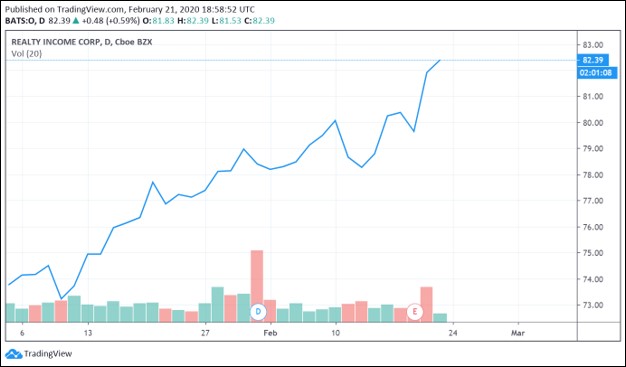

Image Shown: Shares of Realty Income Corporation, a holding in our Dividend Growth Newsletter portfolio, have taken off year-to-date.

By Callum Turcan

On February 19, the commercial property focused real estate investment trust (‘REIT’) Realty Income Corporation (O) reported fourth quarter and full-year earnings for 2019. Its results beat market expectations for both its GAAP revenues and non-GAAP funds from operations (‘FFO’), which saw shares continue to march higher after performing quite well year-to-date. We include shares of O in our Dividend Growth Newsletter portfolio and continue to like the name. Please note that when we update our Retail REIT Industry models, it’s likely Realty Income will receive a nice boost to its fair value estimate and fair value estimate range. As of this writing, shares of O yield ~3.4% on a forward-looking basis and the REIT pays out a monthly dividend.

Earnings Overview

Adjusted funds from operations (‘AFFO’), while an imperfect metric and a non-GAAP one at that, plays a key role in the world of REIT financial reporting. For 2019, Realty Income’s AFFO per share increased by over 4% year-over-year to $3.32. Management noted in the press release that Realty Income paid out ~$0.85 billion in common dividends and generated ~$1.05 billion in AFFO in 2019, allowing for an AFFO payout ratio of ~81%. We prefer that ratio to be at or below 80%, which is roughly where its payout ratio stood at in 2019, and please note Realty Income marginally increased its payout throughout the year.

In January 2020, Realty Income approved another increase to its monthly payout (up over 3% year-over-year), bringing its annualized dividend per share up to $2.79 in February 2020. We give Realty Income an adjusted Dividend Cushion ratio of 1.2x which provides for a GOOD Dividend Safety rating and given its cash flow growth trajectory and shareholder friendly policies, we give the REIT a GOOD Dividend Growth rating as its per share payout trajectory remains strong.

Realty Income ended 2019 with an occupancy rate of 98.6% and was able to generate “a rent recapture rate of 102.6% on re-leasing activity” which means rental rate growth. At the end of 2018, Realty Income’s occupancy rate also stood at 98.6%, highlighting the REIT’s quality asset base and operational performance.

Maintaining Access to Capital Markets

Please note that Realty Income is a capital-market dependent entity, meaning it must retain reasonable access to debt and equity markets at decent rates to raise the funds required to fund its growth trajectory, refinance its debt load, and continue making good on its dividend obligations. While Realty Income has yet to file its 10-K filing for 2019 as of this writing, its 8-K filing covering the fourth quarter of last year notes the firm exited 2019 with $7.9 billion in total debt (inclusive of short-term debt) along with a marginal ~$0.05 billion cash and cash equivalents position.

During the fourth quarter of 2019, the REIT was able to issue out roughly $0.6 billion in common stock and for the full-year, Realty Income raised $2.2 billion from common stock issuances (keeping in mind the share price of O climbed materially in 2019, on top of its nice dividend payouts). Furthermore, Realty Income is supported by a $3.0 billion revolving credit line that matures in March 2023, which can be extended by two six-month terms and additionally, that credit line has a $1.0 billion expansion feature. Within its press release, Realty Income notes that about $0.7 billion has been borrowed against the facility.

In our view, Realty Income retains quality access to capital markets and other sources of funds, which supports its growth trajectory going forward.

Guidance and UK Expansion

Looking ahead, Realty Income is guiding to generate $3.50-$3.56 in AFFO per share in 2020, up ~6% year-over-year at the midpoint of guidance. Please keep in mind various activities could influence this forecast going forward, however, we appreciate the nice trajectory laid out by management. Part of this is due to Realty Income completing its first overseas acquisition last year, moving into the UK property market by acquiring 18 properties in the country for $0.8 billion throughout 2019.

During Realty Income’s latest quarterly conference call with investors, management reiterated the REIT’s international focus would be trained largely on the UK. While Realty Income sees some “interesting” opportunities in Western Europe, the REIT wants to build an international base in the UK first before expanding elsewhere (if that does become the case). Please note that Realty Income now has a “small office in London” to help set the stage for its UK expansion. Here’s what Sumit Roy, Realty Income’s CEO and President, had to say in response to a question from an analyst concerning whether Realty Income would consider EU investments as well (emphasis added):

“Look, our focus is still very much the UK, that’s the geography that we decided to go into first for obvious reasons [similar culture, same language, similar attitudes towards business more or less, etc.]. We feel very comfortable with that. But we are starting to see some very interesting concepts coming out of Western Europe as well. And we are doing our diligence. Neil’s [Realty Income’s Chief Strategy Officer as of 2018] making several trips across the pond to explore those opportunities. So I’m not going to keep those off the table, but in terms of the make up, I think you should expect 20% of the volume plus, minus to come from the international market [regarding future acquisitions]. And I’d love to be surprised and that’s a challenge for Neil. But the vast bulk of our acquisitions will still be US domiciled.”

The goal is to allocate ~80% of Realty Income’s future investments to the US and ~20% to international markets, primarily/solely the UK for now. We appreciate Realty Income’s international push and so far, the firm has been quite successful in locating lucrative opportunities to capitalize on. Brexit is a concern, however, Realty Income seems to see opportunity in the fear arising from ongoing UK-EU trade negotiations, especially after the decisive December 2019 UK General Election that saw a Tory majority emerge in Parliament (which has arguably made it much easier for the UK to make its transition, keeping in mind the UK is now no longer a part of the EU as of the end of January 2020).

Concluding Thoughts

Realty Income continues to chug along nicely, and we continue to like shares of O, at a modest weighting, in our Dividend Growth Newsletter portfolio. The REIT’s growth trajectory is improving, aided by its nascent push overseas, and we think Realty Income has a nice outlook ahead of it. As mentioned previously, when we update our Retail REIT Industry models there’s a very good chance Realty Income’s fair value estimate and fair value estimate range will be revised higher.

Retail REIT Industry – CONE DLR FRT O REG SPG WPC

Related: VNQ, RTL, NETL, ICF, EWRE, XLRE

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) and Digital Realty Trust Inc (DLR) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Digital Realty Trust is also included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.