|

|

Recent Articles

-

Our Reports on Stocks in the Industrial Leaders Industry

Our Reports on Stocks in the Industrial Leaders Industry

Aug 27, 2023

-

Our reports on stocks in the Industrial Leaders industry can be found in this article. Reports include: MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, ITW, EMR, ROP, PH.

-

Dividend Increases/Decreases for the Week of August 25

Dividend Increases/Decreases for the Week of August 25

Aug 25, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

“A New Computing Era Has Begun” -- Nvidia Delivers Yet Again

“A New Computing Era Has Begun” -- Nvidia Delivers Yet Again

Aug 23, 2023

-

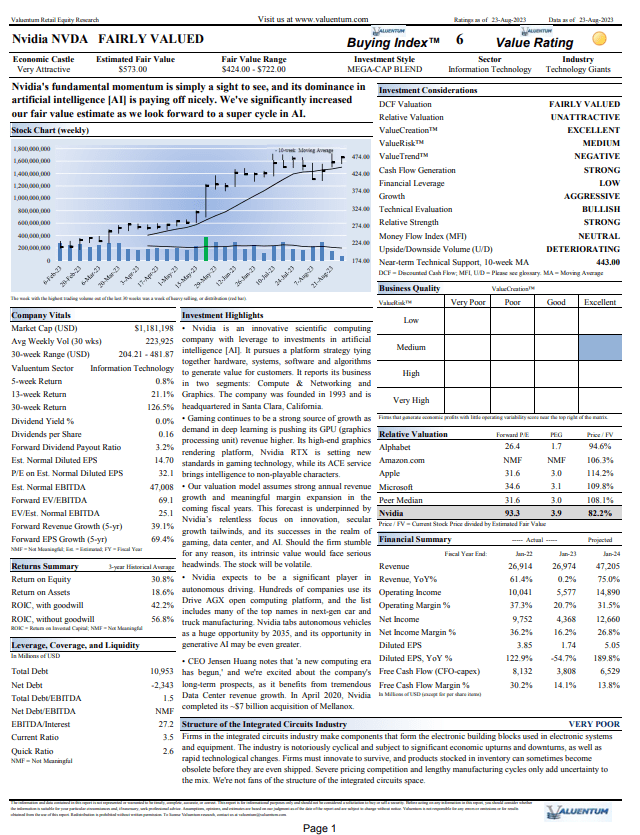

When we first wrote that Nvidia would power this market higher back in May, the firm had just put up one of the most prolific earnings beats I had ever seen. I’d have to go back almost 20 years to the invention of Apple’s iPod click-wheel technology to remember something that came close. Well, on August 23, Nvidia just put up another monster quarter, this one the second of its fiscal year 2024, beating top-line and bottom-line consensus estimates by a huge margin for the period ending July 30. We’ve raised our fair value estimate of Nvidia considerably following the blockbuster second-quarter performance and third-quarter outlook, released today, and the race is on to adopt artificial intelligence [AI].

-

Dick’s Sporting Goods Down ~7% Year-to-Date; Sticking with It Long Term

Dick’s Sporting Goods Down ~7% Year-to-Date; Sticking with It Long Term

Aug 22, 2023

-

Image Source: Mike Mozart.

Some of our favorite dividend growth ideas in the Dividend Growth Newsletter portfolio include Cisco, Microsoft, Oracle, Apple, and Republic Services. Cisco is up more than 15% year-to-date, Microsoft is up more than 34% year-to-date, Oracle is up more than 38% year-to-date, Apple is up over 40% year-to-date, and Republic Services is up more than 14% year-to-date. These dividend growth ideas are trouncing the basket of high-yielding Dividend Aristocrats. With big cap tech and large cap growth powering the market higher during 2023, it’s been great having this type of exposure within the Dividend Growth Newsletter portfolio, and we hope you have enjoyed it, too...Unlike big dividend growth winners such as Cisco, Microsoft, and Oracle, which are higher weightings (5%-7%) in the Dividend Growth Newsletter portfolio, Dick’s Sporting Goods has a smaller 3-5% weighting and fills a more diversifying role with respect to retail. That said, the sporting goods retailer’s second-quarter results (ending July 29, 2023) missed top-line consensus expectations by a small margin, but the miss on the bottom line was a bit more pronounced due to concerns over shrink. Dick’s Sporting Goods, however, still delivered 3.6% sales expansion in the period while quarterly comparable store sales increased 1.8% (an improvement from the 5.1% decline in last year’s quarter), as it reiterated its 2023 comparable store sales target of “flat to positive 2%.” The company’s full-year 2023 outlook for diluted earnings per share now stands at $11.33-$12.13 (was $12.90-$13.80), implying shares are trading at about 10x current-year earnings.

|