Image Source: Nutrien Limited – 2020 Annual Report

Executive Summary: Nutrien Limited is benefiting from the strong global farm economy. The company sells tens of millions of metric tons of potash, nitrogen, and phosphate products every year, which are key ingredients used in the production of fertilizer. With geopolitical tensions building in Eastern Europe, Nutrien is preparing to bring idle potash production capacity in Canada back online while steadily expanding its nitrogen production capabilities. Nutrien is a great free cash flow generator with a promising growth outlook, though its net debt load is rather large. The firm is focusing on deleveraging activities in the near term, which we appreciate. Shares of NTR yield ~2.5% as of this writing, and we think it is one for your radar.

By Callum Turcan

Fertilizer is used to bolster crop yields to enable the agricultural economy to feed a growing global populace year-round. Potash, nitrogen, and phosphate are key inputs for fertilizer production. Nutrien Limited (NTR) is a Canadian company that supplies ~27 million metric tons of potash, nitrogen, and phosphate products across the globe on an annual basis. Headquartered in the city of Saskatoon in Saskatchewan, Canada, Nutrien is listed on both the New York Stock Exchange and the Toronto Stock Exchange. Please note the company reports its financials in accordance with IFRS rules and in U.S. dollar terms.

Company Overview

Nutrien operates half a dozen potash mines in Canada’s Saskatchewan province that combined have over 20 million metric tons of annual potash production capacity. The firm views its potash mines as being on the lower end of the cost curve. It also operates 16 nitrogen production facilities, including over a dozen ammonia plants, in the US, Canada, and Trinidad & Tobago.

Combined, these facilities have the capacity to produce more than 11 million metric tons of nitrogen products per year, including over 7 million metric tons of ammonia production capacity. Nutrien also owns a 50% equity stake in Profertil, a nitrogen producer based in Argentina, through a partnership with state-run YPF SA (YPF).

Ammonia can be used to make nitric acid which in turn is used to nitrate fertilizers, and ammonia can also be used to produce urea, a product used in fertilizers and as an animal feed additive. The firm also operates two integrated phosphate mining and processing facilities in the US along with four regional upgrading plants. Nutrien sees itself being self-sufficient when it comes to sourcing phosphate rock.

Nutrien has a sizable retail network with over 2,000 locations across seven countries in North America, South America, and Australia that supply the agricultural industry with nutrients, seeds, crop protection products, various agricultural-related services, and digital tools. Its retail network operates under the Nutrien Ag Solutions and Landmark brands. At the end of 2020, Nutrien had over 425 locations in Australia and over 35 locations in Brazil, along with roughly 1,500 locations in North America.

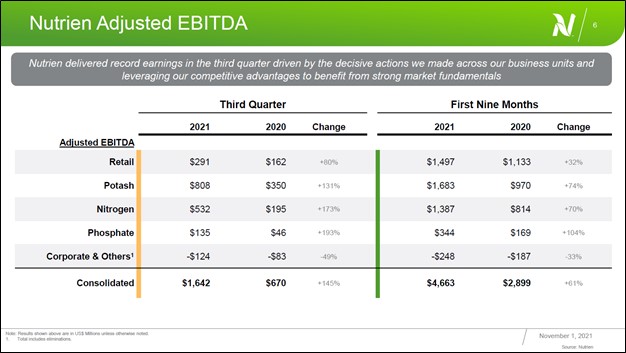

The company has crop advisors and agronomists that offer its customers with solutions as it concerns maximizing their potential crop yield and earnings, among other things. Nutrien aims to offer its customers a comprehensive slate of products and services to provide it with a competitive advantage over some of its peers. As one can see in the upcoming graphic down below, Nutrien’s retail, potash, and nitrogen operations each generate a sizable portion of the firm’s non-IFRS adjusted EBITDA, while its phosphate operations represent a relatively modest portion of its business.

Image Shown: Nutrien’s retail, potash, and nitrogen operations form the backbone of its business profile. Image Source: Nutrien – Third Quarter of 2021 IR Earnings Presentation

Growth Ambitions

Growing its footprint in Brazil is a key goal for Nutrien. As a relevant aside, Nutrien’s former CEO Mayo Schmidt abruptly left the company in early 2022 and the firm is now looking for a permanent replacement. Ken Seitz, Executive Vice President and CEO of Potash, has been named interim CEO. Here is what the firm’s former CEO and board member had to say regarding Brazil’s agricultural economy and Nutrien’s growth plans in the country during the firm’s third quarter of 2021 earnings call, before leaving the job (lightly edited, emphasis added):

“Growers in Brazil are making good progress on planting their soybean and corn crops with acreage expected to be up 5 million to 7 million acres. The strength in Brazilian ag fundamentals is fueling demand for all crop inputs, while with fertilizer consumption projected to grow by more than 10% in 2021…

We remain focused on growing our retail business through tuck-ins and acquisitions, building out our network in Brazil. We’ve announced five transactions in Brazil since the beginning of 2020 and have a good pipeline of accretive opportunities in this market. We are on track to achieve our target of $100 million in run rate EBITDA from Brazil by 2023 and deliver attractive returns on investment.” — Former CEO of Nutrien

Management turnover aside, Nutrien’s growth runway in Brazil is quite large and the company has a solid foundation in the country to build off of. Over the coming years, Nutrien aims to make its Brazilian operations a much larger part of its overall operations.

Financial Update

During the first nine months of 2021, Nutrien generated $20.4 billion in IFRS revenues (up 21% year-over-year) and its IFRS gross margin came in at 30.3% (up over 615 basis points year-over-year). Pricing improvements were key, particularly as it concerns sales of potash and nitrogen products, while its retail businesses also put up rock-solid performance during this period. Nutrien posted $2.0 billion in IFRS net income during the first nine months of 2021 versus $0.1 billion during the same period in 2020.

