Member LoginDividend CushionValue Trap |

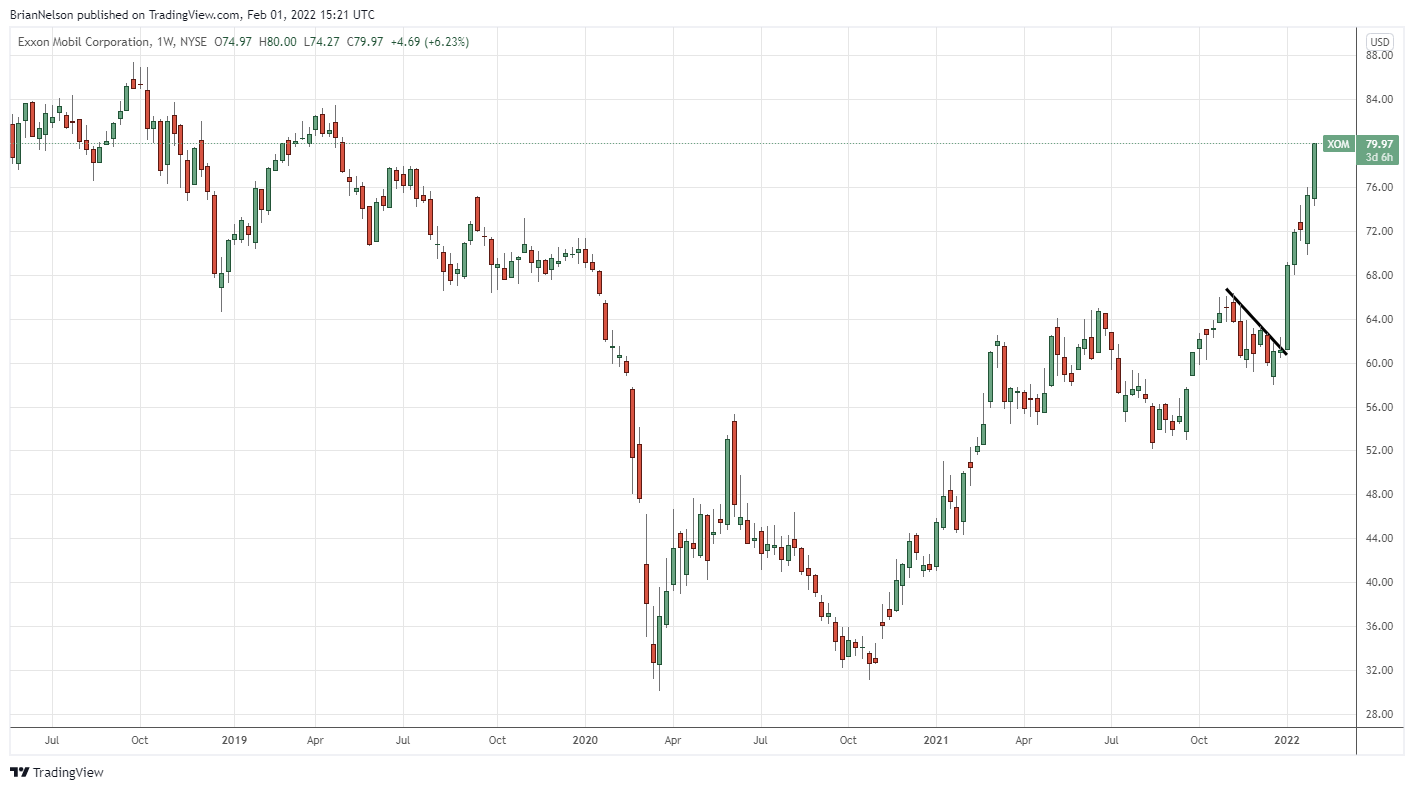

Exxon Breaks Out! Oil Prices Might Rip Higher Still!

