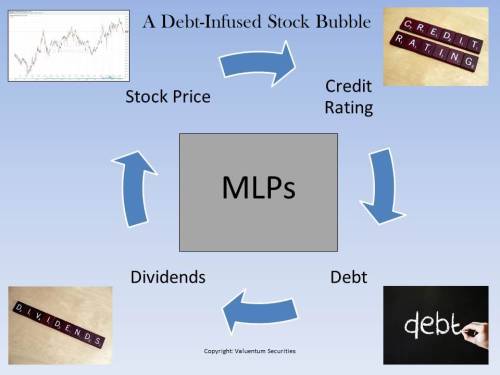

Image Shown: Valuentum’s thesis on MLPs prior to their collapse in mid-2015.

Valuentum’s breakthrough work when it comes to MLPs has revolutionized how many value these entities. Cash, the source of value, is cash regardless of the business model/structure in which it is generated, and therefore valuation approaches should not change between various business models/structures. We continue to work toward helping investment professionals understand this vitally-important connection.

See Pitfalls of Distribution Yield Analysis: https://valuentum.com/downloads/20170312_1/download

See: Linking P/DCF to Enterprise Free Cash Flow Valuation: https://valuentum.com/downloads/20170312/download

Structure of the Oil & Gas Pipeline Industry

Firms in the oil and gas pipeline industry own or operate thousands of miles of pipelines and terminals—assets that are nearly impossible/uneconomical to replicate. Most companies act as a toll road and receive a fee for transporting natural gas, crude oil and other refined products (and generally avoid commodity price risk). Though there is much to like, most constituents operate as master limited partnerships and pay out hefty distributions that can stretch their balance sheets. Additional unit issuance (dilution) has become common, and capital-market dependence is a key risk. We’re neutral on the group.

We’ve reallocated our resources to optimize our energy coverage. See here.

Image Sources: Simon Cunningham, Images Money, Trading View. No alteration has been performed on the pictures.