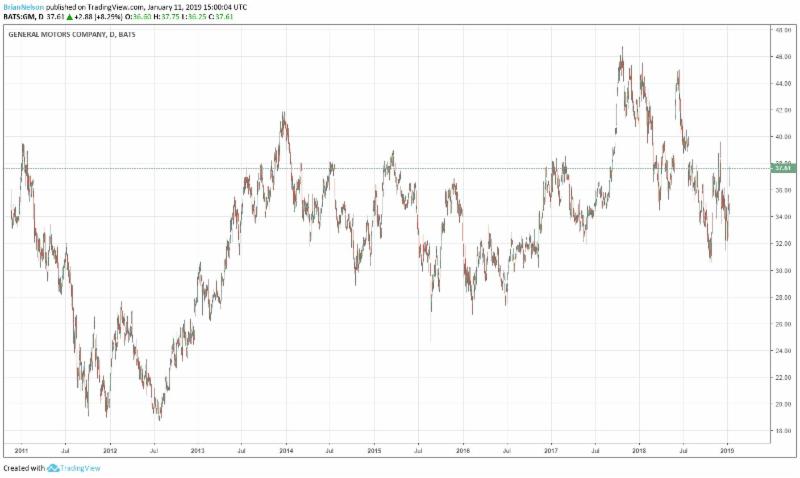

Simulated newsletter portfolio idea General Motors has had one choppy ride since shares were re-released onto the marketplace after the bailout some years ago. The automaker had some good news today, and shares are bouncing nicely in an otherwise weak market. This relative strength is remarkable considering concerns about China’s pace of economic expansion and potential backlash against American icons in the country.

Brian Nelson, CFA

We think General Motors’ (GM) shares are worth $54 each on the basis of our discounted cash-flow process, and with the company trading in the high-$30s, we think the good times are still ahead. GM is included as an idea in both the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. We’ve been bullish on GM for some time, and the stock has been as about as volatile as it gets, but valuation numbers are getting kind of ridiculous. GM is dirt cheap, in our view, and its shares are starting to catch a little market favor.

GM provided a business update today, with the company noting that it expects “2018 EPS-diluted-adjusted and adjusted automotive free cash flow to exceed prior guidance.” The automaker also set full-year 2019 earnings per share diluted-adjusted guidance to the range of $6.50-$7.00 per share, which means at the high end of this target, GM is trading at about 5.4 times forward diluted-adjusted earnings. This valuation is flat-out ridiculous, in our view. Adjusted automotive free cash flow is targeted between $4.5 billion and $6 billion, so earnings quality is solid.

The news from GM today is quite reassuring, too, given US-China trade tensions and encroaching electric-vehicle competition. GM has an impressive presence in China, and its electric-vehicle line-up and share is nothing to scoff at. The company is aggressively advancing this area of its automotive portfolio and recently indicated that Cadillac will be its go-to-brand to compete against Tesla (TSLA) in this space. We like GM’s odds, particularly given its strong automotive free cash flow generation.

That said, GM is an ultra-cyclical industrial with substantial operating leverage that cuts both ways (in good times and bad), but we think the market is getting its valuation wrong. Even if earnings per share diluted-adjusted is halved on a mid-cycle basis, shares are still trading at just 11 times forward earnings. That’s 3-4 turns lower than the forward market multiple. GM is not over-leveraged either. The company held $23.8 billion in cash and marketable securities against $13.5 billion in automotive debt at the end of December 2017. GM does has a mountain of obligations at GM Financial to the tune of ~$80 billion, but this debt should not be viewed similarly as that of the automotive variety.

A back-of-the-envelope perpetuity value function based on the midpoint of 2019 automotive free cash flow, using a 10% discount rate (with no growth), implies a fair market capitalization of $60+ billion, after adjusting for the net automotive cash (its market cap is under $50 billion at the moment). Perhaps one can discount this back-of-the-envelope valuation a bit for the risks related to GM Financial (assuming to be fair-value neutral in this calc), the company’s cyclical operations, exposure to China, heightened domestic competition in electric vehicles, and operating leverage, but it still implies upside, in our view, given the level of the discount rate (and that no future growth in automotive free cash flow is considered). Our fair value estimate range, backed by an extensive enterprise valuation process, is $41-$68 per share.

All things considered, we like the news today. GM shares are trading up approximately 8% at the time of this writing!

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.