Member LoginDividend CushionValue Trap |

“A New Computing Era Has Begun” -- Nvidia Delivers Yet Again

publication date: Aug 23, 2023

|

author/source: Brian Nelson, CFA

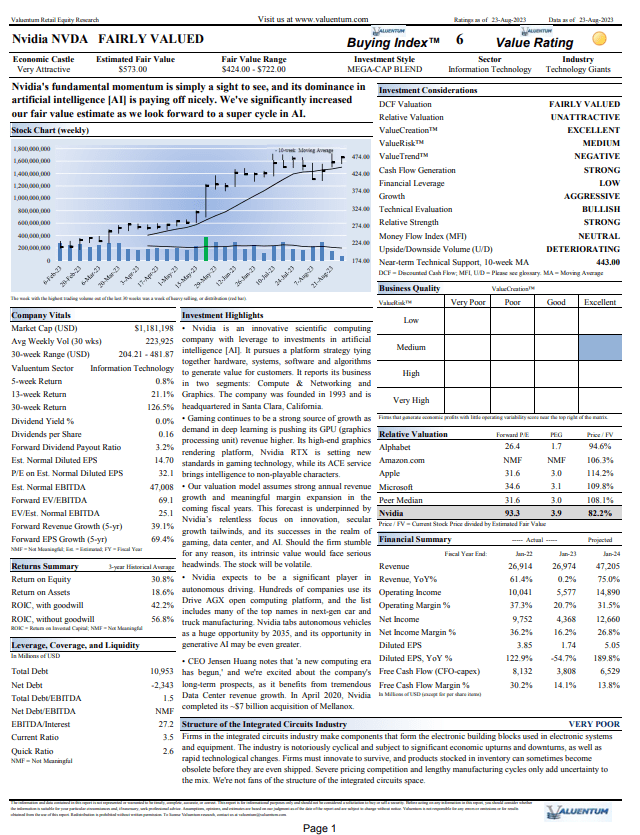

By Brian Nelson, CFA When we first wrote that Nvidia (NVDA) would power this market higher back in May, the firm had just put up one of the most prolific earnings beats I had ever seen. I’d have to go back almost 20 years to the invention of Apple’s iPod click-wheel technology to remember something that came close. Well, on August 23, Nvidia just put up another monster quarter, this one the second of its fiscal year 2024, beating top-line and bottom-line consensus estimates by a huge margin for the period ending July 30. We’ve raised our fair value estimate of Nvidia considerably following the blockbuster second-quarter performance and third-quarter outlook, released today, and the race is on to adopt artificial intelligence [AI]. During the quarter, Nvidia’s Data Center revenue was up 171% on a year-over-year basis, while gaming sales advanced 22% from the same period a year ago. The company guided for third quarter 2023 revenue of $16 billion (+/- 2%), a range that shows clear visibility to a target more than $3 billion greater than the consensus forecast, which had already been raised meaningfully following its first-quarter 2024 results. Nvidia ended the quarter with a net cash position on the balance sheet of ~$6.3 billion, while free cash flow for the first two quarters of its fiscal year came in at $8.7 billion. Capital spending during the six months ended July 30 was just $537 million, or less than 6% of operating cash flow, showcasing Nvidia’s tremendously asset-light business model. Nvidia fits the bill of a net-cash-rich, free-cash-flow generating, secular-growth powerhouse. In the quarterly press release, founder and CEO of Nvidia Jensen Huang noted the following: “A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI.” Artificial intelligence is the real deal and our experience with ChatGPT is that it is a game-changer already, even before the release of subsequent applications that may revolutionize just about every industry out there. We’ve refreshed our valuation model of Nvidia, incorporating a huge delta in top-line growth and profitability, and our updated fair value estimate stands at $573 per share (was $285 per share). If our forecasts come to fruition, Nvidia will be generating a boatload of free cash flow in the coming years, which may explain the company’s new $25 billion addition to its buyback program (it still had billions remaining on the program at the end of July).

We continue to be huge fans of the areas of big cap tech and large cap growth, of which Nvidia is a key component. We won’t be adding Nivida to any of the newsletter portfolios, but we expect to continue to benefit indirectly from the ongoing AI boom via our derivative plays in Microsoft (MSFT), Alphabet (GOOG), and Apple (AAPL). We expect big cap tech and large cap growth to continue to lead the markets higher, and while the market pullback could resume once again at some point down the road, the underlying cash-based sources of intrinsic value across big cap tech and large cap growth are simply unprecedented. Shares of Nvidia will continue to be volatile, but the company may eventually emerge as the key catalyst to drive the stock market to new highs, perhaps even this year. Our updated 16-page report on Nvidia can be downloaded below by selecting on the image. NOW READ: Nvidia Rockets Higher to Propel Large Cap Growth NOW READ -- Questions for Valuentum’s Brian Nelson NOW READ -- ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio NOW READ -- ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio NOW READ -- Expect Huge Equity Returns This Decade, Much More Volatility However NOW READ -- There Are No Free 'Income' Lunches

---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Tickerized for NVDA, AVGO, QCOM, AMD, MSFT, INTC, IBM, AMZN, META, TSM, ASML, ADI, TXN, MU, NXPI, ON, MRVL, SSNLF, SNOW, VMW, SMH, SOXX, MPWR, QRVO, AMAT, KLAC, LRCX, SNPS, WOLF, SCHG, XLK Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment