|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of December 15

Dividend Increases/Decreases for the Week of December 15

Dec 15, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Brief Note: Just How Good Has Our Stock Selection Been?

Brief Note: Just How Good Has Our Stock Selection Been?

Dec 14, 2023

-

Has anyone really done better than this? We hope you have benefited greatly!

-

Latest Report Updates

Latest Report Updates

Dec 13, 2023

-

Check out the latest report refreshes on the website.

-

Best Ideas Booking Holdings, Chipotle Hit All-Time Highs!

Best Ideas Booking Holdings, Chipotle Hit All-Time Highs!

Dec 12, 2023

-

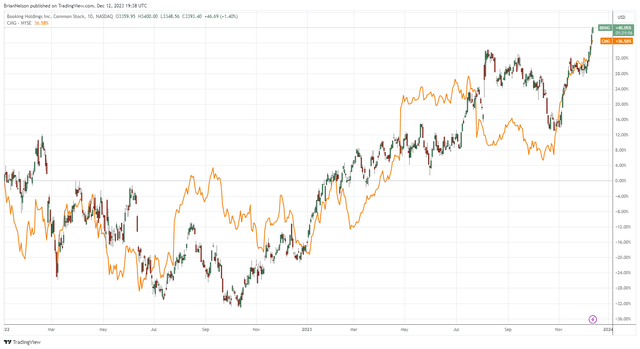

Image: Booking Holdings and Chipotle hit brand new all-time highs!

Two of our favorite investment idea considerations held within the simulated Best Ideas Newsletter portfolio, Booking Holdings and Chipotle, have just hit all-time highs. Our fair value estimate of Booking Holdings stands north of $3,600, and we still expect more upside potential in shares. As it relates to Chipotle, we're huge fans of its long-term restaurant growth potential, and we see upside potential on the basis of the high end of our fair value estimate range. We continue to reiterate our positive stance on both ideas.

|