Image Shown: Prologis Inc is merging with Duke Realty Corporation through an all-stock acquisition that will see Prologis cement itself as a logistical real estate powerhouse in the US and worldwide. Image Source: Duke Realty Corporation / Prologis Inc – June 2022 IR Presentation announcing the acquisition of Duke Realty by Prologis

By Callum Turcan

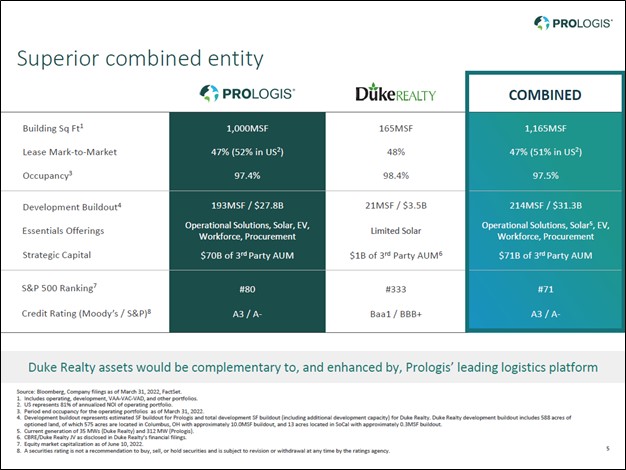

On June 13, Prologis Inc (PLD) announced it was buying Duke Realty Corporation (DRE) through an all-stock transaction worth ~$26 billion when including the assumption of debt. In the wake of severe capital market volatility, some major deals in the real estate investment trust (‘REIT’) space are still getting done. Back in May 2022, Duke Realty rejected Prologis’ previous offer worth ~$24 billion as being “insufficient” which prompted Prologis to sweeten the pot to get a deal done.

Overview

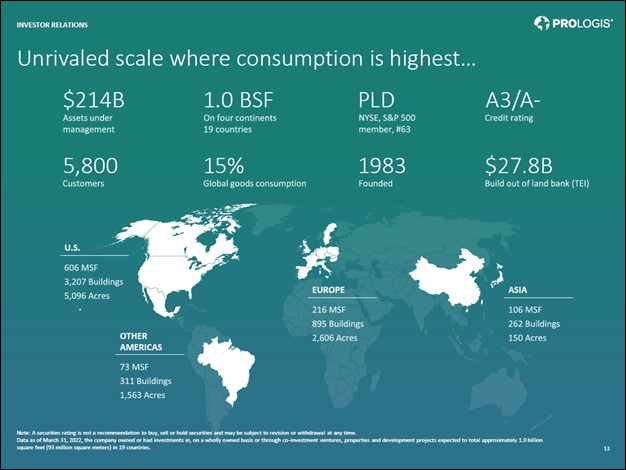

Prologis is a REIT that focuses on logistical properties, namely warehouses and distribution facilities that meet business-to-business (‘B2B’) and retail/fulfillment needs. At the end of March 2022, Prologis had investments in ~1.0 billion square feet of logistical properties across 19 countries in North America, South America, Europe, and Asia. That includes properties that are currently operational and real estate projects under development. Prologis’ position in the US is by far its largest and represents roughly three-fifths of its asset base in terms of square feet.

Image Shown: An overview of Prologis’ logistical real estate footprint which includes assets across four continents. Image Source: Prologis – June 2022 IR Presentation

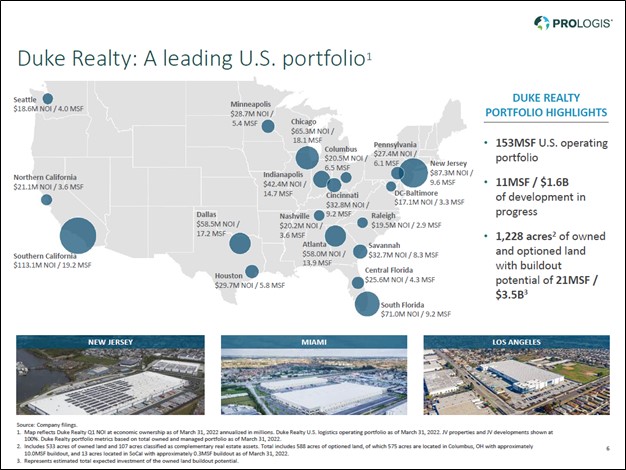

Duke Realty is a REIT that is a pure-play on the domestic logistics real estate market with warehouses and distribution centers in 19 major geographical markets across the US. At the end of March 2022, Duke Realty had investments in just under 0.2 billion square of logistical properties that were either operational or under development. There is substantial operational overlap between the real estate asset bases and overall strategy between Duke Realty and Prologis, underpinning the reasoning behind the relatively big deal in the REIT space.

Image Shown: An overview of Duke Realty’s logistics real estate footprint which covers numerous major metropolitan markets in the US. Image Source: Duke Realty / Prologis – June 2022 IR Presentation announcing the acquisition of Duke Realty by Prologis

Both REITs cater to the e-commerce space and have benefited from the proliferation of e-commerce activities during the past decade. However, after e-commerce activities surged during the first two years of the coronavirus (‘COVID-19’) pandemic, the e-commerce economy has slowed down sharply this year as households resumed outdoor and in-person activities. Prologis and Duke Realty also cater to the supply chain operations of tenants focused on supporting in-store selling activities. The longer term outlook for e-commerce sales remains quite bright as companies with serious omni-channel distribution operations are clearly much better positioned to meet demand than their peers with limited distribution capabilities, something the COVID-19 pandemic exposed.

A combination of e-commerce activities slowing down, ongoing interest rate increases, and the broader selloff seen in equity markets of late led to shares of PLD and DRE selling off sharpy in 2022. Prologis saw an opportunity to scoop up another enterprise focused on logistical real estate properties by acquiring Duke Realty in the wake of major capital market volatility. This acquisition comes on the heels of Prologis’ ~$13 billion deal to acquire Liberty Property Trust in 2020 and its ~$8.5 billion deal to acquire DCT Industrial Trust in 2018. According to the press release announcing its most deal acquisition, Prologis is quite interested in growing its exposure to attractive geographical markets in Atlanta, Dallas, Southern California, New Jersey, and South Florida by acquiring Duke Realty. While Prologis intends to exit one of the markets Duke Realty operates in, management intends to keep ~94% of Duke Realty’s asset base within Prologis.

Historically, Prologis has generated ample net operating cash flows though its free cash flow performance is quite lumpy due to its sizable capital expenditure requirements. The same goes for Duke Realty. The top ten customers of Prologis in terms of net effective rent (‘NER’) represented just under 17% of its annual NER at the end of December 2021 and its top customers in terms of NER included Amazon Inc (AMZN), FedEx Corporation (FDX), Home Depot Inc (HD), Geodis (a subsidiary of SNCF Logistics which is run by the French government), Wal-Mart Inc (WMT), the US government, and the United Parcel Service Inc (UPS). Prologis’ top 25 customers represented just under 23% of its NER at the end of December 2021, highlighting the diverse nature of its tenant base.

Deal Terms

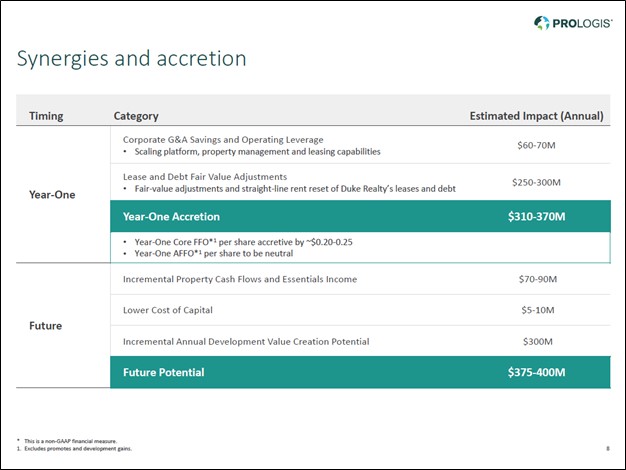

Prologis offered 0.475 share of PLD for each share of DRE, and the board of directors of both REITs have already unanimously approved the deal. The acquisition is expected to close in the final quarter of 2022 and is forecasted to create $310-$370 million in synergies from corporate G&A cost savings and operating leverage along with mark-to-market adjustments on leases and debt. Prologis sees the deal adding $0.20-$0.25 per share in annual core funds from operations (‘FFO’), a non-GAAP metric, in Year 1 of the transaction closing. When removing certain items, the deal is expected to have a neutral impact on Prologis’ per share core FFO performance within a year of the transaction for Duke Realty closing.

Farther out, the two REITs see room for additional synergies worth $375-$400 million in the form of “annual earnings and value creation” which includes $300 million in incremental development value creation along with $70-$90 million in incremental property cash flow and $5-$10 million in the form of cost-of-capital savings. Given the substantial operational overlap between Prologis and Duke Realty, aided by Duke Realty being a pure-play on the logistical real estate market in the US (as compared to a REIT that operates in several different real estate categories and geographical markets), the targeted synergy goals appear reasonable, in our view.

Image Shown: By acquiring Duke Realty, Prologis intends to generate substantial near and long-term synergies. Image Source: Duke Realty / Prologis – June 2022 IR Presentation announcing the acquisition of Duke Realty by Prologis

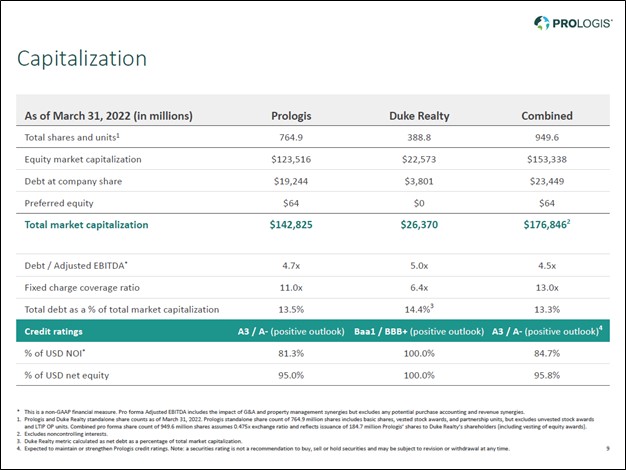

At the end of March 2022, Prologis had $18.4 billion in total debt (inclusive of short-term debt) on the books versus $1.9 billion in cash and cash equivalents on hand. Prologis is utilizing equity to fund its acquisition of Duke Realty in large part due to its bloated balance sheet limiting its options. We caution that Prologis’ balance sheet is set to become further bloated in the near term, though the combined company is expected to have a lower adjusted EBITDA to net debt ratio (a non-GAAP metric) on a pro forma basis should expected synergies get realized in a timely manner. Duke Realty had $3.7 billion in total debt on the books (inclusive of short-term debt) at the end of March 2022, which was offset by a negligible amount of cash-like assets on hand.

Image Shown: Prologis is a capital market dependent entity supported by a nice ‘A-rated’ investment grade credit rating. Image Source: Duke Realty / Prologis – June 2022 IR Presentation announcing the acquisition of Duke Realty by Prologis

Prologis’ business model is capital-market dependent, which is typical for virtually all REITs. Going forward, the REIT needs to be able to tap debt and equity markets at reasonable rate to fund its growth developments, acquisitions, make good on its total payout obligations, and to refinance maturing debt. Should Prologis be unable to tap capital markets for whatever reason, that would negatively impact its business model in a severe way. The company has a nice ‘A-rated’ investment grade credit rating (A3/A-) which should help Prologis maintain access to debt markets at attractive rates going forward. It will be crucial for Prologis to quickly generate synergies from its deal for Duke Realty to help keep its leverage ratios under control.

Within the press release announcing the acquisition, Prologis’ CFO noted that “this transaction increases the strength, size and diversification of (its) balance sheet while expanding the opportunity for Prologis to apply innovation to drive long-term growth” and “in addition to generating significant synergies, the combination of these portfolios will help (it) deliver more services to (its) customers and drive incremental long-term earnings growth.” We view the combination favorably.

Concluding Thoughts

The tie-up between Prologis and Duke Realty makes plenty of sense given the substantial operational overlap between the two REITs and ability to target a significant number of obtainable synergies shortly after the deal closes. Shares of PLD yield ~2.9% and shares of DRE yield ~2.2% as of this writing. We are not interested in adding either REIT to the newsletter portfolios at this time, though we are keeping a close eye on potential M&A activity given the difficult backdrop for dealmaking seen in 2022 as enterprises deal with major exogenous shocks (inflationary pressures, geopolitical tensions, rising interest rates, supply chain hurdles, labor shortages, and other concerns).

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Real Estate Investment Trusts (REITs) Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Related: DRE, PLD, AMZN, FDX, UPS, WMT, HD, VDC, VNQ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS), Home Depot Inc (HD), Digital Realty Trust (DLR), and Realty Income Corporation (O) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. American Tower Corporation (AMT), CubeSmart (CUBE), Life Storage Inc (LSI), Digital Realty Trust, Public Storage (PSA), Vanguard Consumer Staples ETF (VDC), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.