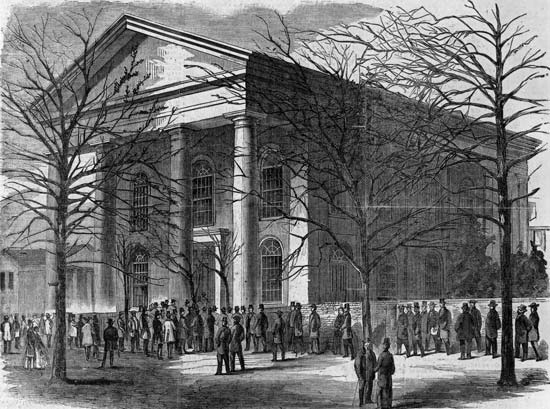

First Baptist Church in Columbia, S.C., where the first secession convention in the United States opened on Dec. 17, 1860. Source: Library of Congress, Washington, DC. Photo. Encyclopædia Britannica Online. Web. 24 Jun. 2016.

Global markets are plunging, and the implosion may still be in the early innings. Market valuations remain stretched among stagnant global economic growth, and “Brexit” may be the catalyst for a correction.

In the paraphrased words of the well-known The Day of the Jackal author, Frederick Forsyth: the peasants have spoken. On June 23, the UK (EWU) held a referendum, in which anyone of voting age could take part, to decide whether the country should leave the European Union. The turnout was incredible at nearly 72%, and those voting to leave the union (“Leave”) came in at 52% of the 30 million that cast a vote, setting the stage for “Brexit,” or Britain’s exit from the EU. On radio, Forsyth called the development the biggest uprising since the Peasants’ Revolt in England in 1381. This is hardly the case of course, but global financial markets are plunging, and the financial sector (XLF, KBE) is getting shellacked as market participants try to figure out which banks may be left holding the bag.

We’re still digesting the implications of “Brexit,” but we’re generally of the opinion that individual economic nuances of member nations of the European Union make centralized monetary policy and a common currency in the EU somewhat of an impediment to achieving individual sovereign-member macro goals. Unlike individual nations with distinct monetary and fiscal policies, the European Union is a combination of 28 member countries with generally unique economies and cultures with varying societal goals. Said differently, where the US can pursue both monetary and fiscal policy in tandem to achieve societal goals of price stability and full employment and the like, member nations of the EU are beholden to collective monetary policy that may at times fly in the face of what an individual sovereign may need at any given point in time. What is good for all may not be good for one. Critics point to this dynamic as to why a break-up of the EU may be an eventuality. Secession bells are ringing! Could Sweden and Denmark be next? What about France? Frexit?

Though it’s too early to know for sure whether “Brexit” may be a catalyst for a sustained global stock-market “correction” (beyond the plunge today), broader market valuations remain frothy, and global economic growth continues to stagnate. In the US, not only are valuations of S&P 500 companies stretched to ~17 times forward earnings, materially higher than both their 5-year and 10-year averages, but even some of the safest business models in the consumer staples sector (XLP), for example, are fetching valuations north of 20 times forward earnings. Though “Brexit” itself may not be enough to drive panic beyond today’s knee-jerk reaction, within the context of an overheated and bubbly US stock market (DIA), it could very well be the tangible catalyst that sends the US market indices tumbling lower during the back half of 2016. Remember, the markets hate uncertainty, and this “Brexit” vote has only increased the market’s uneasiness, which may be enough to keep new money on the sidelines. Without new money, equity markets will have trouble etching new highs.

There’s more. Monetary policy in the US is something we’re very mindful of, and “Brexit” may take any further hikes in the federal funds rate off the table, perhaps for the rest of 2016. Some of the “rate-hike” probability readings we’ve been witnessing suggest that not only are rate hikes probably off the table through at least November, there’s now a possibility of the Fed actually cutting rates…at the next meeting (~6%). Can you believe it? Global capital is flocking to US Treasuries, driving the 10-year rate (TBT, TLT) under 1.5% at last check, approaching record lows of ~1.4% set in July 2012. Though lower rates are generally good for businesses and economic growth, the read-through in this case is that global markets are “scared,” and the mighty US dollar (UUP) is one of the few places investors are willing to park cash (investors exchange foreign currency to US dollars–driving the price of the dollar higher relative to a basket of other currencies–to purchase Treasuries, which in turn then drives Treasury yields lower). The read through: market participants are “happy” with a paltry yield rather than taking on exposure to “risky” equities. Even a modest 20% correction following what has been one of the strongest runs in stock market history from the March 2009 panic bottom to the present day could be considered “normal.” Please be aware of this.

In light of tumultuous conditions in the currency markets, which have sent the UK currency (pound) tumbling 10%+ to a 30-year low, we’re also paying close attention to equities levered directly or indirectly to the USD-pound exchange rate (FXB). We would expect some spillover effects on multinationals, particularly those with significant revenue bases in the UK (pound) and parts of their cost structure overseas (in US dollars and other currencies), reflecting an inconvenient currency mismatch. Some companies with significant revenue exposure to the UK include Penske Auto (PAG), PPL (PPL), Xerox (XRX), Copart (CPRT) Molson Coors (TAP), Ford (F), and News Corp (NWSA), among others. US investors holding ADRs may feel the pinch from a weakening pound as well. Some equities that may fit this profile include AstraZeneca (AZN), BP (BP), Diageo (DEO), GlaxoSmithKline (GSK), Fiat Chrysler (FCAU), Pearson (PSO), Shire (SHPG), Smith & Nephew (SNN), and Unilver (UL, UN), among others. Income investors that are counting on UK-based equities that pay dividends in pounds may also see a cut in their paychecks.

Our team is monitoring the European banks closely. Barclays (BCS), Royal Bank of Scotland (RBS), Lloyds Banking (LYG), HSBC (HSBC), Deutsche Bank (DB), and UBS (UBS) were all down considerably in morning trading, with Barclay’s, RBS, and Lloyds giving back nearly 30% of their respective market values. Ongoing uncertainty about what may or may not constitute the European Union and any changes in the banking regulatory environment following Britain’s exit from the EU may crimp lending causing a slowdown in loan growth and economic resiliency. Many view the UK as a springboard to further business in the European continent and a less-cohesive link between the UK and the EU could end up being quite disruptive, at least in the near term.

Of particular concern, however, is that the massive move in the pound may expose banking equities to unforeseen credit and currency risks. We would not be surprised to hear of hedge fund failures that were rocked as a result of such currency moves. Market observers may remember the “fall out” of the now-defunct Long Term Capital Management, which failed as a result of bad currency bets. Such a concern is reverberating through the US-based global money centers: Citigroup (C), Bank of America (BAC), JP Morgan (JPM), Wells Fargo (WFC), Goldman Sachs (GS), and Morgan Stanley (MS) — all down more than 5% in morning trading. We continue to retain exposure to the US banking sector, however, as the stress tests, released June 23, continue to show a resilient financial foundation in the States. We’re watching the yield curve closely, however.

“Brexit” is also expected to have an impact on the UK transportation industries. Early estimates are projecting UK air passenger volume to be down by 3%-5% by 2020, mostly due to the expectations for an economic downturn brought about by the collapse of the British pound. The UK air market is dominated by outbound traffic, and the weakening of the pound relative to other currencies will weigh on the demand of outbound travel. US airlines Delta (DAL) and United Continental (UAL) are among those impacted by reduced expectations for travel out of London and the UK, but American Airlines (AAL), which generates nearly 20% of total revenue from the Atlantic region that includes the UK, has been the biggest loser of the group thus far.

Global economic uncertainty and financial market turmoil means that its “gold bug” season, and many of the world’s large gold miners are catching a bid on “Brexit” news. Newmont Mining (NEM), Barrick Gold (ABX), Yamana Gold (AUY), Gold Corp (GG), and Eldorado Gold (EGO), for example, are all bucking the sell-off June 24, as traders flock to the yellow metal for “safety.” The SPDR Gold Shares ETF (GLD) is advancing ~5% today, but not all commodities are being spared. Dollar-denominated crude oil (USO) and copper prices are tumbling as concerns about global growth return to the fore, but the latter two have bounced considerably in the past several months. Big commodity producers BHP (BHP) and Rio Tinto (RIO) are feeling pain during the trading session June 24, both down more than 7%. The cost of protection is also on the rise, and on the basis of a time consideration to expiration, we think it’s ripe to close out the June 30 put option position on the S&P 500 SPDR ETF (SPY) in both newsletter portfolios (at $1.19 per contract).

As for newsletter holdings, Altria (MO), the Utilities Sector SPDR (XLU) and Realty Income (O) continue to power higher amid the chaos. Our cash positions in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio stand at ~15% and ~25%, respectively, as we wait patiently for the dust to settle. It’s been quite the morning! Please let our team know if we can elaborate further.

Related travel stocks: RYAAY, PCLN, EXPE, TRIP