|

|

Recent Articles

-

PayPal’s Margin Pressure, Flattish Earnings Outlook Shocks Market; Fair Value Estimate Reduced

PayPal’s Margin Pressure, Flattish Earnings Outlook Shocks Market; Fair Value Estimate Reduced

Feb 2, 2022

-

Image Shown: PayPal Holdings Inc grew at a robust pace in 2021 though its margin outlook is not as promising as once believed. Image Source: PayPal Holdings Inc – Fourth Quarter of 2021 earnings press release.

PayPal is a solid enterprise supported by its pristine balance sheet, strong free cash flows, and promising revenue growth outlook. The proliferation of e-commerce provides PayPal will a powerful secular tailwind to capitalize on. However, PayPal’s operating leverage is not what it once appeared to be, and that weighs negatively on its margin expansion potential. As noted previously, we have fine-tuned our cash flow valuation model on the company, and now value shares at $160 on a point fair value estimate basis. We continue to include PayPal as an idea in the Best Ideas Newsletter portfolio for the time being (as we evaluate the next few quarters). PayPal's refreshed stock page and report will be available shortly.

-

Alphabet and PayPal Report Fourth-Quarter 2021 Results

Alphabet and PayPal Report Fourth-Quarter 2021 Results

Feb 2, 2022

-

Video: Valuentum's President Brian Michael Nelson, CFA, walks through the fourth-quarter 2021 results of Alphabet and PayPal.

-

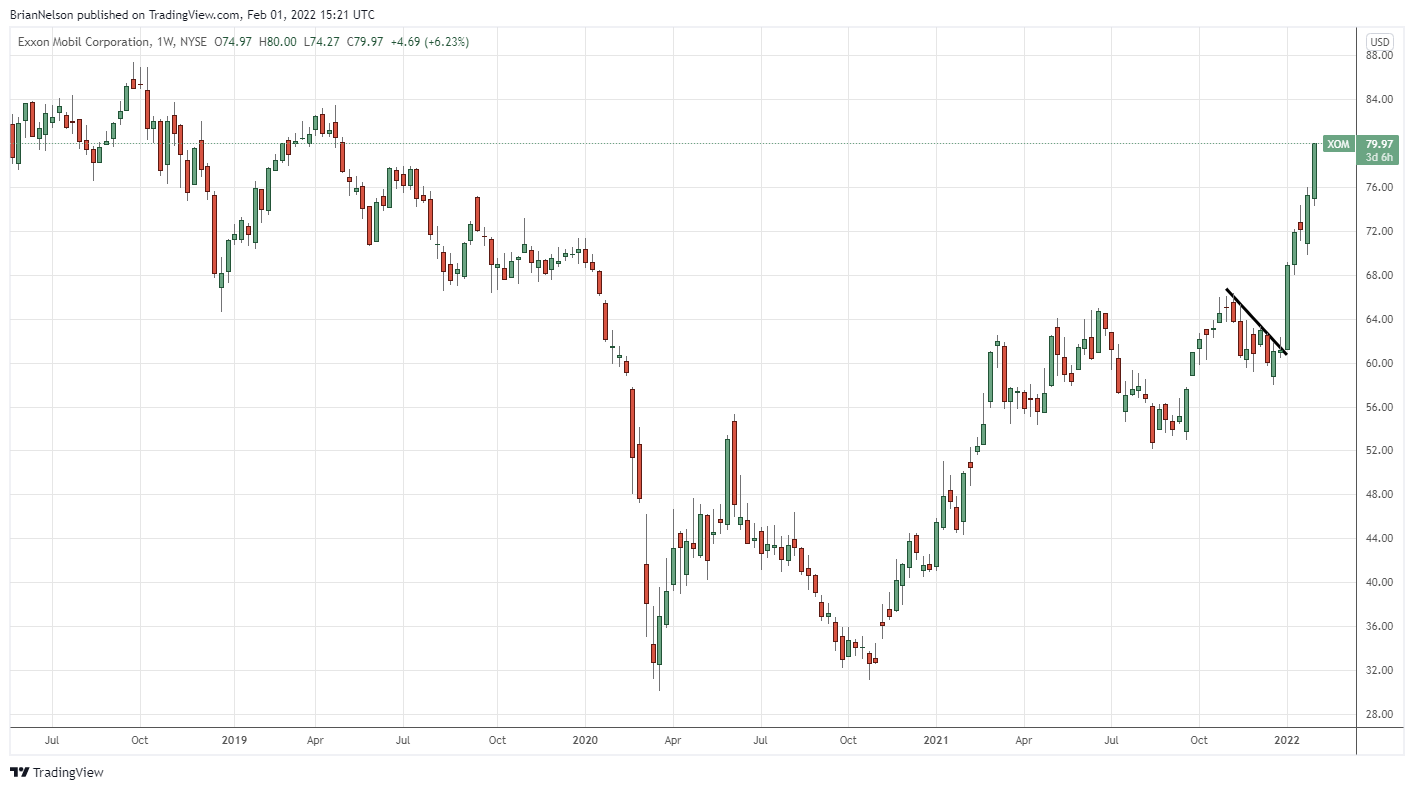

Exxon Breaks Out! Oil Prices Might Rip Higher Still!

Exxon Breaks Out! Oil Prices Might Rip Higher Still!

Feb 1, 2022

-

Image: A pretty technical breakout at Exxon Mobil.

Valuentum's Callum Turcan: "The tight supply-demand dynamics for oil & natural gas combined with rising geopolitical tensions (West-Russia over a potential Russian invasion of Ukraine, reports of potential terror attacks on Northern Iraqi/Kurdish oil infrastructure, West-Iran over Iran's nuclear program and nuclear deal talks reportedly breaking down, civil tensions in Kazakhstan, perennial problems facing Libya and Nigeria's security situation) indicate there is likely room for oil prices to rip higher still."

-

Structural Changes in the Airline and Aerospace Business

Structural Changes in the Airline and Aerospace Business

Feb 1, 2022

-

Image Source: Valuentum.

The future profile for air travel demand will be negatively impacted in the long run (relative to pre-COVID-19 expectations) as increased leisure travel from the wealth effect may not completely offset reduced business travel growth impaired by digital solutions permanently disrupting the way companies conduct business. As with Warren Buffett, who recently wrote down the value of metal casting jet-engine supplier Precision Castparts (one of the best aerospace suppliers in the business), we believe intrinsic values of others in the aerospace supply chain have been permanently reduced as well. We’re staying away from airlines and aerospace with the exception of Honeywell, which offers diversified industrial exposure and a “call option” on a gradual aerospace recovery to a “new normal.” Honeywell is included in the Dividend Growth Newsletter portfolio and showed that it can thrive in a business environment where aerospace demand may not live up to pre-COVID-19 long-term expectations. Honeywell yields ~1.9% at the time of this writing.

|