Image Shown: Shares of top weighted holding in our Best Ideas Newsletter portfolio Visa Inc continues to outperform the S&P 500.

By Callum Turcan

On January 30, Visa Inc (V) reported earnings for the first quarter of its fiscal 2020 (period ended December 31, 2019). While shares sold off on the news, V has since recovered some lost ground and it’s important to keep in mind Visa is up ~42% over the past year as of this writing while the S&P 500 (SPY) was up just ~19% during this period. We continue to like Visa as a top weighted holding in the Best Ideas Newsletter portfolio and given the combination of the firm’s strong long-term technical and fundamental performance (on a historical basis) along with its bright outlook going forward, shares of V could test the upper end of our fair value estimate range which sits at $228 per share.

Due to management preferring to allocate more of Visa’s free cash flows towards share repurchases versus dividends, and in part due to its impressive share price performance, shares of V yield ~0.6% as of this writing. While we like Visa’s dividend growth trajectory, the biggest opportunity Visa offers concerns capital appreciation upside.

Great Generator of Shareholder Value

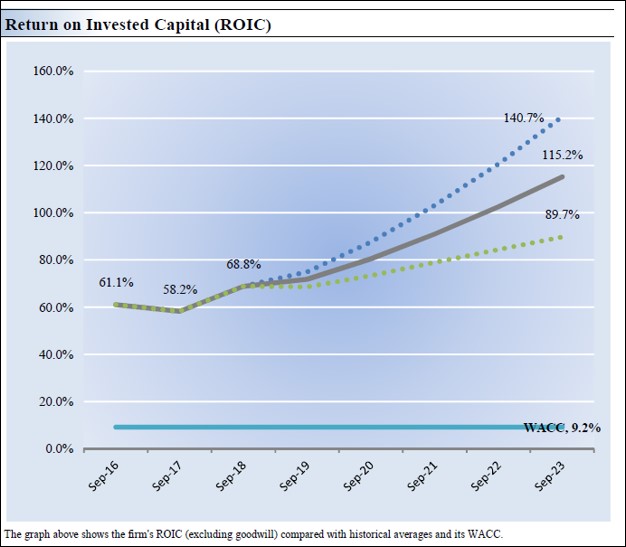

Visa does a tremendous job generating value for its shareholders and that’s seen through its EXCELLENT ValueCreation rating (a historical metric) and its VERY ATTRACTIVE Economic Castle rating (which is forward-looking and based on the magnitude of the ‘economic profit’ the firm is forecasted to generate). Economic profit is defined as having a return on invested capital (‘ROIC’), excluding goodwill, that exceeds the firm’s estimated weighted average cost of capital (‘WACC’), which we view as the source of shareholder value creation. We like to include companies that have rock solid ValueCreation and (more importantly) Economic Castle ratings in our portfolios because regardless of their competitive positions, these are firms that are set to generate the most value for their shareholders. As an aside, we really like Visa’s competitive position in the payment processing and financial services/tech space, a position that’s augmented by material investments in cutting edge financial tech and acquisitions.

In the graphic below, from our 16-page Stock Report covering Visa (can be accessed here), we highlight Visa’s historical ROIC (excluding goodwill) and its forecasted ROIC (excluding goodwill).

Image Shown: Visa is a tremendous shareholder value generator, seen through its ROIC ex-goodwill greatly exceeding its estimated WACC on a historical basis, and through our models forecasting for that spread to expand going forward (even under the lower band of our range of expected scenarios).

Financial Overview

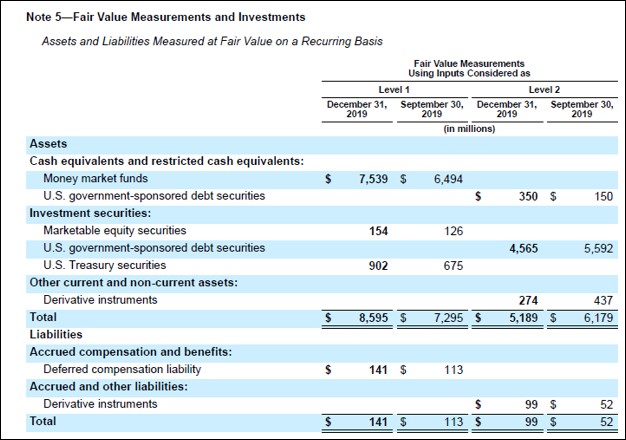

At the end of 2019, Visa was sitting on $8.8 billion in cash and cash equivalents, $3.9 billion in short-term investment securities, and $1.7 billion in long-term investment securities. In the graphic below, Visa provides a snapshot of what those line items are made up of. Please note that Visa is in the process of acquiring financial tech company Plaid for $5.3 billion (~$4.9 billion in cash and ~$0.4 billion in retention and preferred equity), a deal that’s expected to close in the coming months.

Image Shown: A breakdown of Visa’s cash-like line items. Image Source: Visa – First Quarter Fiscal 2020 10-Q Filing

That ~$14.4 billion cash-like balance is stacked up against $3.0 billion in short-term debt and $13.7 billion in long-term debt. We view Visa’s balance sheet as quite strong given the impressive nature of its cash flow profile and its very low net debt position (even when factoring in the Plaid acquisition). Having a quality balance sheet at this stage of the economic cycle is worth a lot, in our view, as that provides a source of funds to continue rewarding shareholders (i.e. dividends and share repurchases) should the global economy slip into a recession. Given the ongoing coronavirus epidemic in China, potential turbulence between Britain and the EU as trade negotiations get underway post-Brexit, trade wars, and the fact that global economic activity is already slowing down in various regions, the chances for a global recession (while low-ish) are rising. While the US economy continues to chug along just fine, exogenous shocks will be hard to circumvent given the large budget deficit and already low interest rates.

Visa generated $3.9 billion in net operating cash flow in the first quarter of fiscal 2020, up 18% year-over-year, while spending $0.2 billion on capital expenditures (up 22% year-over-year off a relatively low base). This exemplifies one of the big reasons Visa is a top weighted idea in the Best Ideas Newsletter portfolio, as companies with very low capital expenditure requirements and very dear net operating cash flows are firm’s that can better translate revenue growth into free cash flows. Last quarter, Visa spent $0.7 billion covering its dividend obligations and $2.4 billion repurchasing its Class A common stock, keeping with its commitment to allocate most of its free cash flow to shareholders.

Guidance Commentary

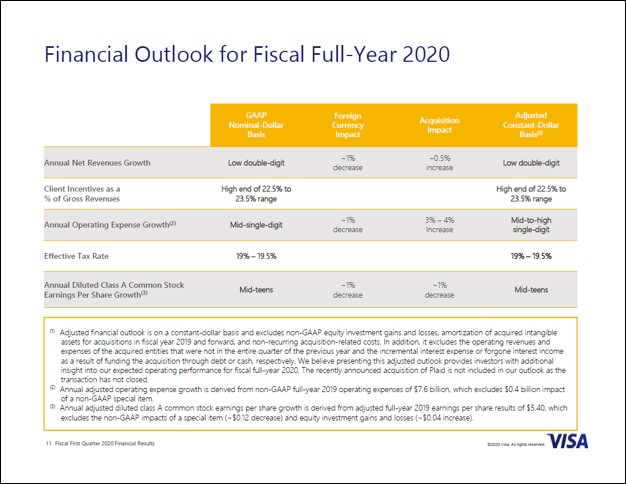

Looking ahead, Visa modified its guidance for the current full fiscal year during its latest earnings report (from guidance issued out during the fourth quarter of its fiscal 2019 earnings report). Visa changed its outlook to mention that client incentives would land at the high end of its previous guidance this fiscal year. Management noted that this was due to fluctuations and timing of the firm’s deal activity. Please note that in fiscal 2019, client incentives were 21.6% of gross revenue according to management, meaning these costs are expected to perk up as a percent of gross revenue, which should be offset over time by ongoing revenue growth (driven by renewing existing deals and establishing new relationships).

Image Shown: A look at Visa’s guidance for fiscal 2020. Image Source: Visa – First Quarter Fiscal 2020 IR Presentation

Visa is forecasting low double-digit revenue growth this year, versus ~14.5% GAAP annual revenue growth in fiscal 2019. Its GAAP and non-GAAP diluted EPS are both forecasted to grow by the mid-teens on an annual basis, which is down from 20% growth and 18% growth, respectively, in fiscal 2019 but still represents a nice growth trajectory. Please note share repurchases are key to supporting its EPS growth trajectory, and that material share buybacks are likely to continue going forward.

In the first quarter of fiscal 2020, Visa generated 10% GAAP revenue growth and its GAAP operating income climbed higher by 8% year-over-year. We caution that due to the aforementioned client incentive pressures, Visa’s GAAP operating margin contracted somewhat. During the conference call covering Visa’s first quarter fiscal 2020 performance, management noted that foreign currency movements and non-recurring items also pressured margins, as did its arrangements with Capital One Financial Corporation (COF). However, management made sure to highlight that Visa’s relationship with Capital One was a source of strength for the firm (from its latest quarterly conference call):

“We continue to have significant renewals and wins among some of our largest financial institutions. Visa renewed our issuing agreement with Capital One effective January 1 of this year. We’re very pleased to continue our longstanding relationship with Capital One…

[When responding to a question from an analyst]

Capital One has been a classic dual-issuer, and it always depends on what portfolios each network happens to have and how they perform at any given point in time. But they’re a big, terrific bank with a lot of innovative people on their team. We love working with them. And so it’s a good thing for us, and I’m sure that’s why I would say it’s a good thing for them as well.” — Alfred Kelly, CEO

Concluding Thoughts

Visa is a great company and we continue to be impressed by its performance. Short-term turbulence aside, Visa’s outlook remains bright and we continue to like the name as a top weighted holding in our Best Ideas Newsletter portfolio. To read more about Visa, check out how the firm is enhancing its long-term outlook by acquiring Plaid here—->>>>

Financial Tech Services Industry – MA MELI PYPL VRSK V

Banks & Money Centers Industry – AXP BAC BBT BK C DFS FITB GS HSBC JPM KEY MS NTRS PNC RF STI TCF USB WFC

Related: IYG, IPAY, IYF

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and PayPal Holdings Inc (PYPL) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Bank of America (BAC) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.