|

|

Recent Articles

-

Republic Services Remains a Cash Cow

Republic Services Remains a Cash Cow

Sep 2, 2025

-

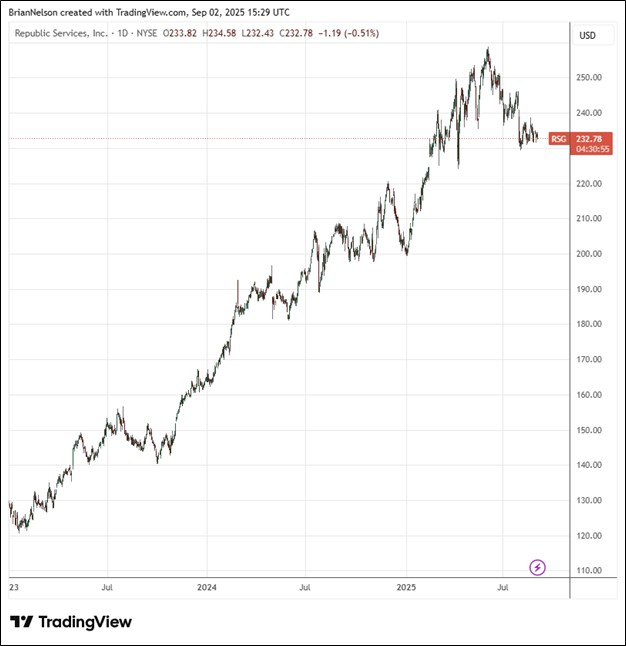

Image Source: TradingView.

Year-to-date, Republic Services’ cash flow from operations was $2.13 billion while year-to-date adjusted free cash flow was $1.42 billion. Year-to-date, Republic has invested $888 million in acquisitions. Year-to-date cash returned to shareholders was $407 million, consisting of $45 million of buybacks and $362 million of dividends paid. For full year 2025, Republic now expects revenue in the range of $16.675-$16.75 billion and adjusted EBITDA in the range of $5.275-$5.325 billion. Adjusted diluted earnings per share is reiterated in the range of $6.82-$6.90 for the year, while adjusted free cash flow is now targeted in the range of $2.375-$2.415 billion. We continue to like Republic Services in the newsletter portfolios.

-

Dividend Increases/Decreases for the Week of August 29

Dividend Increases/Decreases for the Week of August 29

Aug 29, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Best Buy Puts Up Best Comp Growth in Three Years

Best Buy Puts Up Best Comp Growth in Three Years

Aug 28, 2025

-

Image Source: TradingView.

We liked that Best Buy put up its strongest comparable store sales growth in the past three years, with domestic comparable online sales growth of 5.1%, lapping a decline of 1.6% in last year’s quarter. As a percentage of total domestic revenue, online revenue now accounts for 32.8% versus 31.5% last year. For the six month period ended August 2, cash flow from operations was $783 million, while capital spending was $341 million, resulting in free cash flow of $442 million, higher than its cash dividends paid of $403 million over the same time period. Best Buy covers dividends paid while it boasts a net cash position on the balance sheet. Shares yield 5% at the time of this writing.

-

AT&T Is Targeting Free Cash Flow in the Low-to-Mid $16 Billion Range for 2025

AT&T Is Targeting Free Cash Flow in the Low-to-Mid $16 Billion Range for 2025

Aug 28, 2025

-

Image Source: TradingView.

Looking to the full year 2025, AT&T expects consolidated service revenue growth in the low-single-digit range, with mobility service revenue growth of 3% or better and consumer fiber broadband revenue growth in the mid-to-high teens. For the year, AT&T is targeting adjusted EBITDA growth of 3% or better, with mobility EBITDA growth of roughly 3%, business wireline EBITDA lower by a low-double-digit range, and consumer wireline EBITDA growth in the low-to-mid-teens range. Free cash flow for 2025 is expected in the low-to-mid $16 billion range, while adjusted earnings per share is targeted in the range of $1.97-$2.07. We like AT&T but can’t get comfortable with its total debt load of $132.3 billion. We remain on the sidelines. Shares yield 3.8% at the time of this writing.

|