publication date: Feb 1, 2022

|

author/source: Brian Nelson, CFA

Image: A pretty technical breakout at Exxon Mobil. By Brian Nelson, CFA The simulated Best Ideas Newsletter portfolio continues to fire on all cylinders, as we outlined in our most recent email correspondence, which can be accessed here. With Exxon Mobil (XOM), Chevron (CVX), and the Energy Select SPDR (XLE) as key “holdings,” we asked Valuentum’s Callum Turcan what his thoughts were on whether energy resource prices could run higher, and here is what he had to say: The tight supply-demand dynamics for oil & natural gas combined with rising geopolitical tensions (West-Russia over a potential Russian invasion of Ukraine, reports of potential terror attacks on Northern Iraqi/Kurdish oil infrastructure, West-Iran over Iran's nuclear program and nuclear deal talks reportedly breaking down, civil tensions in Kazakhstan, perennial problems facing Libya and Nigeria's security situation) indicate there is likely room for oil prices to rip higher still. We’re putting airline equities (JETS) on high alert and expect the group to experience tremendous fare pricing pressures and higher jet fuel costs as work-from-home trends advance and raw energy resource prices continue to increase. We’re also reiterating our cautious view on Boeing (BA). The aerospace giant is reeling from negative publicity from recent airline crashes and put up a terrible fourth quarter, all the while free cash flow trends remain weak and its net debt position enormous. Here’s what we said about Boeing last August, and the main themes still ring true these days: It may take years, perhaps a decade or more, for Boeing’s financials to fully recover from its 737 MAX debacles and ongoing management miscues within its space division, while rivals such as Virgin Galactic (SPCE) continue to make progress. We’d prefer to remain on the sidelines with one of America’s iconic aviation giants, and we wouldn’t be surprised if Boeing becomes one of the worst Dow performers in the coming years. The company’s financials are in tatters. During the first half of 2021, Boeing burned through ~$4.4 billion in free cash flow after it torched $10.4 billion during the same half-year period a year ago. Total consolidated debt stood at $63.6 billion, while cash and marketable securities stood at $21.3 billion at the end of the second quarter--good (or rather, bad enough) for a net debt position north of $42.3 billion. We caution investors not to pay too much attention to GAAP accounting earnings at Boeing due to program accounting, which offers considerable flexibility for management to “massage the numbers.” Focus on net cash on the balance sheet and free cash flow generation. Both remain weak. We’re not going anywhere near Boeing, and this cautiousness extends to most of the supply chain, including Sprit AeroSystems (SPR) and Triumph Group (TGI). Our favorite long-term ways to play the rise in energy resource prices continue to be in Exxon Mobil, Chevron and the Energy Select Sector SPDR--all newsletter portfolio holdings. XOM, CVX, and the XLE are up ~24%, ~12%, and ~19% year-to-date, respectively. We remain tactically overweight the energy sector in the simulated Best Ideas Newsletter portfolio, simulated Dividend Growth Newsletter portfolio, and High Yield Dividend Newsletter portfolio. Honeywell (HON) remains our favorite industrial play, though dividend growth investors might still dabble in other industrial bellwhethers such as 3M (MMM), Caterpillar (CAT) and Deere (DE). Honeywell yields ~1.9%, 3M yields ~3.6%, Caterpillar yields ~2.2%, and Deere yields ~1.1% at the time of this writing. Our favorite dividend growth ideas remain in the simulated Dividend Growth Newsletter portfolio, however. GE's (GE) dividend yield is paltry, and its glory days are over, in our view. We continue to look for interesting ways to take advantage of the energy price boom with option idea considerations. We’ve released a few new energy options ideas to members to our additional options commentary recently, and you can add that new email-only publication to your subscription here ($1,000/year). The market continues to like our best ideas! We hope you do, too! Take a look at some top large cap growth names: The ARKK CRASHED But Large Cap Growth/Tech Is Still Cheap! Related: XLI, AAL, DAL, LUV, UAL, JBLU, HA, ALK, ALGT, SAVE, MESA, SKYW, SNCY, ULCC ---------- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment