This article first appeared in the September edition of the High Yield Dividend Newsletter. For more information about this publication, please see here.

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.” — Winston Churchill

By Brian Nelson, CFA

Very few of us could have imagined that we’d witness the bull market that began on that fateful day in March 2009 that might very well mark a generational low. In 2009, major investment banks around the globe were struggling to survive, and the fallout in the mortgage markets left the banks holding paper that nobody wanted to own, let alone buy. The global financial system was on the verge of collapse and gross domestic product was plummeting. Companies didn’t want to invest, nor hire, and nobody wanted to lend to anybody. The market system had ground to a halt. Some say during the depths of the Financial Crisis that the US was about two weeks away from complete shutdown, to the point where there might not have been milk available at the local store.

Nothing may have been worse than the Great Depression that engulfed the US following the Crash of 1929, which sent markets down more than 80% over a brief 2.8-year period in the 1930s, but the Great Recession of late last decade was rather frightful. In studying past bear markets, they tend to be short and steep. According to information from First Trust, the average bear market lasts just 1.4 years, leading to an average cumulative loss of ~41% over such a short time. It is interesting how brief broad market declines have been in the context of the average bull market lasting more than 9 years. Based on data from First Trust, there have been 9 bull markets since 1926 and 8 bear markets over the same time, so history provides a good sample set. But why are bear markets so short in duration?

Human psychology. In layman’s terms, bear markets cause considerable pain over short periods of time because everybody runs to the exits…at the same time. Bull markets, on the other hand, are built over years and years of savings, but once bad news hits impacting future expectations, investors want to get their money out as soon as possible. The broad selling with little buyers causes stocks to face considerable, immediate pressure, resetting market prices to reflect a downside scenario much more quickly than the steady build of wealth during bull markets. Regardless of one’s opinion about Treasury or the Fed, the government oversight of the markets kept us from the brink of disaster during the credit crunch, even if certain regulatory policies and loose lending standards may have been the primary reasons why the US was staring down the abyss in 2009.

But there is milk at the store. Another Great Depression didn’t happen. In fact, the Fed’s prolonged zero-interest rate policy (ZIRP) worked incredibly well to drive stock market prices higher, and the multiple rounds of quantitative easing have worked wonders on the global financial system. The US sovereign debt load has exploded higher during the past few years, but the US has always had a large national debt and deficits have never posed a problem, in part because the US continues to be the strongest nation on the planet. When it comes to sovereign credit health, almost everything is relative, particularly when it comes to the strength of currencies. Like it or not, the Fed did a marvelous job in saving the global financial system as we know it.

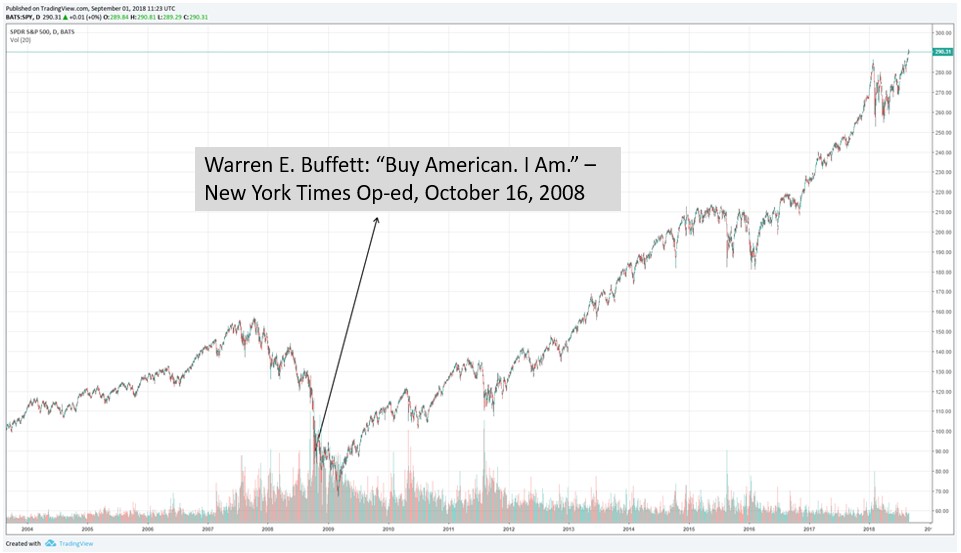

Many had the confidence to believe that the US would bounce back from the Great Recession, and we’d point to Warren Buffett’s masterful op-ed that ran in the New York Times in October 2008 as one example: Buy American. I Am. Boy was Uncle Warren right. As the world around us was crumbling in 2008-2009, Mr. Buffett was loading up on American stocks…in his personal account. His reasoning came down to a simple rule: “Be fearful when others are greedy and be greedy when others are fearful.” During the doldrums of late 2008, before things really fell out of bed in March 2009, people were quite fearful. Some may say, however, that they had good reason to fear.

US gross domestic product had fallen by 8.2% during the fourth quarter of 2008, and it fell by 5.4% during the first quarter of 2009. The economy was truly in shambles, and people were feeling it on the frontlines as US unemployment ratcheted up to nearly 10% by October 2009. There were good reasons to be scared. There were good reasons to pull one’s money out of the stock market. There were sound arguments to be made that the decade following the credit crunch might be like that of the Great Depression. The future could not be predicted, and many tried and true companies were failing from General Motors to AIG and beyond. Even Washington Mutual experienced a modern-day run-on-the-bank. Many hardly even remember just how close to Armageddon we truly were.

But we’d posit that even Mr. Buffett could not have imagined the meteoric rise of the stock market since then through today. Where we may have believed the Oracle of Omaha that things would bounce back, and that not all would be lost, and that new highs would be had once again, if not next decade than in the decades ahead, not even he could have predicted the pace of the market’s rise these past 9 years, at least in this humble author’s opinion. What we’re saying is that while eclipsing the prior highs of the Great Recession may have been expected by some of the more experienced investors, witnessing the subsequent surge in the stock market has been something of a spectacle. Nobody could have predicted a Trump Presidency and the passing of tax reform, in 2008, but my goodness, look at things now!

US unemployment is now at 3.9%, as of July 2018, the lowest it has been in as long as we can remember. The US economy has not been in recovery, but it has been in expansion since 2010. The economic weakness of 2009 was a mere blip in history, and US gross domestic product has advanced steadily, to now eclipse $19+ trillion, a far cry from the $14.7 trillion during 2008. We’re talking real growth and real prosperity for Americans, and a stock market supported by strong earnings. FactSet is estimating that S&P 500 companies will earn $178.28 per share in calendar year 2019, as of their August 31 update, which is up from $73.70 in calendar year 2008, prior to the Great Recession, and $61.95 per share during calendar 2009 when the global financial system was a mess.

Even the expansion from calendar year 2016 levels of $119.29 per share in earnings per share is remarkable. Although a good portion of the S&P 500 earnings-per-share growth has been driven by significant buybacks, the bottom-line growth of S&P 500 companies has been and is expected to be robust, nonetheless. As of August 31, FactSet estimates that the 12-month forward P/E ratio for the S&P 500 is 16.8, and while this is above the 5-year average of 16.3 and the 10-year average of 14.4, it is certainly not bubbly, by any stretch of the imagination. The US economy may have been propped up by ultra-low rates, quantitative easing, and significantly increased sovereign (and corporate debt) during the past several years–and earnings growth may largely be driven by buybacks–but the stock market is operating on a firm foundation of valuation.

One of our major concerns regarding the threat to valuation has been interest rates. As Warren Buffett has often stated, interest rates are one of the most important, if not the most important, drivers behind stock prices, and they have been (ultra) low in the US for some time (they’ve even been negative elsewhere in the world). Corporate tax reform may reduce the cash coffers of the US government creating an increased threat of US credit risk and inflation, and while the Fed is intent on raising the federal funds rate, President Trump is now attacking the issue of rising rates head on. Though we believe the Fed will act independently, it will become much more difficult for it to continue to raise rates in 2019, in our view, if the White House is breathing down the Fed’s neck. The latest strong recovery in the equity markets during the past several months may be, in part, a function of expectations of a slower pace of rate hikes starting in 2019.

Still, nobody could have predicted the magnitude and duration of the current bull market, one that is now over 9 years in duration, driving compound annual returns of 17.5%+ since. Nobody could have predicted that Donald Trump would become President of the United States back when GDP was plummeting by high-single-igit rate during the fourth quarter of 2008. Following the Bush II administration, some may have believed that we wouldn’t see another Republican President in a few decades, or at least not for some time. If you recall, even the election polls had put Hillary Clinton as the clear favorite to win the 2016 election over Donald Trump. Since election night, Democrats have been working around the clock to get Mr. Trump out of office, and with all the investigations, the US is starting to look a bit silly on the world stage–not because of Trump, but because of the rallying cry of its citizens against their elected President of the United States.

Lehman Brothers, Bear Stearns, Washington Mutual – these are just a few historic brand names that the new generation of investors may never have even heard of, as arguably the names of many companies that folded during the Great Depression may never have reached the ears of the baby-boomer generation. History may not repeat exactly, but it definitely seems to rhyme quite often. Uncle Warren was right. Look at how good things are today, and the stock market is Categories Member Articles