Top weighted Best Ideas Newsletter portfolio holding Visa continues to augment its long-term outlook for the betterment of its shareholders, in our view.

By Callum Turcan

On January 13, top weighted Best Ideas Newsletter portfolio holding Visa Inc (V) announced it was buying financial tech company Plaid for $5.3 billion. Plaid primarily offers a network that allows consumers to connect financial accounts to apps securely and safely, meaning that when a consumer downloads a mobile financial-oriented app to their phone (for example), Plaid is the company that ensures a smooth connection between app and the relevant financial institution when it comes to transferring information and ultimately money. What’s important about this acquisition is that Visa, once again, is showcasing its ability to spot and capitalize on high quality opportunities within the financial services space.

Deal Overview

Plaid’s customers include firms such as Acorns (specializes in micro-investing and robo-investing), Betterment (an online investment company based), Chime (an online bank), TransferWise (a British online money transfer service), and the widely-popular mobile payment service Venmo, owned by now top weighted Best Ideas Newsletter portfolio holding PayPal Holdings Inc (PYPL). Generally speaking, these start-ups and subsidiaries are experiencing high levels of growth given the rising popularity of less traditional banking and investing institutions. Here’s a key excerpt from the press release (please note some of the upcoming data that’s cited by Visa comes from the multinational consultancy and professional services firm Ernst and Young):

Connectivity between financial institutions and developers has become increasingly important to facilitate consumers’ ability to use fintech applications. 75 percent of the world’s internet-enabled consumers used a fintech application to initiate money movement in 2019 versus 18 percent in 20151. Plaid has been a leader in enabling this connectivity at scale. Today, one in four people with a U.S. bank account have used Plaid to connect to more than 2,600 fintech developers across more than 11,000 financial institutions…

1 Source: https://www.ey.com/en_us/ey-global-fintech-adoption-index

Financial Strength

Due to the strength of Visa’s free cash flow profile and its relatively strong balance sheet, Visa’s financials can easily absorb this purchase. In fiscal 2019 (the period ended September 30, 2019), Visa generated $12.0 billion in free cash flow while its annual dividend obligations came in at $2.3 billion. Share buybacks of $8.6 billion consumed most of its free cash flow, however, management can more easily flex those repurchases up or down as Visa’s needs change (as compared to having elevated dividend obligations limit the financial flexibility normally provided by large free cash flow streams).

On a side note, considering Visa traded near or below its fair value estimate throughout most of its fiscal 2019, those meaningful share repurchases were a good use of capital, in our view. Additionally, as the top end of our fair value range estimate sits at $228 per share of V, further buybacks could still be considered a good use of capital.

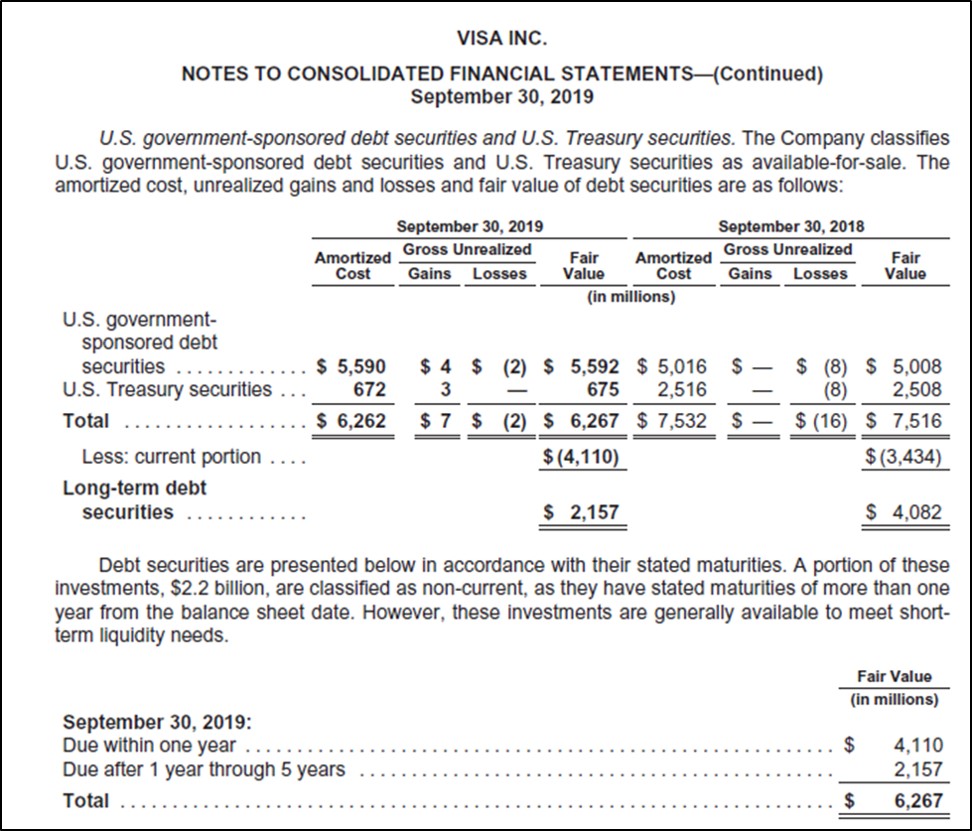

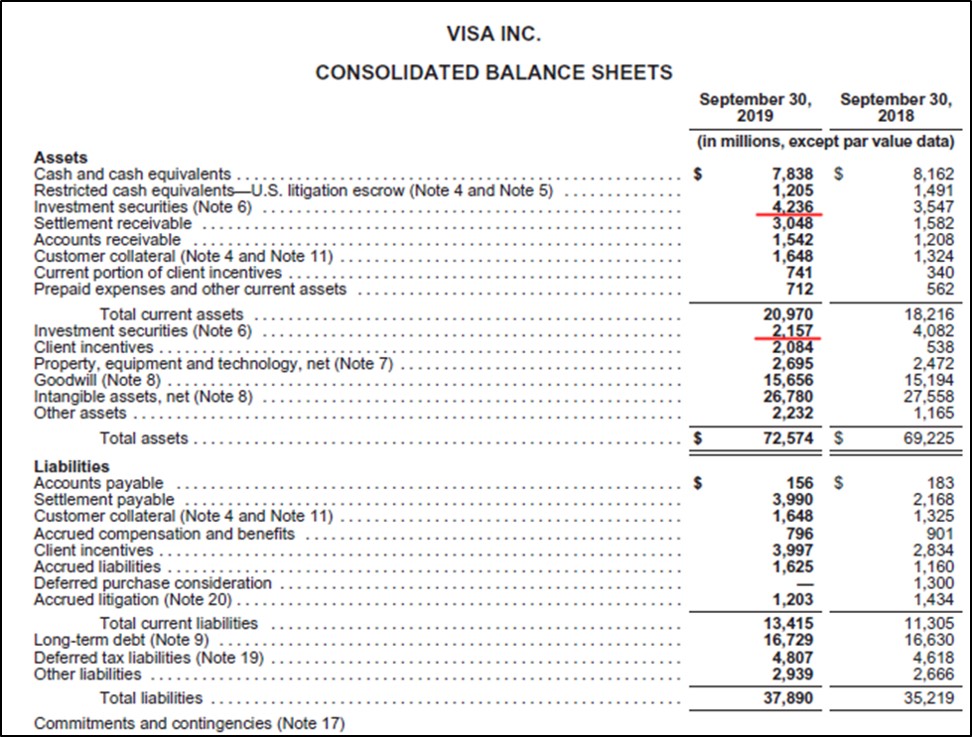

At the end of Visa’s fiscal 2019, the company was sitting on $7.8 billion in cash and cash equivalents along with $4.2 billion in short-term investment securities and $2.2 billion in long-term investment securities. Please note we aren’t including restricted cash here, which is held in escrow for US litigation and legal payment purposes. Most of Visa’s cash and cash equivalents balance was in money market funds at the end of this period. Visa’s investment securities portfolio consisted primarily of US government-sponsored debt securities and US Treasury Securities at the end of fiscal 2019, as you can see in the two upcoming graphics below. Visa generated ~$0.4 billion in investment income from its cash, cash equivalents, and investment securities portfolio in fiscal 2019.

Image Shown: Most of Visa’s investment securities are composed of debt securities holdings, as of September 30, 2019. Image Source: Visa – Fiscal 2019 Annual Report

Image Shown: Visa has more cash-like assets on the books than its ‘cash and cash equivalents’ line-item balance would make it appear, given that its short-term and long-term investment securities can be converted into cash. Image Source: Visa – Fiscal 2019 Annual Report

Stacked up against $16.7 billion in long-term debt at the end of fiscal 2019, Visa’s $14.2 billion in cash, cash equivalents, short-term investment securities, and long-term investment securities balance provides for a relatively small net debt position. Visa easily possesses the financial firepower to acquire Plaid while maintaining its strong financial position. In the press release, Visa’s management team notes that this deal will be funded with a combination of cash on hand and debt issuance “at the appropriate time” and that this move will not impact Visa’s stock buyback program and dividend policy. Furthermore, the deal is expected to close within three to six months.

We will note here that it’s conceivable that while material share repurchases will continue, management will likely keep an eye towards the health of Visa’s balance sheet as well. Here’s additional commentary from Visa:

Visa’s acquisition of Plaid represents both an entry into new businesses and complementary enhancements to Visa’s existing business. First, Plaid’s fintech-centric business opens new market opportunities for Visa both in the U.S. and internationally. Second, the combination of Visa and Plaid provides the opportunity to deliver enhanced payment capabilities and related value-added services to fintech developers. Finally, the acquisition will enable Visa to work more closely with fintechs through all stages of their development and drive growth in Visa’s core business.

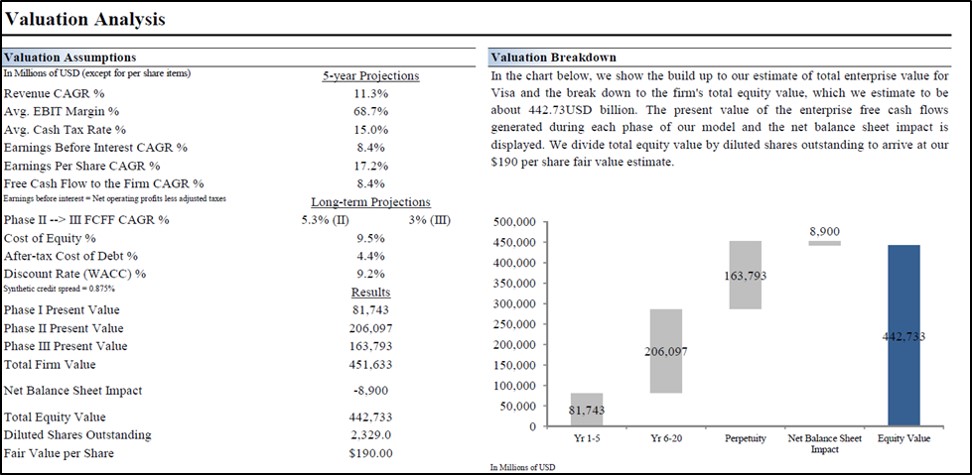

We forecast quite strong mid-cycle growth in our valuation model of Visa, which augments the intrinsic value of its equity immensely. In the graphic below, from our 16-page Stock Report (can be accessed here), we cover the base case valuation assumptions used to arrive at a fair value estimate of $190 per share. Should Visa outperform these assumptions, which could very well happen given its stellar fundamental performance over the past decade and acquisitions like Plaid supporting its future free cash flow outlook, shares of V could march towards the upper end of our fair value range estimate of $228 per share.

Image Shown: We continue to like Visa as a top holding in our Best Ideas Newsletter portfolio in part because of the forecasted strength of its mid-cycle free cash flows.

Concluding Thoughts

There are a lot of things to like about Visa, and while some may question the price Visa paid for Plaid, forward-thinking deals like these are what underpins the company’s impressive long-term outlook. Unconventional and mobile-oriented banking networks, apps, and systems will likely play a much bigger role in the financial services industry going forward. By solidifying its position here and moving into a new market, Visa continues to stay ahead of the curve for the betterment of its shareholders, in our view.

Financial Tech Services Industry – MA MELI PYPL VRSK V

Related: IYG, IPAY, IYF

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and PayPal Holdings Inc (PYPL) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.