Member LoginDividend CushionValue Trap |

2023 Was a Fantastic Year! Are You Ready for 2024?

publication date: Dec 31, 2023

|

author/source: Brian Nelson, CFA

By Brian Nelson, CFA 2023 was a fantastic year by almost any measure, with the S&P 500 (SPY) advancing almost 25%. The markets bounced back from a very difficult 2022 and overcame a crisis in the regional bank sector and rising mortgage rates through the course of the year. The great promise of artificial intelligence [AI], easing inflation, and a dovish Fed pivot late in the year helped to propel the broader indices higher. As we look out into 2024, we think there are 12 reasons why investors should stay aggressive in this new bull market, “12 Reasons to Stay Aggressive in 2024.” Valuentum’s newsletter suite has delivered throughout the good times and bad times. 2023 numbers were great, but we think it is informative to measure performance from the beginning of 2022, as it provides better insight into the value of sticking with your membership through thick and thin. With a steady hand at the wheel, the High Yield Dividend Newsletter portfolio held up well, the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio carved out relative outperformance versus their benchmarks, while the success rates in the Exclusive publication remained top notch. The Exclusive publication

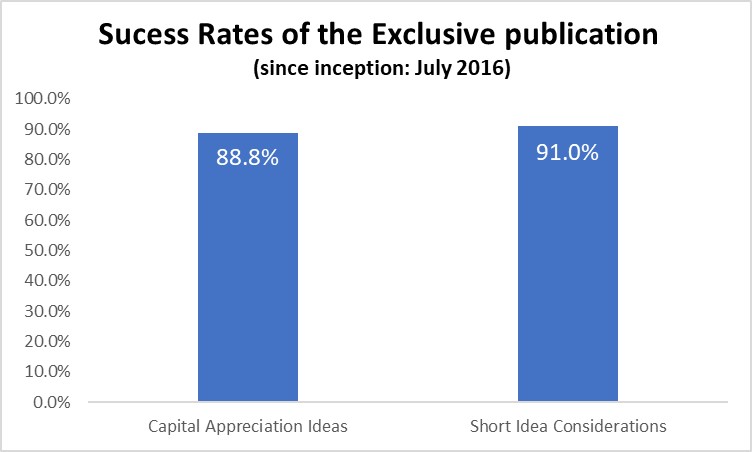

Image: The percentage of ideas highlighted in the Exclusive that have moved in the direction of our thesis (i.e. up for capital appreciation ideas and down for short idea considerations) through the current price or closed price, with consideration of cash and stock dividends. Success rates do not consider trading costs or tax implications. Data through December 8, 2023. Past results are not a guarantee of future performance. The Exclusive publication is released to its members by email on the 8th of each month, and within each edition highlights an income idea, a capital appreciation idea, and a short idea consideration each month. The income ideas continue to sport nice yields, while the success rates for capital appreciation ideas and short idea considerations remain fantastic after another strong year of stock selection in 2023. In the year, we tied the previous record streak of 25 consecutive short idea considerations working out in a row. Two of the best capital appreciation ideas that worked out this year were the Global X Uranium ETF (URA), which advanced 29.3% from highlight through close, and Woodward (WWD), which advanced 28.7% from highlight through close. Two of the best short idea considerations that worked out this year were Fossil Group (FOSL), which fell 52.1% from highlight through close, and Camping World Holdings (CWH), which fell 32.5% from highlight through close. The High Yield Dividend Newsletter portfolio

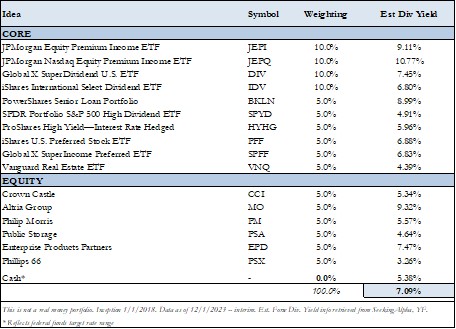

Image: The simulated High Yield Dividend Newsletter portfolio, as of December 1. Through the course of 2023, we added some heavy hitters to the simulated High Yield Dividend Newsletter portfolio, including the JPMorgan Equity Premium Income ETF (JEPI), Global X SuperDividend U.S. ETF (DIV), and the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ). The forward estimated dividend yield of the simulated High Yield Dividend Newsletter portfolio now stands north of 7%. This year, we also shed some of the lower dividend yielding plays given rising yields on risk-free alternatives. From the beginning of 2022 through the end of 2023, we estimate that the simulated High Yield Dividend Newsletter portfolio generated a mid-single-digit total return, inclusive of dividends. On a price-only basis over this time period, we estimate that the portfolio fell approximately 3.8%, far better performance than utilities (XLU), which fell ~11.5%, and equity REITs (VNQ), which fell ~24%. Where other high-yielding areas are faltering, the simulated High Yield Dividend Newsletter continues to do well in preserving capital while generating robust income. The Dividend Growth Newsletter portfolio

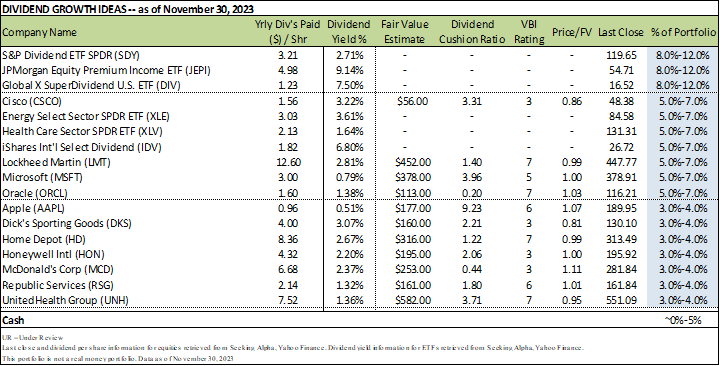

Image: The simulated Dividend Growth Newsletter portfolio, as of November 30. Dividend growth benchmarks had a difficult year during 2023 as rising interest rates pressured returns. On a price only basis, the SPDR S&P Dividend ETF (SDY), which tracks the S&P 500 High Yield Dividend Aristocrats Index, was roughly flat, while the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), which tracks the S&P 500 Dividend Aristocrats Index, advanced ~5.6%--both trailing the market return considerably during 2023. However, the simulated Dividend Growth Newsletter portfolio benefited greatly from its cash-based process and exposure to large cap growth stocks, which fared particularly well during 2023. On a price-only basis from the beginning of 2022 through the end of 2023, we estimate the simulated Dividend Growth Newsletter portfolio advanced approximately 3.5%, while both the SDY and NOBL fell by more than 3%, carving out an estimated 6-7 percentage points of relative outperformance during the past two years. The Best Ideas Newsletter portfolio

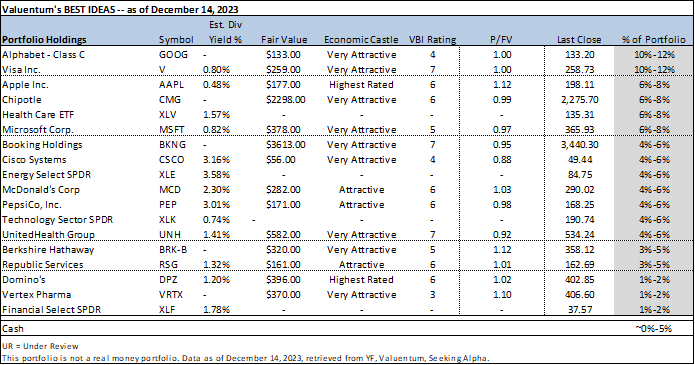

Image: The simulated Best Ideas Newsletter portfolio, as of December 14. From the beginning of 2022 through the end of 2023, we estimate the simulated Best Ideas Newsletter portfolio generated 3.7 percentage points of relative outperformance on a price-only basis versus the S&P 500, with a price-only estimated return of approximately 3.5% over this time. Exposure to energy during 2022 and some of the strongest large cap growth entities during 2023 drove the outperformance, despite stiff headwinds from Meta Platforms (META) and PayPal (PYPL) during 2022. From fantastic success rates in the Exclusive publication and strong capital preservation tendencies in the simulated High Yield Dividend Newsletter portfolio to relative outperformance in both the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio the past two years, the Valuentum newsletter suite continues to deliver in a big way for what members are looking for. We thank you for another excellent year in 2023, and we hope that you have a happy, healthy, and prosperous 2024! ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment