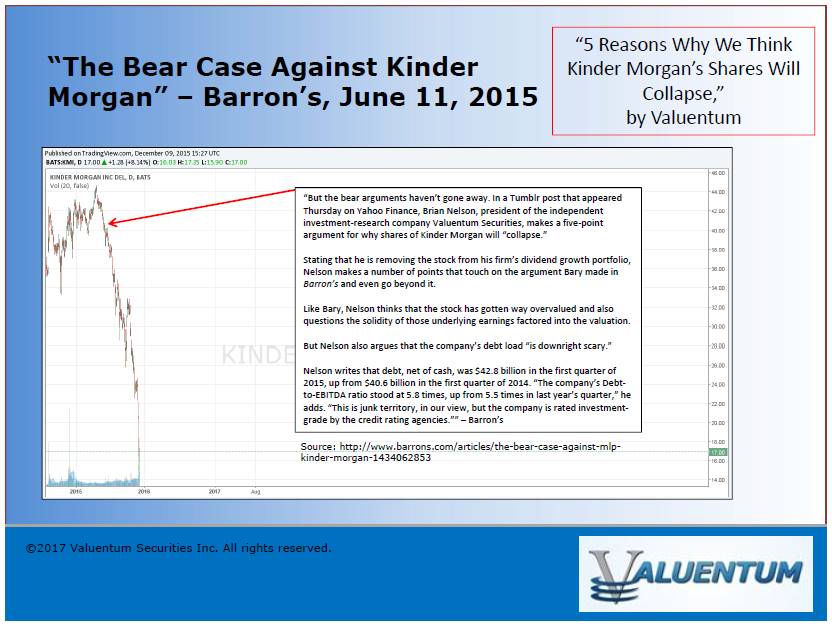

Image shown: An illustration of Valuentum’s call on Kinder Morgan during 2015. You can read about this in more detail in the Preface of Value Trap: Theory of Universal Valuation. For a consider-selling discipline to be successful, it must be systematic, forward-looking and repeatable. The Valuentum process worked equally well with General Electric during 2017 (image later in note).

No changes to simulated newsletter portfolios.

By Brian Nelson, CFA

Good morning everyone!

The markets took a shellacking yesterday with the Dow Jones Industrial Average (DIA) falling over 300 points during the trading session January 22. Had there not been a near-100 point leap in the Dow during the past few minutes of trading, the fallout may have been worse. Most are pointing to the ongoing back-and-forth regarding trade talks with China, but we think price-agnostic trading is to blame for the whipsawing action the past couple months. While Fed monetary policy, US-China trade talks and fourth-quarter earnings season provide the macro and fundamental backdrop, the foundation of the market continues to weaken as indexing and quantitative trading proliferates.

A few things on your radar for this morning. Yesterday, Johnson & Johnson (JNJ) reported decent fourth-quarter results. Here’s what my colleague Kris Rosemann had to say about J&J (read Kris’ full write-up here):

2018 marked Johnson & Johnson’s 35th consecutive year of adjusted operational earnings growth (excludes intangible amortization expense, special items and the impact of translational currency) and its 56th consecutive year of annual dividend increases, and it generates ~70% of sales from products with #1 or #2 global market share positions while having 26 brands or platforms with $1 billion or more in annual sales. The company is one of only two companies to currently hold an AAA credit rating, the other being fellow simulated Dividend Growth Newsletter portfolio idea Microsoft (MSFT).

While we await the release of Johnson & Johnson’s 10-K to roll its valuation model forward and have a look at its balance sheet and cash flow statement for the full-year 2018, we are sticking with our fair value estimate of $137 per share following its fourth quarter earnings report, released January 22. The company’s strong Dividend Cushion ratio of 2.3 pairs nicely with its dividend yield of 2.8% as of this writing, and we expect to continue highlighting it as an idea in the simulated newsletter portfolios. Our stance on its pending legal matters remains the same, and members can find that opinion here.

We continue to seek out stocks that we think have fantastic competitive positions, generate strong levels of free cash flow, have solid balance sheets, and ones in which the market generally agrees with our assessment of their undervalued nature via an appreciating equity. At the moment, we have two companies that are highly-rated on the Valuentum Buying Index, Facebook (FB) and Alphabet (GOOGL, GOOG).

As with J&J, these two companies are fraught with regulatory and political risk and are navigating their own public-relations nightmares (J&J and talcum powder; Facebook/Alphabet and consumer privacy data, security). We think news flow may not be great for these three simulated newsletter portfolio “holdings” in the coming months, but long-term, we like these three ideas a lot. We think Facebook may bounce back considerably after a very difficult 2018.