The company generated $1.8 billion in annual free cash flow in both 2019 and 2020, defining its capital expenditures as ‘additions to property, plant and equipment’ and ‘additions to intangible assets.’ Nutrien’s cash flow statement is a messy read on a quarter-by-quarter basis, which is why looking at its annual performance provides a better snapshot of its financial trajectory, in our view. In 2020, Nutrien spent $1.0 billion covering its dividend obligations and another $0.2 billion buying back its stock, with both activities fully covered by its free cash flows.

At the end of September 2021, Nutrien had a $11.0 billion net debt position (inclusive of short-term debt) and its bloated balance sheet remains its biggest weakness. Nutrien continued to make good on its dividend obligations throughout the coronavirus (‘COVID-19’) pandemic, and modestly increased its quarterly payout on a sequential basis in February 2021, though we caution that its dividend growth going forward will likely be muted as Nutrien intends to focus on deleveraging activities. During the company’s third quarter earnings call, management noted (emphasis added):

“We repurchased 2.4 million shares in the third quarter and returned $900 million to shareholders so far in 2021 through dividends and share buybacks. We plan to significantly strengthen our balance sheet by reducing our long-term debt by approximately $2 billion over the next 6 months. This will provide flexibility to deliver on future growth opportunities and return of capital to shareholders, while reducing our finance costs by approximately $50 million per year.” — Former CEO of Nutrien

In the near term, deleveraging activities are expected to represent a core capital allocation priority alongside investing in the business. Nutrien will likely continue to make good on its dividend obligations going forward given its promising outlook and strong free cash flow generating abilities, while also buying back a modest amount of its stock. We will stress that bringing its net debt load down represents a great use of capital given that Nutrien operates in a volatile environment.

Industry Overview

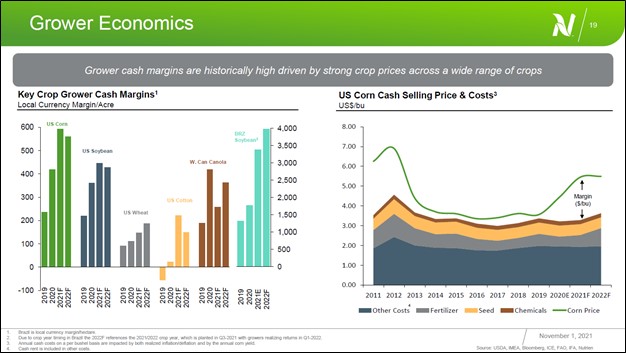

The strength of the global farm economy plays an outsized role in the trajectory of Nutrien’s financial performance. Rising commodity prices seen in recent quarters have significantly improved the cash margin outlook for farmers as you can see in the upcoming graphic down below.

Image Shown: Cash margins for farmers of key crops are expected to be quite hefty in 2022. The outlook for the global farm economy is robust. Image Source: Nutrien – Third Quarter of 2021 IR Earnings Presentation

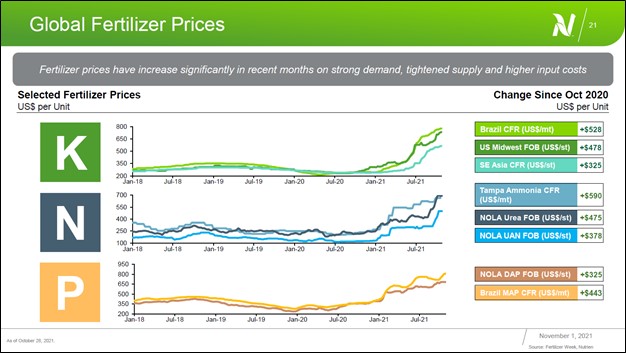

Demand for fertilizer and related products is supported by the favorable cash margins for farmers growing various agricultural products including corn, soybeans, wheat, and canola flowers. Since the middle of last year, fertilizer, ammonia, and urea prices started climbing sharply higher as you can see in the upcoming graphic down below. This coincided with the improving outlook for the global farm economy.

Image Shown: Fertilizer, ammonia, and urea prices started to shift sharply higher in the middle of 2021. Image Source: Nutrien – Third Quarter of 2021 IR Earnings Presentation

Geopolitical Considerations and Idle Capacity

Geopolitical tensions are also at play as it concerns the outlook for potash prices and fertilizer prices more broadly. Russia and Belarus are both major potash producers. Western governments have already slapped sanctions on both Russia and Belarus over a litany of issues. Should Russia decide to invade Ukraine again after taking over part of the country in 2014, and there is a chance that Russian troops could come from both its own territory and from Belarus in the coming weeks or months, Western governments have already communicated that they would respond via expansive economic sanctions programs.

For Nutrien, these geopolitical tensions are significant because the firm’s interim CEO recently told Reuters that the company could boost its potash production by almost 30% over the coming years. According to Reuters, the prices for granular potash fertilizer in the US and Brazil are currently near ten-year highs. Nutrien may restart idle potash production capacity in Canada if market conditions warrant such a move. Canpotex Ltd, a Canadian potash export and marketing firm that is owned by Nutrien and Mosaic Company (MOS), has fully booked its sales capacity through the end of this upcoming March according to Reuters.

Furthermore, during Nutrien’s third quarter of 2021 earnings call, management noted that high natural gas prices in Europe were weighing negatively on the continent’s ammonia production, driving up demand for imports. Nutrien could meet that demand from its North American operations where natural gas prices are much lower. