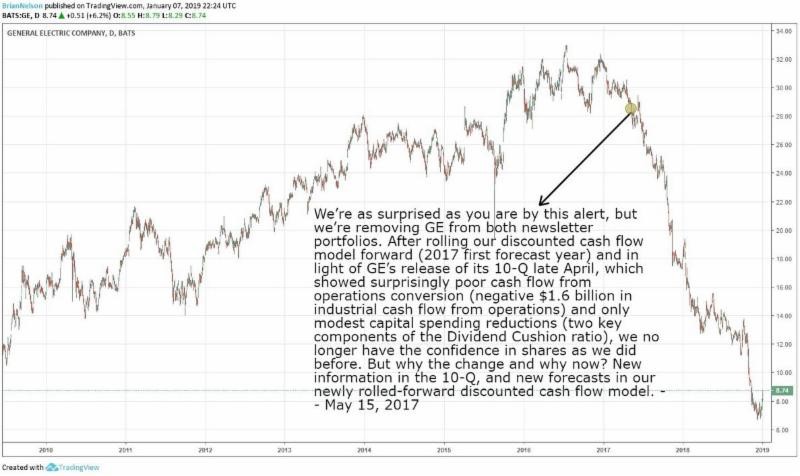

Image shown: The decision to remove GE from the simulated newsletter portfolios when we did may have been our best call yet.

In this note, let’s talk about the importance of reading Value Trap, learn why we’ve gone “fully invested,” talk a little bit about put options, learn some of the intricacies of the Valuentum process, find out where to find VBI rankings to download and sort, and talk about some of our recently-highlighted ideas in the simulated newsletter portfolios.

No Changes to Simulated Newsletter portfolios

Brian Nelson, CFA

Trust you are having a wonderful Monday morning! I hope that many of you made the conference call last Thursday at 11amET, but if you didn’t, we’ll have another one coming soon. We’ll also record this next one. I’ll let you know the date and time as soon as I have one nailed down. In the meantime, please read our new book Value Trap: Theory of Universal Valuation. It’s well worth your time, and it will give you incredible depth on a large number of topics (there are more than 250 footnotes in the text alone…just the footnotes!). You can purchase the download at the following link and get started today: https://valuentum.com/store/products/45

With each passing day, I grow more and more appreciative of you, your interest, and your questions. Many of you have written some very kind emails to me, and I cannot tell you how much I appreciate them. I asked our members if you thought our call on General Electric (GE) was even better than ours on Kinder Morgan from 2015, the story of which is included in the Preface of Value Trap. Here is what one of our members said about our work on GE:

—–

Dear Nelson and Valuentum Staff,

I just wanted to send you a quick comment on your latest email titled: “Catching the Bottom?” This catch was surely well done. You stayed in cash when almost everyone was nearly “all in” or on leverage while the market surged in the early part of the second half of 2018. That was a tough decision, but in retrospect of the huge November and even larger December market selloff a very prescient and wise one. Getting all in now near what appears to be the bottom of the market is also well played.

Of all the financial reports you have written and all the portfolio changes you have made in the model portfolio, your prediction of an imminent drop in the price of GE stock and your decision to sell out your portfolio holdings in GE has to be one of the best yet. Who would have thought that such a long-established company with such world-wide holdings could fall so far, but your analysis showed that it was highly probable and thereby acted wisely in eliminating GE from your model portfolio – in time to avoid a substantial loss. This type of analysis and forward-looking model action is what makes your publications well worth the subscription costs.

Keep up the good work,

Detlev T.

—–

Thank you Detlev. It is because of the kind words like this from members that we do what we do. I remember the title of the intro to our previous Best Ideas Newsletter. The title was, “Pay Attention…,” and the newsletter was released on December 15, before the markets swooned considerably. Our team works hard to get our members ahead of what we think is to come. Shortly after the release of that newsletter, we wrote about the potential for a stock market breakdown, and when we witnessed some of the most volatile trading in stock market history during the holiday break, we stayed in front of you with our daily notes, reminding you of the large cash “weightings” in the simulated newsletter portfolio and how this move turned out to be a savvy one. This is what one of our members had to say about this:

—–

I know this response comes a few days late, but I was staying away from emails and focused on the important things like family time during the last week. I want to thank you for all your wisdom. I, too, have been ~30% cash since late 2017 because of your insight. I listened and resisted the temptation of buying as things looked good. It would have been easy to get caught up in the flurry of the market back then while watching our retirement accounts grow. “Putting all our money to work” as others around me did, would have been costly. In fact, a lifetime of membership fees would not come close to what was potentially saved. As painful as the last 3 months have been, it could have been much worse. I value your research, your newsletters and I look forward to your new release. Congratulations! — Chip G.

—–

On December 26, we said we were going “fully invested” in both the simulated Best Ideas Newsletter and simulated Dividend Growth Newsletter. How can we possibly do this when we’re concerned about market structure and its influence on market volatility, right? Well, we continue to believe the market will encounter unprecedented levels of volatility in the years ahead, but we’ve simply changed our strategy to guard against such volatility (from having a large cash “weighting” to instead being “fully invested” and ready to add protection). But why?

For starters, we think there will be either a melt-up or a meltdown as a result of the proliferation of price-agnostic trading (indexing and quant), and we don’t want to sit out on a potential melt-up, which is why we’ve gone “fully invested” in the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. To guard against a meltdown, instead of the large cash “weightings,” we’re now keeping our finger on the put-option trigger while being “fully invested.” In doing so, we won’t miss out on any potential melt-up while we remain prepared for a meltdown. Investing is about thinking in terms of probabilities and positioning accordingly.

A lot of members have been asking about put options, including a question on the conference call Thursday. To put it simply, put options are a speculative bet (and they are a bet) on the price decline of a given security, whether it is a stock or ETF. For example, if I wanted to bet on the price decline of the S&P 500 ETF (SPY) over a certain time period, I would buy put options at a specific strike price for a specific premium (in the money or out of the money or at the money). The longer time duration of the option, the more expected volatility of the asset, and how far away the strike price is away from the trading price are major factors in the price of a put option.

If the security price goes down, the price of the put option goes up, all else equal. If the security price goes up, the price of the put option goes down, all else equal. However, the eroding time value of options and the uncertainty of how volatility is factored into the pricing coupled with large bid/ask spreads make any options trading quite risky. Most options expire worthless, meaning most that buy options often lose their entire premium, so they are dangerous vehicles. We don’t dabble in these derivatives much at all, and at most, we’d only risk about 1-3% of the simulated newsletter portfolios at any time. You can lose a bundle in options. Please be careful. Always talk to your personal financial advisor if any of these risk-mitigation techniques may be right for you.

We’ve been putting in front of you some of our favorite ideas from the simulated newsletter portfolios of late. We wrote up Dollar General (DG) here, PayPal (PYPL) here and General Motors (GM) here more recently, but we’re also watching Schlumberger (SLB). Here’s what my colleague Kris Rosemann recently had to say about the company and its prospects:

—–

Schlumberger has been hurt by greater than expected softness in US hydraulic frac activity and pricing in recent quarters, and some are questioning the viability of the Permian basin to continue to provide its previously expected production growth as unit well productivity has eroded more than anticipated.

Schlumberger continues to have confidence in its global portfolio, however, as its unmatched footprint allows it to pursue to most attractive growth opportunities across the globe. Its expanding technology portfolio is a notable strength as well, and management reports that it has expanded its total addressable market by 50% over the past three years.

The company’s Dividend Cushion ratio is just above parity as our expectations for free cash flow generation remain relatively solid, but the less-than-ideal ratio is picking up risks associated with its exposure to volatile energy resource pricing and its sizable net debt load. We currently value shares at $52 each, but the lower end of our fair value range may be more appropriate should crude oil prices face additional pressure in the face of global economic growth concerns and an ever-fluid supply/demand environment.

—–

Remember, however, we’re only interested in ideas that we think are undervalued and are going up in price. What this implies is that, while we think shares of Schlumberger are cheap, we want to bet in the same direction as the market, and this requires the market to be driving shares of the company higher, too. When it comes to Schlumberger, shares have just fallen too fast, and we’ll need to see more technical strength first (even after considering the recent bounce). At the end of the day, the market has to agree with us for any of our ideas to work out. Let’s talk about this a bit more.

There is a lot behind the Valuentum processes for capital appreciation and dividend growth, respectively, and both the criteria for inclusion to either the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio are different. Our best ideas at any time are always included in the simulated newsletter portfolios. This is a very important consideration. If you’re just cherry-picking highest-rated ideas, you could be too concentrated, and you may not be pursuing the important qualitative portfolio management overlay, which we view as vital to our process. We use our research as a means to identify new ideas for consideration in the simulated newsletter portfolios, as well as to consider removing ideas from the simulated newsletter portfolios.

As it relates to the simulated Best Ideas Newsletter, for example, if a stock registers a 9 or 10 on the Valuentum Buying Index, we would consider adding it to the simulated newsletter portfolios. When the stock then/eventually registers a 1 or 2 on the Valuentum Buying Index in time, we might then consider removing it from the simulated newsletter portfolios. The changes in the “big middle” of the Valuentum Buying Index offer more tactical considerations, but we generally only consider the highest and lowest VBI ratings to be material. During times of market froth, however, as in arguably today’s environment, in the simulated Best Ideas Newsletter portfolio, we may relax some of the VBI criteria and consider undervalued stocks with neutral technical/momentum indicators, or fairly valued stocks with good relative valuation metrics and strong technical/momentum indicators. We may only consider removing ideas from the simulated newsletter portfolios when both their valuation and technical/momentum indicators point in the same direction (good/good or poor/poor), or if we’re making more strategic/tactical moves.

The criteria for the simulated Dividend Growth Newsletter is somewhat different. We’re looking for strong dividend growth stocks in this simulated Dividend Growth Newsletter portfolio (something that is not a part of the criteria in the simulated Best Ideas Newsletter portfolio), meaning that in addition to considering the VBI and fair value estimate range, the Dividend Cushion is also very important. We still look to add highly-rated stocks on the VBI and those that are undervalued to this simulated newsletter portfolio, but we may be more open to ideas that have strong dividend growth prospects, on the basis of the forward-looking Dividend Cushion ratio. After adding ideas to this simulated newsletter portfolio, we may continue to include them in the portfolio even if they have modest VBI ratings that are trading within our fair value estimate range, as long as they have strong dividend growth prospects (e.g. Microsoft). We’d only consider removing a stock from the simulated Dividend Growth Newsletter portfolio when we lose confidence in its intrinsic value support and its dividend growth prospects.

The way to think about our process is rather simple. In the simulated Best Ideas Newsletter portfolio, if a company registers a high rating in our coverage universe, we consider adding it (but we won’t consider adding all companies because of portfolio constraints). If we do decide to add the idea, then we watch its fair value estimate and technical/momentum indicators as it navigates the “big middle” of VBI ratings, and only consider removing the idea from the simulated Best Ideas Newsletter portfolio if it registers a 1 or 2 on the Valuentum Buying Index. In the simulated Dividend Growth Newsletter portfolio, we pay attention to the price-versus-fair value estimate range and the company’s Dividend Cushion ratio, as we’re looking for resilient equities with intrinsic-value support that have strong dividend growth prospects. Only when intrinsic-value support and dividend growth strength wane will we consider removing an idea from the simulated Dividend Growth Newsletter portfolio.

As you can tell, there’s a ton of reasoning behind our process, but there’s a lot more content on our website, too (even besides the newsletters and simulated portfolios). Many of you use the screens, for example. All of the screens that are on the website are included in the newsletters. So if you’re looking for “Stocks with High Valuentum Buying Index Ratings and Strong Dividend Growth Prospects” or “The Financially-Healthiest Dividend Payers Yielding Over 2%” or “Yields to Consider Avoiding,” you can find these in the monthly Dividend Growth Newsletter, released on the 1st of each month. If you’re looking for “Stocks that are Undervalued on a DCF Basis and are Undervalued on a Relative Value Basis” or a listing of the “Highest and Lowest Ranked Companies on the VBI,” these are always included in the monthly Best Ideas Newsletter, released on the 15th of each month.

Each and every week, usually on Saturday or Sunday, we update a data screen, which can be downloaded from our website here (csv) – login required. This link is always found on the left column of our website, and the best time to retrieve the updated one is generally Sunday evening. This screen is updated at the same time that the data in the stock tables on each company’s stock page are updated, each weekend. So, not only are the screens in the newsletters, but you can use the screener to sort based on a large number of criteria. We also have a more advanced screener that we make available as part of the Financial Advisor level membership plan. Download a sample of that one here (xls). Remember–the most important data is forward-looking data, and that’s what we strive to focus on at Valuentum.

Just a few things to remember as we wrap up this note–please be sure to read our new book Value Trap (purchase download here). Understand that we have a new strategy to capitalize on what we consider to be a binary outcome of market performance, either a melt-up or a meltdown driven by the proliferation of price-agnostic trading. We want to keep a few ideas on your radar: DG, PYPL, GM (and SLB, which is not included in either simulated newsletter portfolio). We want you to keep getting familiar with our methodology and how we think about investing (especially the information contained in prices), as well as work to use the weekly screener (csv) on our website, and the much larger quarterly DataScreener. Most importantly, thank you for your kind words and feedback. None of this would be possible without you.

Tickerized for holdings in the S&P 500 SPDR (SPY).

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.