|

|

Recent Articles

-

A Note on Valuation -- Low P/E Stocks with High Dividend Yields

A Note on Valuation -- Low P/E Stocks with High Dividend Yields

Dec 1, 2023

-

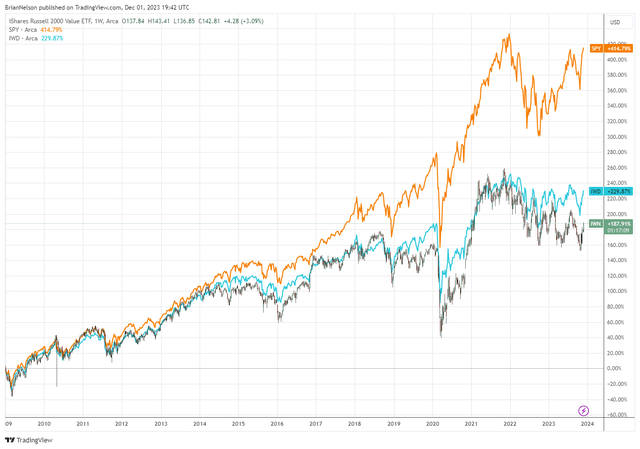

Image: Stocks with low valuation multiples have trailed the broader S&P 500 (orange) considerably since the depths of the Great Financial Crisis.

Today, with all the readily available information and data out there, it is far more likely the case that a company with a low P/E ratio actually deserves it, and a firm with an outsized dividend yield just holds a lot of net debt on their books. Investing in low P/E stocks or stocks with low valuation multiples without considering their intrinsic values (i.e. fair value estimates) may result in owning a basket of value traps. Investors may be attracted to these types of stocks for their low P/E ratios and hefty dividend yields, but just having a low P/E ratio and a high dividend yield doesn’t a good stock make. If investing were this easy, so-called “value stocks” wouldn’t have underperformed the market significantly for more than a decade and a half now.

-

Dividend Increases/Decreases for the Week of December 1

Dividend Increases/Decreases for the Week of December 1

Dec 1, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Net-Cash-Rich, Free-Cash-Flow Generating Powerhouse Salesforce Has a Long Growth Runway

Net-Cash-Rich, Free-Cash-Flow Generating Powerhouse Salesforce Has a Long Growth Runway

Nov 30, 2023

-

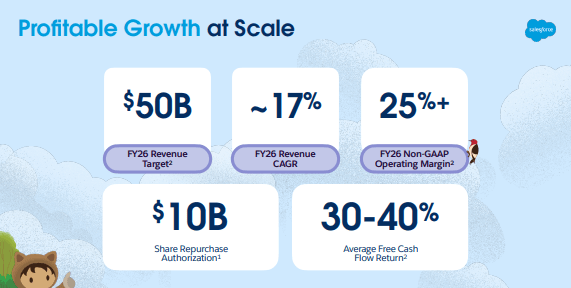

Image Source: Salesforce.

On November 29, Salesforce reported excellent fiscal third-quarter results and issued an outlook for its fiscal fourth quarter that came in better than expectations. The Dow Jones Industrial Average component’s results were welcome news as the bellwether revealed that spending on cloud-based CRM software remains robust. In the quarter ending October 31, revenue advanced 11% on a year-over-year basis, while non-GAAP diluted earnings per share came in at a solid $2.11. Its outlook was rosier than what the Street was expecting. For the fiscal fourth quarter, the company is targeting non-GAAP earnings per share in the range of $2.25-$2.26 per share, better than the consensus forecast of $2.18. The strong quarter only increases our confidence in Salesforce’s longer-term outlook, and we plan to raise our fair value estimate of the firm upon our next report update.

-

3 Dividend Growth Stocks For The Long Run

3 Dividend Growth Stocks For The Long Run

Nov 29, 2023

-

We think dividend growth investors should focus on total return first, and then move on to the evaluation of a company's dividend health. We believe that total return is a function of a company's net cash position and future expectations of free cash flow, and in this article, we have highlighted three strong, net-cash-rich, free cash flow generators that also have increased their dividends consistently over the years. Though these names are not hidden by any stretch, the strong performance of the Magnificent 7 reveals that investors don't need to look very far to find some of the best-performing ideas. Make sure that you know the Dividend Cushion ratio for companies in your dividend growth portfolio!

|