Image Source: Realty Income

Realty Income’s dividend track record largely speaks for itself, and the REIT may be one of the most attractive in its peer universe. With a focus on some of the strongest retail tenants, it has largely avoided most of the trouble in retail, too. The REIT recently declared its 566th consecutive common stock monthly dividend.

By Brian Nelson, CFA

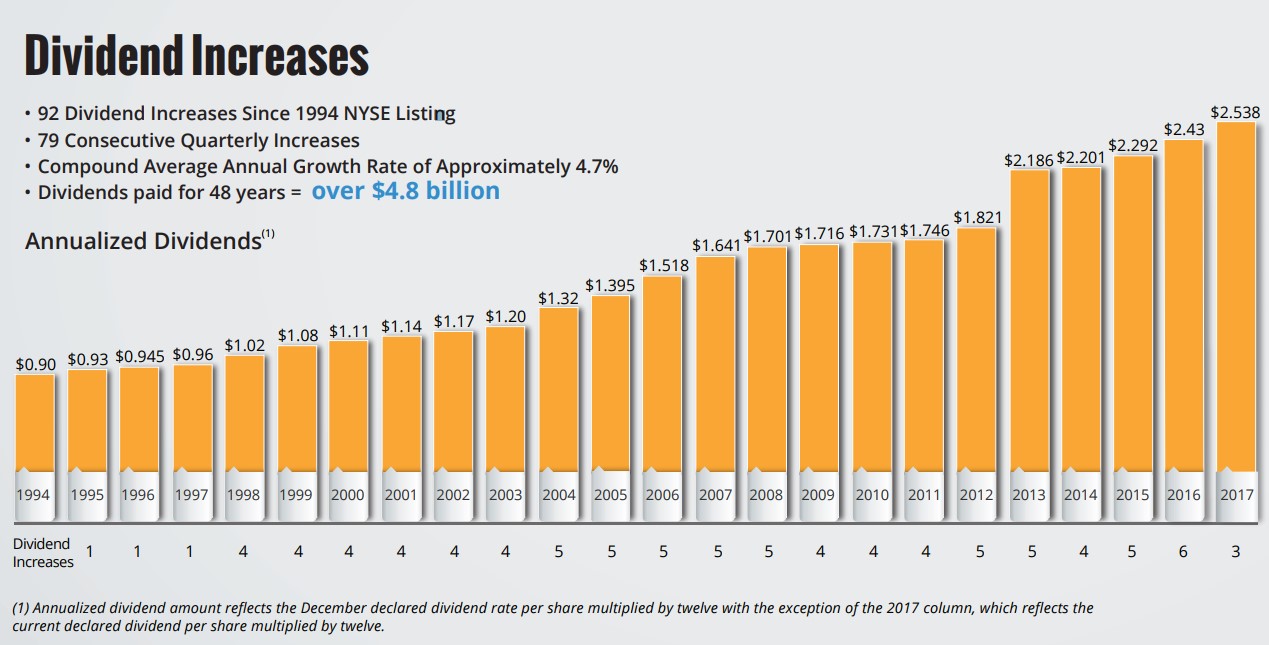

Those that don’t know Realty Income (O) should get to know it. The real estate investment trust (REIT) isn’t called the ‘Monthly Dividend Company’ for no reason. Its dividend growth track record is simply a sight to see (1), and the company’s dividend yield is still relatively attractive at ~4.6%, better than the that of the average S&P 500 company (2%) and even its equity REIT peers (~3.9%). None of this should be new ‘news,’ however, as we include this dividend growth giant as an idea in the Dividend Growth Newsletter portfolio. For the quarter ended June 30, 2017, adjusted funds from operations (AFFO) per share advanced 7%, while the company raised its 2017 AFFO guidance to $3.03-$3.07, up from $3.00-$3.06 previously. From its second-quarter report:

We achieved another solid quarter of positive operating results and are pleased with our company’s position of strength across all areas of our business,” said John P. Case, Realty Income’s Chief Executive Officer. “During the second quarter, we completed approximately $321 million in acquisitions at attractive investment spreads to our cost of capital, bringing us to nearly $700 million in acquisitions completed during the first half of the year. Our high-quality real estate portfolio now exceeds 5,000 properties and remains healthy with quarter-end occupancy of 98.5%, our highest level in 10 years. Additionally, we recaptured 113% of expiring rent on 53 properties re-leased to existing or new tenants.

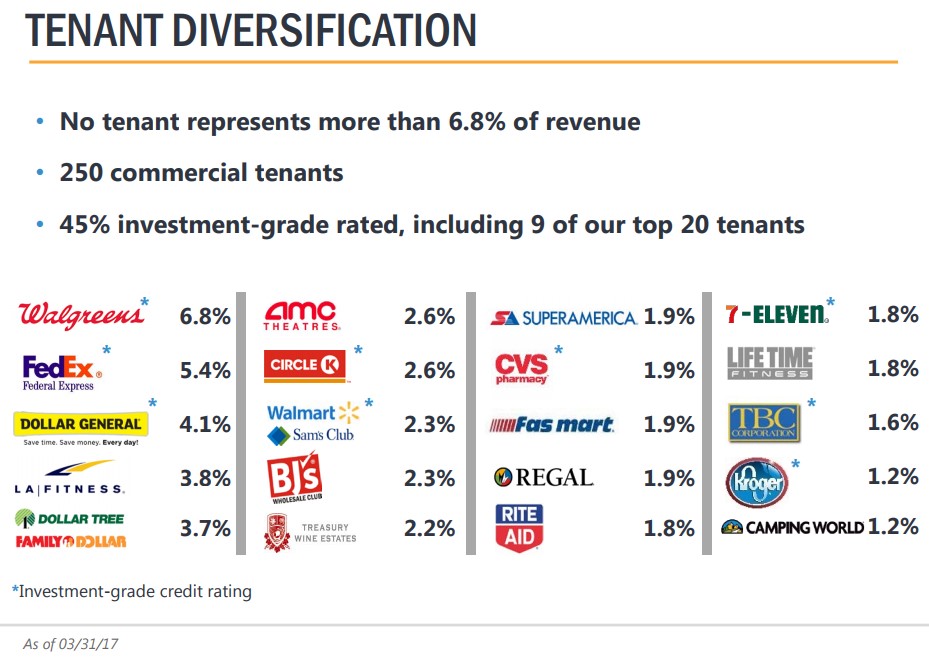

Though retail (XRT), its tenant backdrop at ~80% of property-type composition, continues to be in a world of hurt, Realty Income has been able to avoid most of the trouble, with some very healthy tenants at the top. The REIT’s combined exposure to retailers that declared bankruptcy during 2017 (True Religion, Wet Seal, Limited Stores, Rue 23, Gymboree, Radio Shack, hhgregg and the like) has been less than 1% of annualized rent. The executive team estimates that, among the most vulnerable industries within the retail sector–apparel, sporting goods, electronics, general merchandise and shoe stores—Realty Income has only about 1.2% of its annualized rent tied to them. Recession-resistant drug stores, convenience stores, and dollar stores collectively account for about ~28% of its business, while somewhat more cyclically-tied health-and-fitness tenants make up ~8%. California and Texas each contribute ~9.3% of the company’s total rental revenue, though Realty Income remains well-diversified geographically, in our view. Walgreens (WBA), FedEx (FDX), Dollar General (DG) are its top three customers, and all three are investment-grade clients.

Image Source: Realty Income

Our biggest concern with Realty Income is that its debt-to-total market capitalization may be a little high for any entity, but it does boast investment-grade credit ratings (Baa1/BBB+/BBB+), meaning the capital markets are wide open to this strong dividend payer. Despite a troubling retail backdrop, Realty Income’s performance continues to hold up well, and we still like the monthly dividend growth giant in the Dividend Growth Newsletter portfolio as one of our favorite REIT ideas. The company is also a member of the S&P High-Yield Dividend Aristocrats index, a grouping of companies that have consistently increased dividends each year for at least the past 20 years. It’s hard to find another company with a bigger focus on dividend growth than Realty Income. Shares continue to trade below all-time highs of $70+ set in July 2016.

(1) On August 17, Realty Income declared its 566th consecutive common stock monthly dividend since its founding in 1969. The REIT has increased its dividend 90+ times, with ~80 consecutive quarter increases, amounting to dividend growth of 180%+, or a compound average annual dividend growth rate of ~4.7%.

REITs – Retail: CONE, COR, DDR, DLR, FRT, GGP, KIM, MAC, O, REG, RPAI, SKT, SLG, SPG, SRC, TCO, WPC