Member LoginDividend CushionValue Trap |

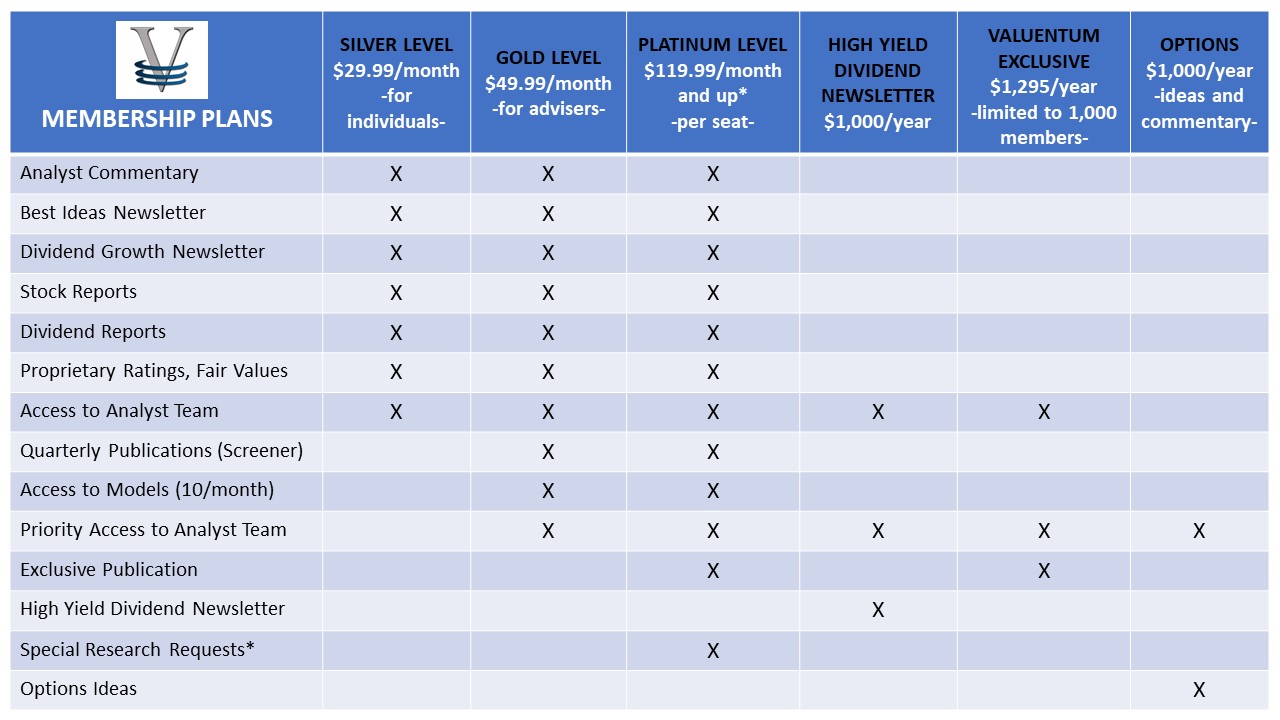

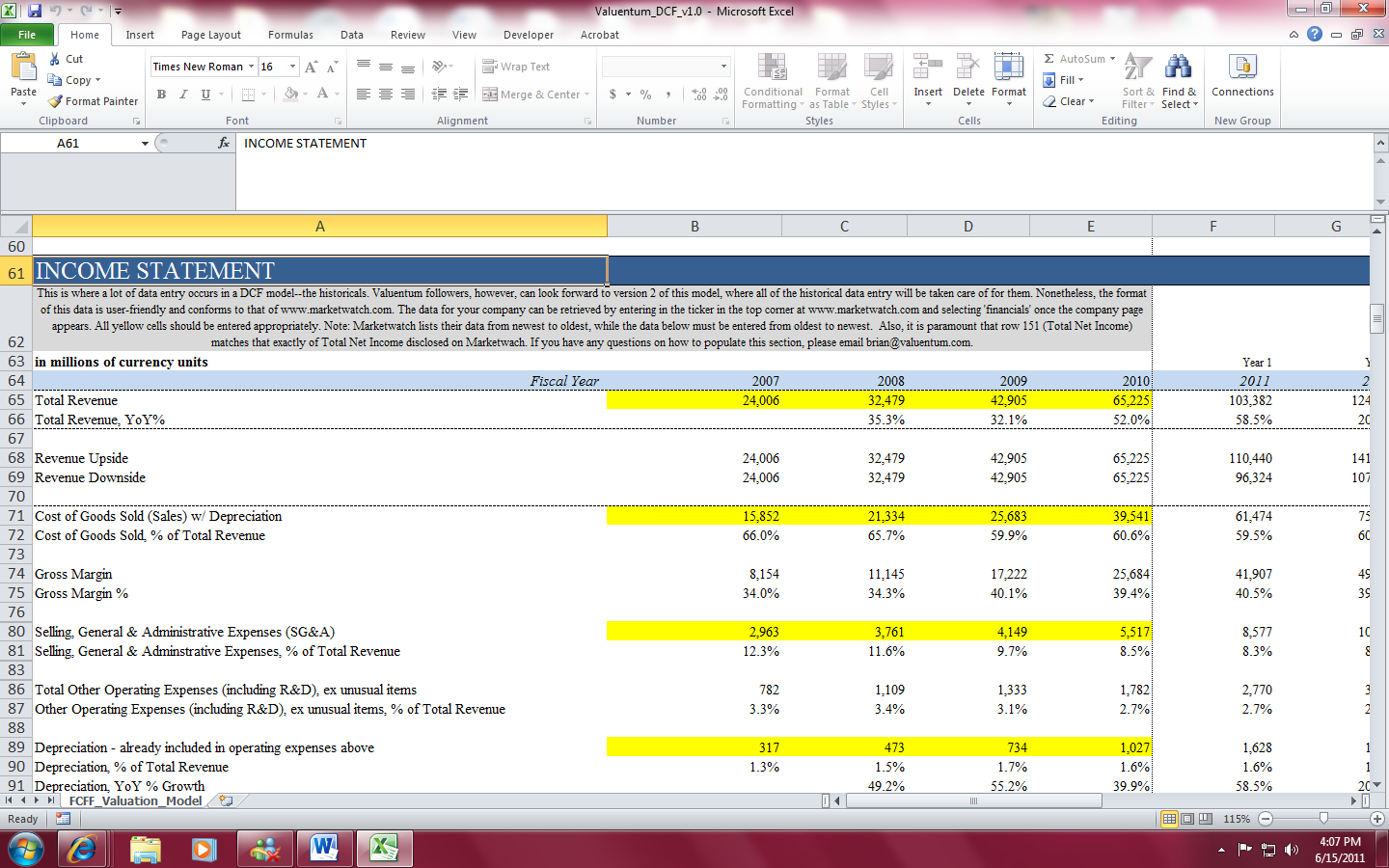

InstitutionsInvestment Research Services for Institutions (PLATINUM LEVEL) We provide an independent, insightful systematic investment evaluation process that combines a rigorous discounted cash-flow and relative-value methodology with a timeliness overlay via technical and momentum indicators. Use our discounted cash-flow process by itself or blend it with a variety of other metrics we generate. Our coverage universe spans hundreds of stocks, and we make fully-populated valuation models available as part of a membership (limited to 10/month; it's as easy as emailing info@valuentum.com). Access our valuation models, view our Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, and add our Valuentum Buying Index or Valuentum Dividend Cushion ratings to your process today! Contact Sales for More Information >> Download (pdf): "How Well Do Enterprise-Cash-Flow-Derived Fair Value Estimates Predict Future Stock Prices? -- And Thoughts on Behavioral Valuation" ---------------------------------------- Our Product Offering for Institutions (PLATINUM LEVEL) Valuation Models We offer institutional investors fully-populated discounted cash-flow models that contain at least three years of historical financial detail and five years of future explicit forecasts. Institutional and financial-adviser subscribers can access models on companies spanning our entire stock coverage universe to evaluate future estimates, or alter key inputs to generate a customized fair value estimate. Our model is academically sound and professionally-tested and includes a three stage process, with fading returns on new invested capital to a company's cost of capital over time (limited to 10/month; it's as easy as emailing info@valuentum.com).

