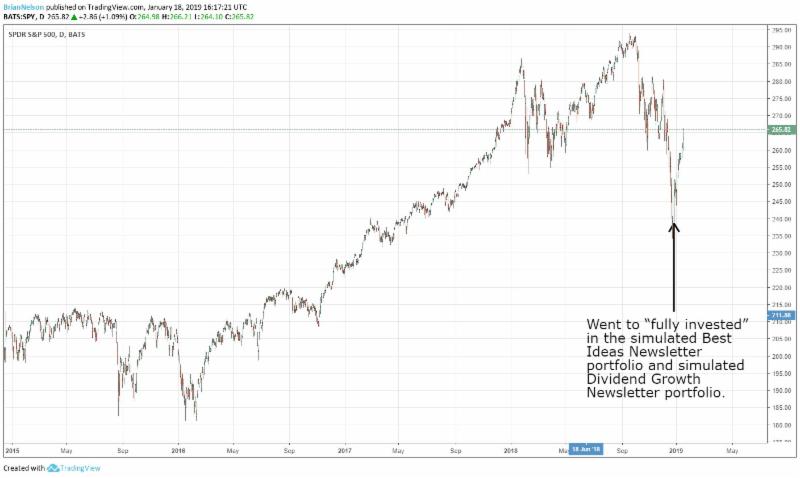

Image shown: The markets continue to rally significantly since the near-term bottom in December. The decision to move the cash “weightings” to zero in the simulated portfolios of the Best Ideas Newsletter and Dividend Growth Newsletter during the trading session December 27 has been quite rewarding for members that have been following our research and newsletters. The S&P 500 SPDR.

No Changes to Simulated Newsletter portfolios. This article was sent to members via email January 18. The original email can be accessed via the link that follows this article.

Brian Nelson, CFA

The S&P 500 (SPY) continues to march higher in this young 2019, and we trust many of you are pleased with what is turning into quite a nice bounce thus far. We think the market still has room to run higher in the near term, but the bigger question remains what will happen for the remainder of 2019. On that note, too, it is starting to look better.

More recently, we highlighted how the flattening yield curve seems to make a series of more rate hikes by the Fed less likely, given that the FOMC, itself, would be purposefully inverting the yield curve by doing so. This wouldn’t make much sense, in our view, given the potential behavioral implications that an inverted yield curve would have on economic activity. Here’s what we said in “Fed Might Slow After All, Bank Reports Just Okay:”

—–

It’s not so much that either the Fed or the market is “correct,” but the behavioral implications from the inversion may be more material to the Fed’s decision-making process than the inversion itself. For example, if investors think an inverted yield curve is associated with a recession, they may sell their stocks and save more in advance of what they think will be a recession, and these actions may actually cause a recession. In my view, while a yield curve inversion suggests less-desirable long-term conditions than short-term ones, an inverted yield curve actually causing the behavior that drives a recession is what may be the biggest concern of all.

The Treasury spread of the 10-year yield minus the 1-year yield stood at 7 basis points on January 2, and Bullard notes that “various measures are all trending toward inversion,” including the 5-year/2-year and the Fed near-term forward. Bullard’s conclusion seems logical and sound to me: “Market based signals such as low market-based inflation expectations and a threatening yield curve inversion suggest that this window of opportunity has now closed.” Bullard seems to think that the Fed hikes during the past couple years are adequate to “contain upside inflation risk.”

We’ll have to wait and see what the Fed has in store for 2019, but we don’t think it is likely it will purposefully drive a significantly inverted yield curve, unless of course it thinks the market is manipulating long-term rates in an effort to influence Fed policy. If it holds that opinion (and it might), then more rate hikes can be expected (regardless of the impact on the yield curve). Inflation expectations appear benign, economic growth remains resilient, the jobs numbers are good, and the unemployment rate certainly isn’t bad. Still, the Fed must know that it may only take the idea of an inverted yield curve, itself, to actually cause the next recession, and that’s definitely something it doesn’t want. All told, the Fed has a lot to think about during 2019, and that it is forced with such a dilemma at 2%-3% short-term rates and not at 6%-7% speaks of just how fragile the global economy may very well be.

—–

We’re also witnessing better sentiment when it comes to the health of China (FXI, MCHI). Apple’s (AAPL) guidance a few weeks ago sent shockwaves through the tech ecosystem and drove concerns with respect to the demand profile of companies tied to China, but the performance we’ve seen from Nike (NKE) and Tiffany (TIF) may indicate conditions aren’t as troubling as one might have thought. Tiffany’s holiday quarter wasn’t bad at, and the company even reported double-digit sales growth in China. The latest data point from Nike with respect to sales trends in China, released on December 20, was also solid.

My colleague Kris Rosemann has written up a few articles that I think are worth a read. We think the department-store business model is going by way of the do-do, and while Eddie Lampert may have saved Sears for the time being, the trends are against the space. J.C. Penney may be the next to file bankruptcy, and we doubt the failures by these two companies will ease the pain felt by Macy’s (M), Kohl’s (KSS), and Nordstrom (JWN). Read Kris’ note on the disappointing sales trends at the department stores here.

Netflix (NFLX) has been quite the attention-getter these past many years, but we’ve never been interested in it. The range of probable fair value outcomes on the basis of enterprise valuation for Netflix is just too large to call exposure to the company any more than gambling. Netflix has a great product, but a great product and solid brand name a good stock doesn’t always make. The company’s share price can continue to catch the favor of speculators, but we’re okay with sitting on the sidelines. Take a read of Kris’ note on Netflix’s quarter here.

All told, this rally may have legs given more “dovish” expectations of monetary policy and more encouraging news regarding sales trends by US icons in China. I hope that you have a nice Friday as we close out this week of trading, and most of all, I hope that you enjoy the weekend. 2019 may be one of the most volatile years we’ve seen in a while. Let’s keep paying close attention. If you haven’t yet read my tribute to Vanguard founder Jack Bogle, please do so here. We lost an investing legend this week.

Tickerized for holdings in the SPDR S&P 500 ETF (SPY).

Link to original email: http://campaign.r20.constantcontact.com/render?preview=true&m=1110817109903&ca=ac85ae6d-d218-4413-8bff-7a5cd294f564&id=preview

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.