Image shown: The depths of how far the S&P 500 (SPY) has fallen more recently, and the timing of the decision to move to being “fully invested” in simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio.

No Changes to Simulated Newsletter portfolios.

This article was sent to members via email January 9. That email can be found at the link that follows this article.

By Brian Nelson, CFA

On the evening of December 26, we emailed members that we were moving to “fully invested” in both the simulated Best Ideas Newsletter and simulated Dividend Growth Newsletter portfolio. First of all, please let me apologize. I wanted to stay in front of members during one of the most volatile times in market history, and that it happened during the holiday season was something that nobody expected. I know at least a few of you may not have seen the email until after holiday or might have not had time to read the contents while traveling.

Going forward, I’m going to be much more cognizant of putting the notifications to changes in the simulated newsletter portfolios front and center. What I will do in each note and email is highlight in bold any changes where you currently see “No Changes to Simulated Newsletter portfolios.” That way, you can quickly discern whether we’re making any changes or not prior to reading the note or email. I’ll also be more proactive highlighting changes in the title of notes and emails with the word “Alert.” Just a reminder–we’re not after daily or weekly performance, so our ideas are more long term in nature.

I’m not writing this note to talk about how we got members ahead of a big bounce in the market for the simple reason that we could still test the lows in December very easily. If you missed our notification December 26, you might still be able to consider even lower prices. That said, however, we’re not taking any chances in this market, one filled with price-agnostic trading, and a melt-up as we’ve seen more recently may continue to ensue, as the Fed continues to tell the markets what it wants to hear.

What we are witnessing is nothing more than Fed strategy 101: tell the market what makes participants happy, and then do whatever it wants with rates, regardless. The markets and economy have truly experienced a best-case scenario since the doldrums of the Financial Crisis, in my opinion. Markets are up huge, and I see no reason why the Fed will stop raising rates anytime soon. We continue to expect more market volatility as a result, exacerbated by market structure.

As for recent news and ideas, I want to keep Dollar General (DG) in front of you. The company has been one of the best-performing equities since it was added to the simulated Best Ideas Newsletter in April 2017, trouncing the market’s return by 50 percentage points over that time period. If you’re worried about the economy and a recession, then the dollar-stores may be a good place to look, and Dollar General’s business model speaks of considerable consistency. See latest note here.

We’re also putting the garbage haulers back on your radar screen, with Waste Management (WM) and Republic Services (RSG) being our two favorites. With the precipitous drop in energy resource prices of late, Schlumberger (SLB) is also on our radar. Right now, both the simulated Best Ideas Newsletter and simulated Dividend Growth Newsletter are “fully invested,” and we have our finger on the put-option trigger as we’re monitoring market volatility. Let’s keep watching these markets.

————–

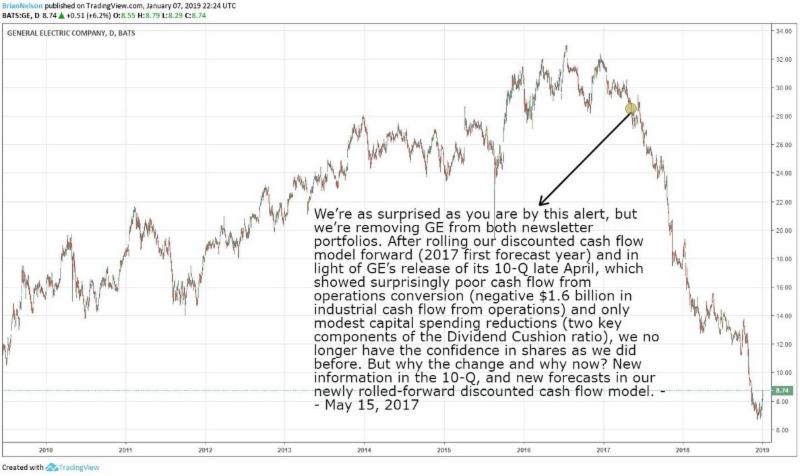

Remember our call on General Electric? I think this type of research and analysis is worth thousands and thousands of dollars each year. Was this call better than the one on Kinder Morgan? Let us know your opinion.

Link to original email: http://campaign.r20.constantcontact.com/render?m=1110817109903&ca=7a6f6d80-1089-49ba-a908-8318b165a91e

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.