|

|

Recent Articles

-

It’s All About Free Cash Flow – Walgreens Cuts Its Payout

It’s All About Free Cash Flow – Walgreens Cuts Its Payout

Jan 4, 2024

-

Image: Walgreens’ shares have been under consistent pressure for years, and a turnaround is not guaranteed.

Today, January 4, Walgreens announced that it would slash its quarterly dividend payment to $0.25 per share, a 48% decrease. This should not be surprising to members. Walgreens’ Dividend Cushion ratio stood at -0.3 (negative 0.3), and we hope members have avoided this catastrophe of a Dividend Aristocrat. A Dividend Cushion ratio below 1 signals increased long-term risk to the payout, while a firmly negative Dividend Cushion ratio signals heightened risk. Our cash-based dividend growth process has led to outperformance in the Dividend Growth Newsletter portfolio the past couple years, while other areas have suffered, and it has also shown to be useful in predicting dividend cuts. Walgreens is now one of more than 50 companies across our coverage universe in recent years where the Dividend Cushion ratio has warned of significant risk to the sustainability of the dividend in advance of the cut.

-

4 Very Good Reasons Why We Don’t Like Dividends of Banking Stocks

4 Very Good Reasons Why We Don’t Like Dividends of Banking Stocks

Jan 4, 2024

-

Image: Bank Run in Michigan, USA, February 1933. Source: Public Domain.

It’s sometimes easy to lose sight of the fragility of a banking firm’s business model. Let’s examine the reasons why we don’t like banking firms’ dividends. Reason #1: A Bank Run Is Always Possible. Reason #2: Others Have Tried to Invest in Bank Dividends and Have Failed. Reason #3: Cash Flow Is Not Meaningful at Banks. Reason #4: There Are Plenty of Other Options. Let's dig in.

-

2023 Was a Fantastic Year! Are You Ready for 2024?

2023 Was a Fantastic Year! Are You Ready for 2024?

Dec 31, 2023

-

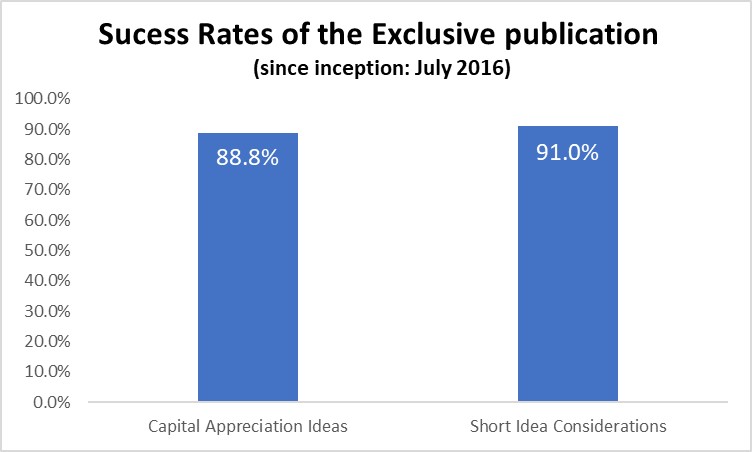

Image: The percentage of ideas highlighted in the Exclusive that have moved in the direction of our thesis (i.e. up for capital appreciation ideas and down for short idea considerations) through the current price or closed price, with consideration of cash and stock dividends. Success rates do not consider trading costs or tax implications. Data through December 8, 2023. Past results are not a guarantee of future performance.

From fantastic success rates in the Exclusive publication and strong capital preservation tendencies in the simulated High Yield Dividend Newsletter portfolio to relative outperformance in both the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio the past two years, the Valuentum newsletter suite continues to deliver in a big way for what members are looking for. We thank you for another excellent year in 2023, and we hope that you have a happy, healthy, and prosperous 2024!

-

Kinder Morgan’s ~6.4% Dividend Yield Is Much Stronger These Days

Kinder Morgan’s ~6.4% Dividend Yield Is Much Stronger These Days

Dec 29, 2023

-

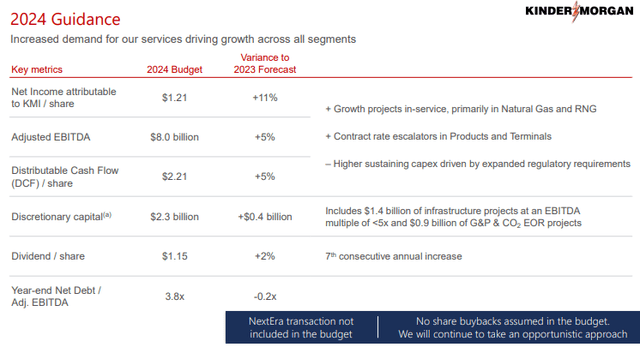

Image: Kinder Morgan is back on track. Image Source: Kinder Morgan.

Early in December, Kinder Morgan released financial expectations for 2024 that showed the midstream energy giant is back on track. Excluding its recent purchase of NextEra Energy Partners’ STX Midstream assets, Kinder Morgan expects 5% expansion in adjusted EBITDA and distributable cash flow [DCF] in 2024 thanks to growth in its Natural Gas Pipelines and Energy Transition Ventures segments coupled with rate escalations across its operations. For 2024, management is targeting its 7th consecutive year of dividend increases with a projected annualized dividend of $1.15 in 2024. Net debt-to-Adjusted EBITDA is targeted at 3.8x at the end of 2024, a level that is materially lower than its long-term target of 4.5x. We're liking the continued improvements at Kinder Morgan in recent years.

|