|

|

Recent Articles

-

Shares of Dividend Growth Idea Oracle Surge!

Shares of Dividend Growth Idea Oracle Surge!

Sep 10, 2025

-

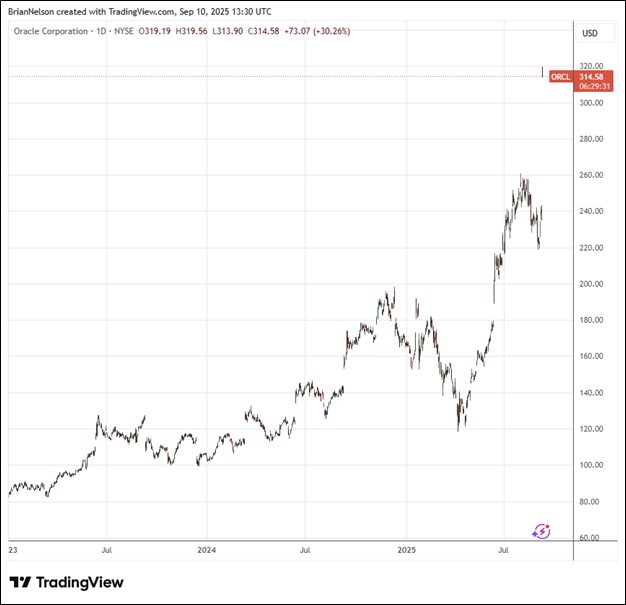

Image Source: TradingView.

Oracle’s non-GAAP operating income in the fiscal first quarter of 2026 was $6.2 billion, up 9% in USD and up 7% in constant currency. Non-GAAP net income was $4.3 billion in the quarter, up 8% in USD and up 6% in constant currency. We were impressed by the company’s remaining performance obligations growth in the quarter and management’s guidance calling for Oracle’s Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years. Management noted that most of the revenue in this 5-year forecast is already booked in its reported remaining performance obligations. Shares of Oracle surged on the news, and we continue to like Oracle in the newsletter portfolios.

-

Tesla’s Second Quarter Results Weren’t Great

Tesla’s Second Quarter Results Weren’t Great

Sep 8, 2025

-

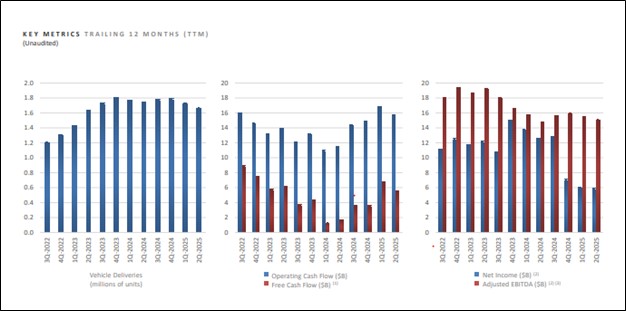

Image Source: Tesla.

Tesla’s cash flow from operating activities was $2.54 billion in the quarter, while it spent $2.4 billion in capex, resulting in free cash flow of $146 million. Its cash and investment balance was up 20% from last year, to $36.8 billion. All things considered, Tesla’s second quarter results weren’t great. The company experienced a decline in vehicle deliveries, lower regulatory credit revenue, reduced vehicle pricing, and a decline in Energy Generation and Storage revenue due to lower average sales prices. Meanwhile, operating income was impacted from higher operating expenses driven by AI and other R&D projects. We remain on the sidelines.

-

Albemarle Targets Positive Free Cash Flow for 2025

Albemarle Targets Positive Free Cash Flow for 2025

Sep 8, 2025

-

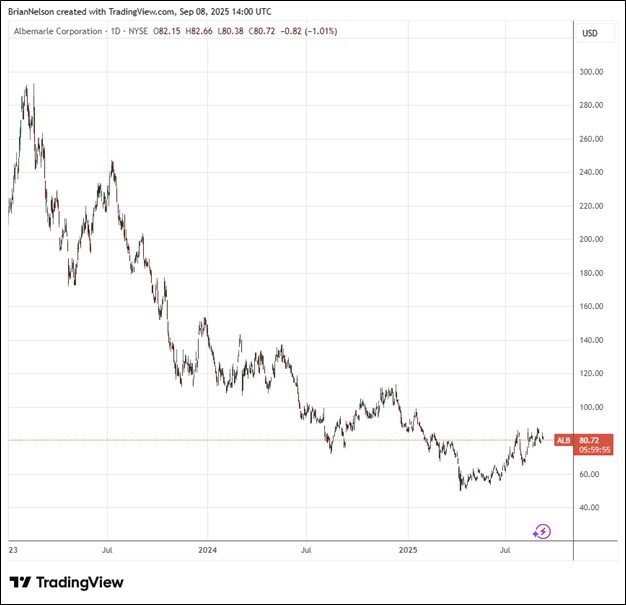

Image Source: TradingView.

For the first half of 2025, Albemarle’s cash flow from operations increased $73 million to $538 million, and as management noted, the company expects to achieve positive free cash flow for the full year 2025 assuming current lithium market pricing persists. Albemarle reduced its capital expenditure outlook to the range of $650-$700 million. Assuming $9/kg LCE average lithium market price for 2025, net sales is targeted in the range of $4.9-$5.2 billion, with adjusted EBITDA in the range of $0.8-$1 billion. Albemarle exited the quarter with estimated liquidity of approximately $3.4 billion. We like Albemarle’s upside potential from here, as operations remain depressed from low lithium pricing. The company remains an idea in the ESG Newsletter portfolio.

-

Dividend Increases/Decreases for the Week of September 5

Dividend Increases/Decreases for the Week of September 5

Sep 5, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

|