Newsletter Portfolios We offer ongoing access to our Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. On the basis of our processes, both portfolios represent the cream of the crop in terms of investment ideas, in our opinion, for opportunistic and dividend growth investors, respectively. The Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio are not real money portfolios. Results are hypothetical and do not represent actual trading. Best Ideas Newsletter Each monthly issue of our Best Ideas Newsletter reveals our best ideas for capital appreciation constructed in a portfolio. We write commentary associated with the companies in the portfolio or stocks in the news and notify you immediately via email if our thoughts or opinions have changed on any company or position in the portfolio. Consistent with our investment methodology, the Valuentum Buying Index, our best ideas may span investing disciplines, market capitalizations and asset classes. Past results are not a guarantee of future performance, and actual results may differ from simulated performance being presented. << About Our Best Ideas Newsletter We seek to deliver the very best of dividend growth ideas, and the Dividend Growth Newsletter does just that for dividend growth investors, in our view. In each monthly edition of the Dividend Growth Newsletter, we provide a portfolio of the best dividend growth stocks that we think will generate a strong and growing stream of cash flows, as well as a forward-looking assessment of the dividend safety of hundreds of firms through our innovative, predictive dividend-cut indicator, the Valuentum Dividend Cushion™. We also provide commentary and analysis about the stocks we hold in the portfolio and on any new dividend growth ideas to consider. Helpful screens that overlay our Valuentum Buying Index™ with dividend-payers that have safe and growing dividends are provided, and we send email alerts notifying you of any changes we may make to our portfolio. << About Our Dividend Growth Newsletter The Valuentum Exclusive Publication The Valuentum Team highlights three new ideas each month to consider, one for income, one for capital appreciation, and a "short" idea (all three will be outside our existing coverage universe). Ideas are delivered to your inbox. << Learn more about the Exclusive

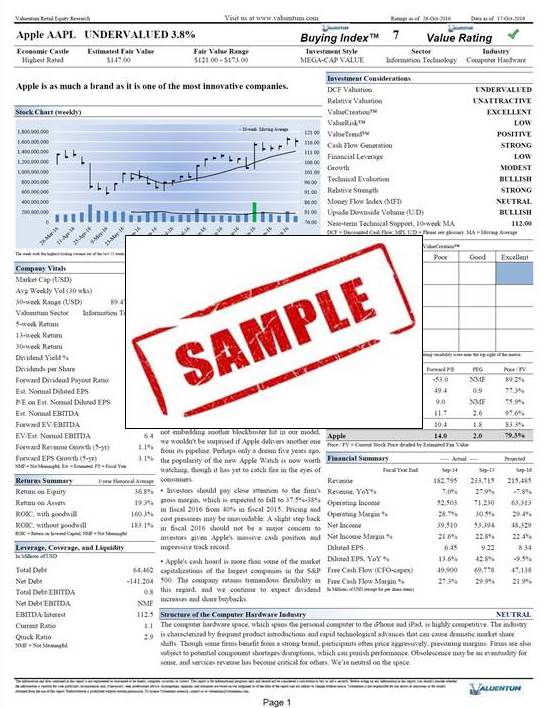

In our 16-page equity reports, we offer a fair value estimate for each company, give our opinion on the attractiveness of the stock based on a firm-specific margin of safety assessment, and provide a relative valuation comparison in the context of the company's industry and peers. Each report includes detailed pro forma financial statements, explicit fundamental forecasts, and scenario analysis. A cross section of our ValueCreation and ValueRisk ratings provides a financial assessment of a company’s business quality (competitive position), while our ValueTrend and Economic Castle ratings offer insight into the trajectory of a firm’s economic profit creation (ROIC versus WACC). Included in each report is a firm's rating on the Valuentum Buying Index (VBI), which combines our rigorous financial and valuation analysis with an evaluation of a firm's technicals and momentum indicators to derive a score between 1 and 10 for each company (10=best). We believe our methodology helps identify the most attractive stocks at the best time to consider buying, helping to avoid value traps and lagging performance due to the opportunity cost of holding a stock with great potential but at an inopportune time. The Best Ideas Newsletter portfolio puts the VBI methodology into practive. Read more about the Valuentum Buying Index rating system, "Value and Momentum Within Stocks, Too." << View a sample company report Download (pdf): "How Well Do Enterprise-Cash-Flow-Derived Fair Value Estimates Predict Future Stock Prices? -- And Thoughts on Behavioral Valuation" Insightful, Forward-looking Dividend Reports We understand the critical importance of income for the dividend investor. As a result, we've developed forward-looking dividend analysis backed by a robust cash-flow based process. As a supplement to our 16-page stock