|

|

Recent Articles

-

Theft Becoming a Huge Problem for Retailers

Theft Becoming a Huge Problem for Retailers

Aug 22, 2023

-

Image Source: Ben Schuman.

Theft has always been a problem for retailers, but it has never been as big of a problem as it has been in recent quarters. Emboldened by the lack of police response and employees sometimes getting fired for confronting shoplifters, retail organized crime is on the rise. We’re not talking theft in the millions, or billions, but likely in the tens of billions per year or more across the U.S. Some attribute the rise of organized retail crime to the pandemic, which paved the way for shoplifters to post their loot online in order to make a quick buck. Some retailers are especially feeling the pinch, and recent commentary reveals just how bad retail theft (shrink) has become to their respective businesses.

-

Dividend Increases/Decreases for the Week of August 18

Dividend Increases/Decreases for the Week of August 18

Aug 18, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

3 High Dividend Yielders for Consideration

3 High Dividend Yielders for Consideration

Aug 17, 2023

-

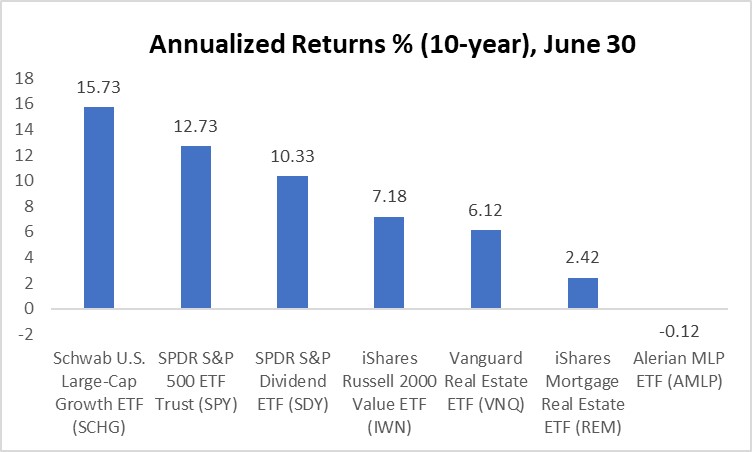

Image: Entities with large net cash positions and substantial free cash flow generation have outperformed not only the broader stock market, but also key high yield areas, including REITs, mortgage REITs and master limited partnerships during the past 10 years. Source: The respective ETF sponsors.

The skills to successfully invest for long-term capital gains or long-term dividend growth are much different than those required for generating high yield dividend income. Income investing is a much different proposition. However, the skills do center on a similar equity evaluation process, but one that requires an acknowledgement and heightened awareness of considerably greater downside risks. Income investing, or high yield dividend income investing, should at times be considered among the riskiest forms of investing, as many high dividend-yielding securities tend to trade closer to the characteristics of junk-rated bonds than they do most net cash rich and free cash flow generating powerhouses that we like so much in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

-

Home Depot’s Comparable Store Sales Continue Declines, Big Ticket Purchases Slow

Home Depot’s Comparable Store Sales Continue Declines, Big Ticket Purchases Slow

Aug 15, 2023

-

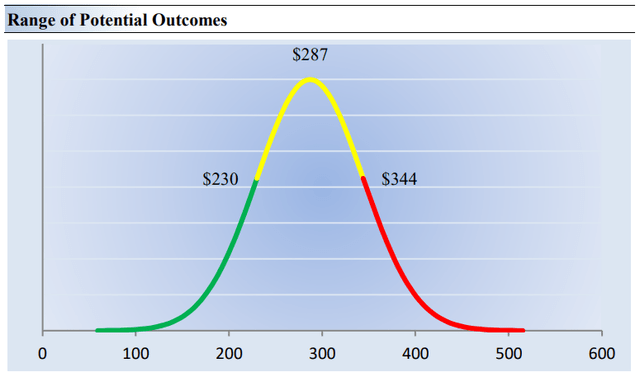

Image: Our fair value estimate range of Home Depot. Shares of Home Depot are trading at the high end of the range at ~$325 per share at the time of this writing.

Home Depot is one of the most resilient companies across the retail arena. The firm weathered the Great Financial Crisis [GFC] well and it handled the vicissitudes of the COVID-19 pandemic and aftermath flowingly as it juggled supply chain issues, changing consumer buying preferences, and increased demand as consumers remodeled and upgraded their working and living spaces while cocooning at home. The company’s second-quarter 2023 results, released August 15, came in better than expected, but comparable store sales fell 2% both in aggregate and in the U.S. Though comparable store sales declines improved from bigger declines in the first quarter, Home Depot’s guidance for comparable sales to fall 2%-5% for all of fiscal 2023 indicates there may be some further year-over-year weakness ahead. We’re sticking with Home Depot in the Dividend Growth Newsletter portfolio, however.

|