|

|

Recent Articles

-

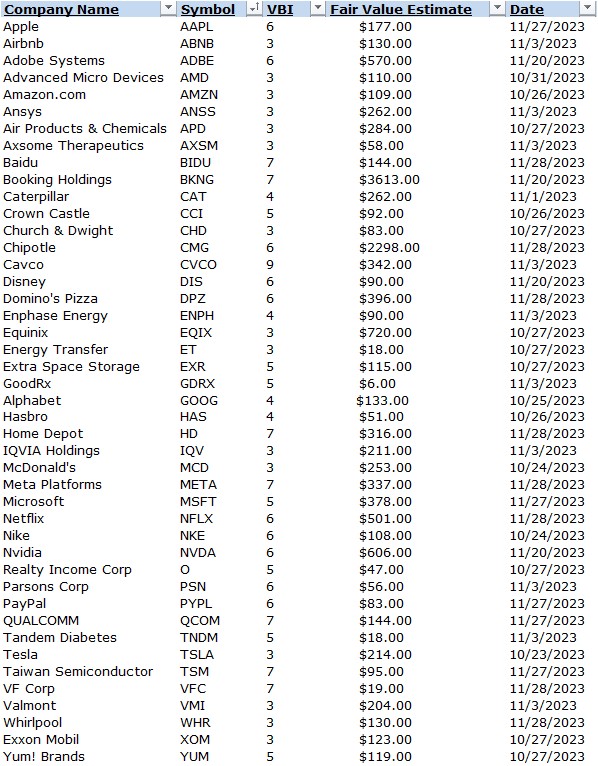

Latest Report Updates

Latest Report Updates

Nov 28, 2023

-

Check out the latest report refreshes on the website.

-

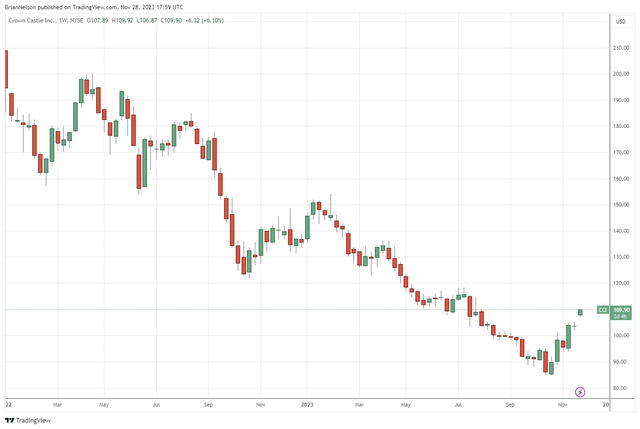

Crown Castle Continues to Languish

Crown Castle Continues to Languish

Nov 28, 2023

-

Image: Crown Castle’s shares have not fared well through 2023, and we’ll be looking to remove them from the High Yield Dividend Newsletter portfolio in coming months.

Crown Castle benefits from attractive tower economics as it can scale customers across its shared infrastructure to drive increased profitability, but the company's massive net cash position continues to weigh on our enthusiasm of the company. Shares of the firm may get a bounce as spot interest rates may continue to ease in the near term, but we’ll be looking to remove it from the simulated High Yield Dividend Newsletter portfolio in the coming months. We also plan to remove the Vanguard Real Estate ETF from that portfolio, too.

-

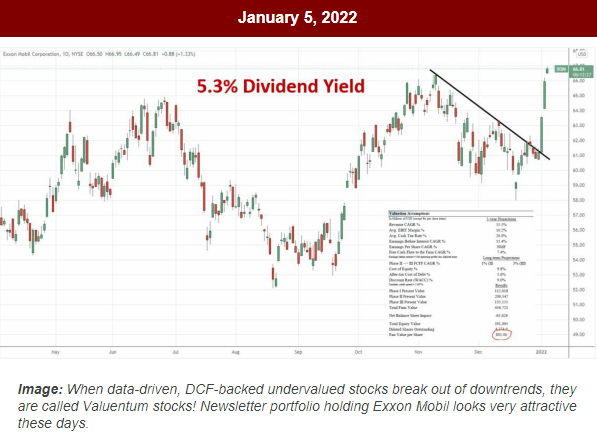

How Do We Use the Valuentum Buying Index?

How Do We Use the Valuentum Buying Index?

Nov 27, 2023

-

Image: We highlighted Exxon Mobil to start 2022, and the stock was one of the best performers in the S&P 500 last year. Exxon Mobil became a “Valuentum” stock last year, with shares being undervalued, exhibiting a strong technical breakout, and sporting an attractive dividend yield to boot. The stock became a huge winner. Note: Exxon is no longer included in the simulated newsletter portfolios. The image is an excerpt from an email sent to members January 5, 2022.

We answer one of the most frequently asked questions about the Valuentum Buying Index.

-

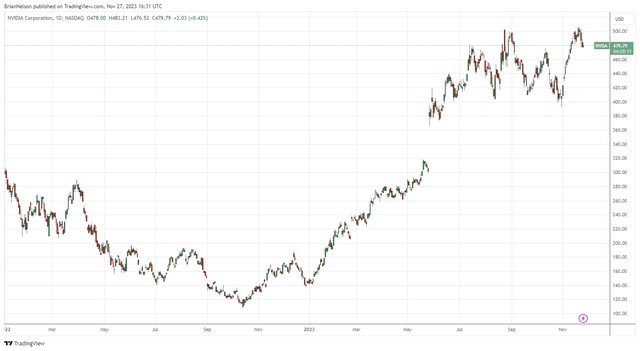

Nvidia’s Shares Could Run Higher Even More!

Nvidia’s Shares Could Run Higher Even More!

Nov 27, 2023

-

Image: Nvidia has been a market darling, and the firm's equity looks to have further upside potential on the basis of our valuation.

On November 21, market darling Nvidia Corp. reported excellent fiscal third quarter results for the period ending October 29 that showcased the power behind the revolution in artificial intelligence. The company’s revenue hit a record, advancing more than three-fold on a year over year basis thanks to strength in its Data Center business. Its non-GAAP earnings were up six-fold from the year-ago period, and the firm continues to haul in tremendous free cash flow. We’ve raised our fair value estimate of Nvidia to $606 per share, and we think the company’s shares could continue to run higher.

|