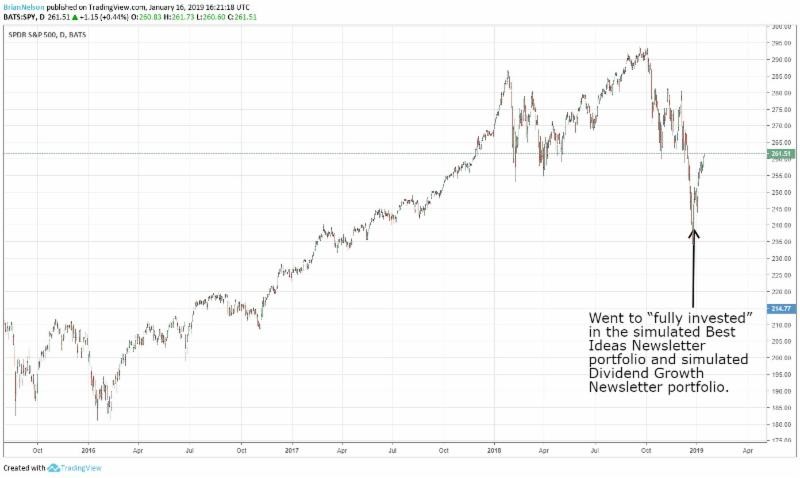

Image shown: This holiday season was mighty hectic, and not many were anticipating the volatility we experienced. Here’s where the simulated Best Ideas Newsletter and simulated Dividend Growth Newsletter portfolios went to “fully invested,” reducing a 30% and 20% cash “weighting” at the high end of their respective ranges for each portfolio, respectively. Email.

No Changes to Simulated Newsletter portfolios

Brian Nelson, CFA

After what perhaps has been the most volatile December in stock market history, the markets are off to the races in January. We continue to watch the broader equity markets closely, but directionally the call to go to “zero” in cash after the close December 26 has worked out, for anyone that received the notification after that date. However, it is more important than ever to not rest on this fortuitous move. The market could very well be carving out a long-term downtrend, and if the “quants” and technicians get a whiff of it, a drop could happen quickly. Let’s keep watching this market with our finger on the put-option trigger. Expect more volatility, not less.

Many of you have offered some great praise for my new book Value Trap, and I cannot thank you enough for that. If you haven’t yet reviewed the text, please select “Write a Customer Review” after selecting this link. I would appreciate it very much. I also want you to read an article by Gary Smith, the Fletcher Jones Professor of Economics at Pomona College. He has written a number of books including The AI Delusion and Standard Deviations: Flawed Assumptions, Tortured Data, and Other Ways to Lie With Statistics. He recently wrote an op-ed in Wired called, The Exaggerated Promise of So-Called Unbiased Data Mining, and I highly recommend the piece to get a feel for some of the big problems finance faces when it comes to certain analytical methods, whether it be within traditional quantitative applications or artificial intelligence and machine learning.

My colleague Kris Rosemann wrote up some of the most talked-about news, including an update on the Apple (AAPL) versus Qualcomm (QCOM) saga, rumors that Intel (INTC) may acquire AMD (AMD), Visa (V) in China, and also Netflix’s (NFLX) new pricing plans. The latter is quite intriguing, as I highlight in Value Trap how pricing power is the key lever to economic-value generation. If customers remain sticky at Netflix, the company’s business model could have legs. We recently grew more optimistic on Netflix in the past year or so, but we’re still very concerned about its net debt position and content costs. We’re not comfortable with the idea in the simulated Best Ideas Newsletter portfolio, even if its speculative run higher continues.

In case you missed it, Facebook (FB) and Alphabet (GOOG, GOOGL) have now registered 10s on the Valuentum Buying Index. They are both off to a good start, but their upcoming quarterly reports will be very telling of just how much political and regulatory pressure is damping their ability to grow advertising revenue and advance other initiatives. Data security and customer privacy remain key issues, and we believe measures taken by these companies to ensure this end, while costly, only increase barriers to entry. New entrants, for example, don’t stand a chance given what Facebook is now spending to address some of the privacy issues. Facebook is expected to report earnings January 30 after the market close.

Our favorite idea remains Visa (V). It was the top weighting in the simulated Best Ideas Newsletter at the end of 2017, and the company was a big winner during 2018 when the market swooned. We love that Visa doesn’t take on the credit risk of its customers and is paid every time one of its cards is swiped. It has a fantastic business model, and the secular trend toward toward a cashless society still has a long way to go. We like Visa as an idea on the general trend toward electronic payments, and PayPal (PYPL), more specifically as an e-commerce idea with “safer” exposure to crypto. Both Visa and PayPal have fantastic free-cash-flow generating business models. That’s all for now. We’ll talk more soon.

Tickerized for holdings in the S&P 500 SPDR (SPY).

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.