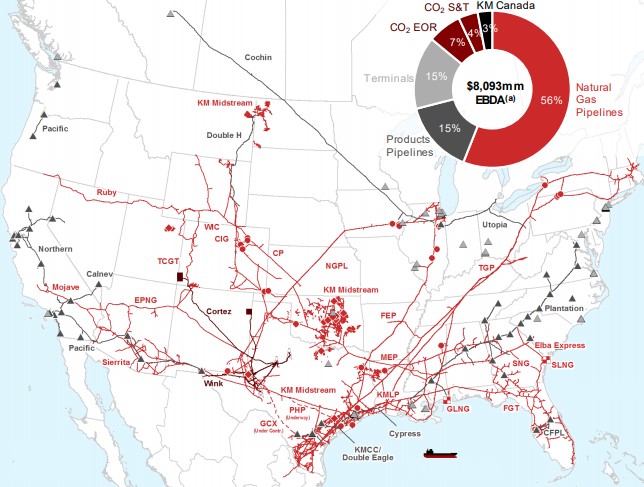

Image shown: Kinder Morgan’s pipeline network and estimated breakdown of 2018 EBDA. Source: Kinder Morgan investor presentation

Pipeline operator Kinder Morgan has benefited from a significant increase in natural gas supply and demand of late, and it expects more of the same in 2019. Management continues to execute on its capital allocation priorities, and it reiterated previously-announced guidance for dividend growth in the years ahead.

By Kris Rosemann

2018 was a transformative year for Kinder Morgan (KMI).

The once-troubled pipeline operator has come a long way in terms of capital allocation since its massive dividend cut in late 2015, but management continues to expect significant growth in the payout in the years ahead. The company’s growth in 2018 (fourth quarter results released January 16) was largely driven by robust US natural gas demand, which rose to 90 billion cubic feet per day, an 11% increase over 2017. The company rode this wave of strong demand to fourth quarter net income available to common stockholders of $483 million (up from a loss of more than $1 billion in the year-ago period) and a 6% year-over-year increase in distributable cash flow per share, which came in at $0.56 in the quarter.

Higher utilization rates for a large portion of Kinder Morgan’s system came without the need to deploy capital, and the resulting bottom-line growth should help its growth capital allocation plans moving forward. Management expects 2019 to be another strong year for natural gas, which should help it maintain its target leverage ratios. The company was the recipient of a credit rating upgrade from both Moody’s and S&P (BBB/Baa2), and it reduced its adjusted net debt-to-adjusted EBITDA (1) ratio to 4.5x at the end of 2018 from 5.1x a year earlier. The reduction in leverage is largely due to its share of asset sales from the Trans Mountain project, which helped push its cash position to nearly $3.3 billion at the end of 2018 from $264 million at the end of 2017.

While we await the release of the 10-K to get a look at Kinder Morgan’s full, audited financial statements, most notably its cash flow statement, which was absent from the earnings release, management states that it was able to “fund all growth capital through operating cash flows with no need to access capital markets for that purpose.” Management’s 2019 outlook suggests a similar dividend coverage profile as that of 2018 as it expects “internally generated cash flow to fully fund its 2019 dividend payment as well as the vast majority of its 2019 discretionary spending, without the need to access equity markets.”

Shareholders should expect a portion of its capital outlays in the year to be funded with debt, but the company anticipates ending the year with a net debt-to-adjusted EBITDA ratio of ~4.5x. Kinder Morgan expects distributable cash flow to grow to $2.20 per common share in 2019, up from $2.12 in 2018, and it continues to project an increase in its quarterly dividend to $0.25 per share in the year, up from $0.20 declared for the fourth quarter of 2018. Management also reiterated its expectations for its annual dividend to hit $1.25 in 2020.

All things considered, we aren’t looking to add exposure to Kinder Morgan in either simulated newsletter portfolio for the time being; we have been ‘fully invested’ in each simulated portfolio since December 26. The company has made nice progress in deleveraging, but its debt load of ~$37 billion is still enough to raise some eyebrows and weighs on its Dividend Cushion ratio, which currently sits at parity (1) on an adjusted basis. We value shares, which yield ~4.5% as of this writing, at $23 each, suggesting a bit of upside may be in store if 2019 brings more of the same in terms of strong demand for natural gas and management executes effectively.

Valuentum’s call on Kinder Morgan and the collapse of the MLP space in 2015 was as high-profile a call you will find. Valuentum’s President of Investment Research Brian Nelson details the story of that call in the preface of his book Value Trap. The pdf digital download can be purchased here, or the paperback can be purchased here.

———-

1) Adjusted net debt includes adjustments related to: 50% of KML preferred shares, which is included in noncontrolling interests, of $215 million as of both December 31, 2018 and 2017. Also, the cash component as of December 31, 2018 has been (i) reduced by $890 million, representing the portion of cash KML distributed to KML restricted voting shareholders on January 3, 2019 as a return of capital; and (ii) increased by $91 million, representing the unrecognized gain as of December 31, 2018 on net investment hedges which hedge our exposure to foreign currency risk associated with a substantial portion of our share of the proceeds from the sale of TMPL, TMEP and related assets.

Pipelines – Oil & Gas: BPL, DCP, ENB, EPD, ET, GMLP, HEP, KMI, MMP, NS, PAA, WES

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.