By Callum Turcan

On January 7, Iran retaliated against the US for the killing of Iranian major general Qasem Soleimani (leader of a group that the US has deemed a terror threat under the Trump administration) less than a week earlier by firing missiles from Iranian soil at bases in Iraq that contain US, Iraqi, and coalition troops. The Iranian government aggressively publicized the attack by providing Iranian media outlets with footage of missiles leaving Iran that were targeted towards Iraq. Fortunately, no US, Iraqi, or coalition casualties were reported. We are very thankful that nobody was hurt as a result of the Iranian missile strike. For our first article covering recent events regarding Middle East tensions, click here.

In the morning of January 8, President Trump gave an address to the US and the world. He noted there were no casualties due to the Iranian missile attack and that damage was “minimal” to the bases and related facilities. Furthermore, and most importantly, President Trump struct a consolatory tone and appeared to want to deescalate US-Iranian tensions.

Crude Tanks, Defense Holds the Line

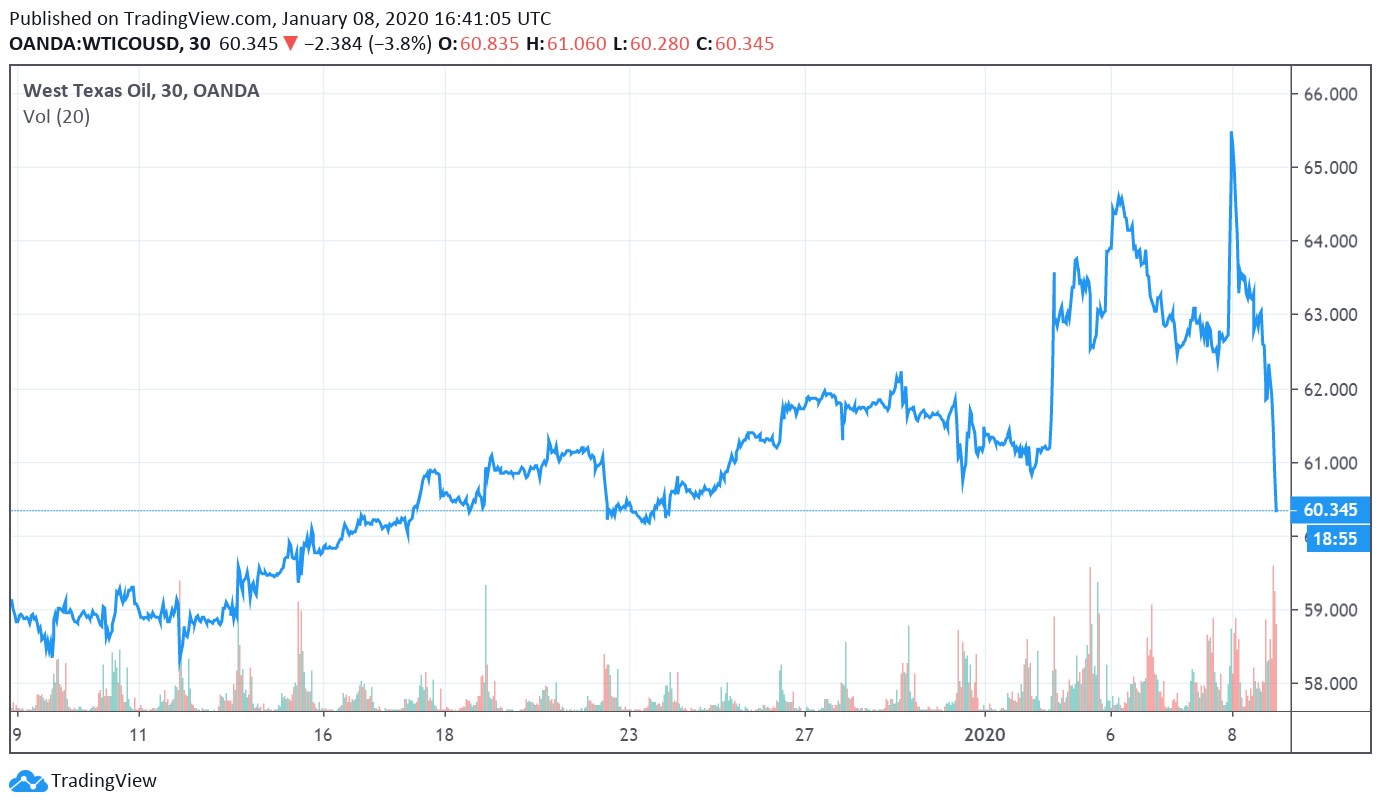

Oil prices (USO) (BNO) tanked on the news, as did oil and gas related equities (XLE), especially smaller upstream producers of oil and gas (XOP). Here we would like to stress the importance of not reading too much into knee-jerk reactions in oil prices. Defense names (ITA) performed better. Here’s what we had to say in our first article:

“Here, we would like to stress that while near-term oil prices rose on the news initially, what matters most is what happens at the back end of the curve and more broadly, whether oil prices are shifting towards a dynamic where the structural price should shift upwards (meaning on a forward-looking basis, oil prices could justify trading at a higher valuation for a sustained period of time). Please keep in mind that the WTI futures contract for December 2020 deliveries sits near $58 per barrel as of this writing, far below ~$63 per barrel for February 2020 deliveries. The price for December 2021 deliveries is just ~$54 per barrel, and as the futures curve is downward sloping, we are looking at an oil market in backwardation (near-term prices are higher than medium-term prices).

For oil and gas equities, particularly smaller upstream producers of oil and other liquid raw energy resources (natural gas liquids and condensate), rising geopolitical tensions in the Middle East (and ever-growing US-Iran tensions) saw shares of almost all names surge upwards on the news. However, as the oil price gains appear short-lived given the muted action at the back end of the futures curve, that exuberance seems misplaced. Short of an escalation of tensions in the Middle East that leads to actual supply losses, instead of just fears over supply losses, the bump in oil prices will have just a negligible impact on the future free cash flows of upstream producers and thus the intrinsic value of those companies. We caution that this could see shares of upstream producers, particularly those that rallied the hardest initially on the news, shift lower. Refineries sold off heavily on the news as the industry’s expected future input costs rose, a situation that could reverse itself if oil prices shift lower.

Defense names also rose on this news, and this is a space where the price gains are more justified given that rising geopolitical tensions tie directly into greater defense spending at the national level in both the US and elsewhere (such as various Middle Eastern countries including Iran). Even though oil supplies might not have been impacted directly, at least not yet (as of this writing), geopolitical fears could see greater demand for anti-missile defense systems, airplanes, drones, and much more.”

The upcoming graphics provide additional context on this ongoing situation.

Image Shown: Oil sold off aggressively as it appeared the US would pursue de-escalation efforts, after spiking earlier due to recent events.

Image Shown: Defense names held their ground after recent events.

Arguably, what happened here could be described as an escalation to allow for de-escalation. Before the strike, Iran notified the Iraqi government that a strike was incoming (and effectively, the US and coalition forces as well). After the strike, while no casualties were reported, Iranian media (particularly those with connections to the state) reported numerous US casualties and that the strike was a success. However, that appears to not be the case, but given the walled gardens that authoritarian regimes can create in terms of information dissemination, that is the official domestic message in Iran. It seems this event was more coordinated than first appeared.

Concluding Thoughts

We hope cooler heads prevail in this conflict, but caution that significant geopolitical tensions remain. The chance for unconventional retaliation remains very real. We will continue updating our members on these events as they unfold.

Furthermore, tragedy struck when a Boeing (BA) 737-800 crashed in Iran on January 7 (Eastern Standard Time), killing all of the passengers onboard. This doesn’t appear to be because of ongoing US-Iran tensions, but investigations are ongoing. Our heart goes out to the victims and their loved ones.

Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Refining Industry – HES HFC MPC PSX VLO

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Aerospace & Defense Industry – BA FLIR GD LLL LMT NOC RTN

Related: ARMCO, USO, OIL, XLE, XOP, BNO, VDE, AMLP, AMZA, ITA, SPY, DIA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Callum Turcan is long Whiting Petroleum Corporation (WLL) $9 put options expiring January 31, 2019. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. BP plc (BP), Enterprise Products Partners L.P. (EPD), and Magellan Midstream Partners L.P. (MMP) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.