Image Source: BLS

The future is all that matters. This is a basic tenet of the stock market, where prices of equities are forward-looking discounting mechanisms.

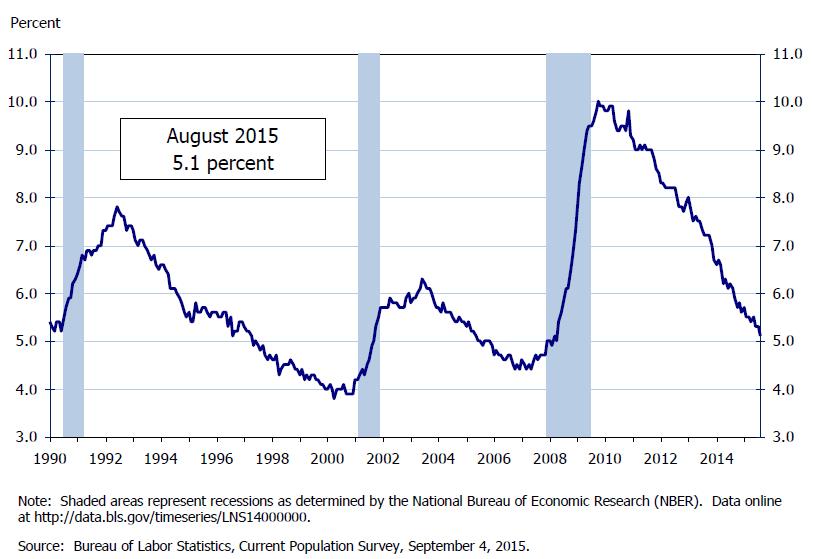

August is now over, and we learned that the job market in the United States is close to the healthiest it has been in a long time—that is, if you buy into the data calculations behind the national unemployment rate, which now stands at a 5.1%. The mark is the lowest level since the Great Recession of late last decade and is now roughly half the levels experienced at the “height” of the Great Recession, which drove 10% of Americans that were willing to work out of a job.

The Fed has worked a “miracle,” pulling the US from the edge of a cliff, over which was the coming of a modern-day Great Depression, and times are so good in America that “would-be” workers are leaving the civilian labor force in droves. The labor force participation rate held near all-time lows of 62.6% in August, hovering near the lowest levels in decades, while civilian employment remains near all-time highs matching the near all-time highs in the civilian labor force. The Bureau of Labor Statistics is not “fudging” the numbers, in our view, contrary to the latest musings of conspiracy theorists, nor do we think the unemployment rate is being propped up by “depressed” labor participation rate numbers from workers unable to locate “suitable” work.

Quite simply, we believe that due to accumulated wealth or other life decisions, people that don’t want to work are leaving the work force and people that want to work are finding jobs like never before, for the most part. Frictional job shifts and a mismatch of skills will prevent near-0% unemployment, but “persons not in the labor force who want a job,” a tally of ~6 million is only a smidgen above the 5.2 million available job openings, as of June. The pace of new job openings has been hovering at a 3% monthly pace. Those not currently working but want a job may disagree, and they have every right, too, but times in America are great, and a sub-5% mark for the unemployment rate may be just around the corner!

Savvy readers, however, understand that such optimism means little when it comes to the stock market. Just ask Radio Shack, or Eastman Kodak (KODK) or Washington Mutual, now a part of JP Morgan (JPM), or Merrill Lynch, now a part of Bank of America (BAC) how little their histories mattered as they were swept into financial distress.

There are as many ways to interpret the numbers as there are economists, but one thing is clear: we’ve come a long way since the depths of the Great Recession, and for the most part, consumers aren’t as much upset about finding a job as they are about getting paid more. We had outlined in March that the only mention of “deflation” in the latest Fed minutes at the time, the January 27-28 meeting, was in relation to wages, something we called out as “ludicrous.” Just a few short months later, highlights from the recent Beige Book released earlier this month centered on wage pressures.

The imposing strength of organized labor, something best exemplified in the falling price of Republic Airways (RJET) stock, which is battling for survival in light of disagreements with its pilots’ union, and the domino effect of $15 minimum wage legislation across the largest cities in the country, have been taking their toll on business health. Walmart (WMT) is struggling to contain costs in light of continued investments in store associate wages, and the impact of minimum wage hikes have yet to take their toll on fast-food giants McDonald’s (MCD) and Yum! Brands (YUM), among others. Fast-casual companies won’t be spared either, as Panera Bread’s (PNRA) most recent performance revealed.

We’re not sure the Fed has a good handle on the US economy, and the labor report September 4 will likely have little bearing on whether it raises rates later this month, given recent dislocations in Asia and the recent US market crash. Richmond Fed President Jeffrey Lacker seems to be of the opinion that everything is going great in the US, however, and that a rate hike is “warranted sooner rather than later.” He also tends to agree with our view that “research suggests that there is little if any excessive slack in the labor market.” As we’ve outlined many a time before, the problem with looking strictly at economic indicators with respect to a coming contractionary monetary policy is the profound impact that a tightening would have on high-yielding dividend paying equities–which are priced more like bonds than anything else due to recent Fed policy, fair or not.

Not only are the fixed-income markets tied at the hip to Fed policy, but more so than in any other time in the history of financial markets, due in part to the current relationship between dividend yields and commonly-followed Treasury benchmark securities, accommodative and dovish Fed policy has become vital to the sustainable health of the equity markets. They’ve become interconnected in such a way arguably like never before. If we get a rate hike in September, the markets will likely sell off in the weeks and months following the announcement, even if it is met with relief at the time of the announcement. If we don’t get a rate hike, the realities of the “Asian Contagion” are likely much more serious than even we have pondered, and the realities of such a dynamic coming to fruition may be even more concerning than any damage that any series of ill-timed rate hikes could ever do.

Broad market indexers could be in for more sliding in coming months.

Staffing Services: ADP, DLX, EFX, JOBS, KFY, MAN, NSP, PAYX, RHI