reports, our dividend reports assess the safety of a firm’s dividend through our Valuentum Dividend Cushion™ ratio, the potential growth of a firm’s dividend by evaluating its capacity and willingness to increase the dividend, the historical track record of the company’s dividend performance, and the overall strength of the dividend by putting all of this analysis together. Each report offers our estimate of the future growth rate of the firm's dividend. << View a sample dividend report Valuentum Ideas100 We email our Valuentum Ideas100 publication to institutional (platinum) level members at the beginning of each quarter. In each edition, we highlight 100 of the highest-quality stocks in each of the major market sectors to help you generate new ideas for a diversified portfolio. Companies that make the publication are best-in-class within their respective sectors based on our assessment of their competitive position and underlying business risk. Though quality is our first consideration in this publication, firms that make this expansive report can also be undervalued on the basis of our rigorous, discounted cash-flow process. Valuentum Dividend100 We email our Valuentum Dividend100 publication to institutional (platinum) level members at the beginning of each quarter. This quarterly publication puts the top 100 high-quality, dividend-growth gems at your fingertips. We believe the Valuentum Dividend100 to be a must-have for any income portfolio manager. << About Our Valuentum Dividend100 Valuentum DataScreener We email the Excel-based Valuentum DataScreener publication to institutional (platinum) level members at the beginning of each quarter. You'll receive our data and metrics to help you pick and screen the best stocks for either you or your clients. Our Excel-based data feed and screener runs the gamut of Valuentum data points from our estimated fair value, price-to-fair value, Valuentum Buying Index to normalized earnings and EBITDA and a variety of technical and momentum measures. All stocks can be sorted by any key metric to uncover hidden investment gems. << About Our Valuentum DataScreener Analyst Access Institutional (platinum) level members have access to the Valuentum Analyst Team. Most conversations center on industry insights and firm-specific valuation assumptions. Add-on Publications Institutional (platinum) level members can add the High Yield Dividend Newsletter to their membership. The High Yield Dividend Newsletter portfolio seeks to find some of the highest-yielding stocks supported by strong credit profiles and solid business models, but not always robust traditional free cash flow. Ideas in this newsletter offer higher-yielding opportunities, but also much higher capital and income risk. Members can also add more options commentary as an add-on feature. << Add the High Yield Dividend Newsletter Training and Support All Valuentum institutional (platinum) level services are supported by our team that is available from Monday through Saturday, including market holidays. Valuentum also offers training sessions to help you get the most from your institutional subscription. Call or email with questions. ---------------------------------------- Contact a Sales Representative To learn more about our institutional offering, please contact us to speak with a sales representative. ---------------------------------------- The High Yield Dividend Newsletter, Best Ideas Newsletter, Dividend Growth Newsletter, Nelson Exclusive publication, and any reports and content found on this website are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of its newsletters, reports, commentary, or publications and accepts no liability for how readers may choose to utilize the content. Valuentum is not a money manager, is not a registered investment advisor, and does not offer brokerage or investment banking services. The sources of the data used on this website and reports are believed by Valuentum to be reliable, but the data’s accuracy, completeness or interpretation cannot be guaranteed. Valuentum, its employees, independent contractors and affiliates may have long, short or derivative positions in the securities mentioned on this website. |