In case you missed it, my colleague Kris wrote up Kinder Morgan’s fourth-quarter results (read the full-write up here), and the pipeline operator has come a long way since the doldrums of 2015. We value the company’s equity in the low-to-mid $20s, as we have for years now, so we do anticipate some upside. The executive team has largely been paying common dividends out of traditional free cash flow, so we believe its dividend growth plans have merit. We’re not looking to add the equity to either the Best Ideas Newsletter portfolio or Dividend Growth Newsletter portfolio, but the company is growing stronger and stronger each day.

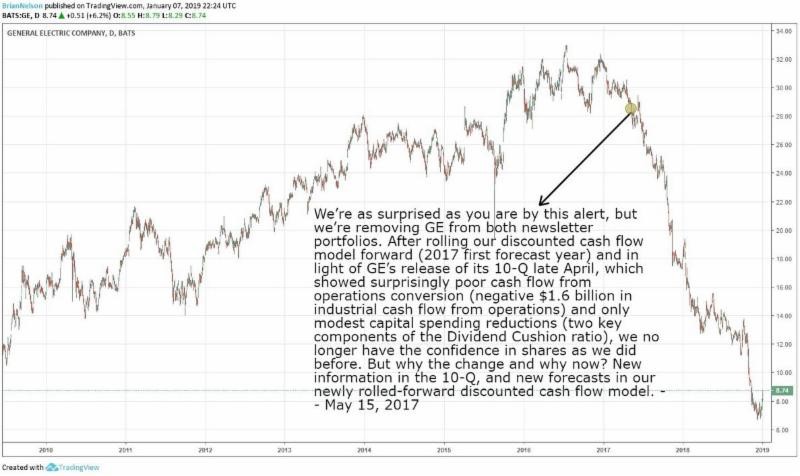

Kinder Morgan and General Electric (GE) are two great illustrations of the Valuentum consider-selling discipline. In the former case, in mid-2015, we viewed shares of Kinder Morgan as overpriced, the dividend as at risk, and once technicals broke lower, Kinder Morgan registered a 1 on the Valuentum Buying Index. The timing was near-perfect. Nearly a couple years later, however, the story with GE unfolded, and it was similar. If you recall in May 2017, we said the following about GE when it was trading in the high-$20s:

We’re as surprised as you are by this alert, but we’re removing GE from both newsletter portfolios. After rolling our discounted cash flow model forward (2017 first forecast year) and in light of GE’s release of its 10-Q late April, which showed surprisingly poor cash flow from operations conversion (negative $1.6 billion in industrial cash flow from operations) and only modest capital spending reductions (two key components of the Dividend Cushion ratio), we no longer have the confidence in shares as we did before. But why the change and why now? New information in the 10-Q, and new forecasts in our newly rolled-forward discounted cash flow model.

Image shown: The timeline removal of General Electric from the simulated newsletter portfolios in May 2017.

To be successful, a methodology and process must be systematic, forward-looking and repeatable (e.g. KMI, GE). The Valuentum consider-selling discipline is rather straightforward. In the simulated Best Ideas Newsletter portfolio, for companies that we think are overpriced and have deteriorating technical and momentum indicators, if they no longer fit a sector allocation, we consider removing them. In the simulated Dividend Growth Newsletter portfolio, for companies that have weakened Dividend Cushion ratios and/or whose intrinsic value is no longer supported by robust free-cash-flow generation and net-balance sheet health, we consider removing them.

In the simulated High Yield Dividend Newsletter portfolio, the consider-selling discipline is a bit more sensitive and market-dependent. A company’s credit health, as indicated by its debt rating, and the technical/momentum characteristics of the equity are the two prime considerations. Capital market dependence remains a key risk to high yield dividend equities, unlike other equities. Where for example, pricing declines of companies with strong balance sheets that have strong traditional free-cash-flow generation in excess of the dividend might be considered opportunistic. For high-yield dividend payers, price declines should be considered fundamental, adding risk to the credit assessment and therefore dividend health.

Fourth-quarter earnings season is now in full swing, and while Apple’s outlook for 2019, released a few weeks ago, may have been a warning shot across the bow for the tech ecosystem, it is looking like the company’s troubles relative to expectations are more firm-specific in nature than we originally thought. We still like Apple for the long haul, particularly its tremendous free-cash-flow generation and net-balance sheet health, but we also note that it won’t take much for the market to truncate expectations of its long-term economic profit stream, which may make its equity much more volatile as investors sort out its long-term value duration. We’ve seen such skepticism before with Apple, and we’re not overreacting.

That’s all for this morning. Let’s see how earnings reports come in. Don’t forget to read Value Trap: Theory of Universal Valuation.

——————–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

—–

Pasted below is the first review of Value Trap on Amazon. Please be sure to leave yours here. The more buzz you create, the better.

——

Tickerized for holdings in the SPDR S&P 500 ETF (SPY).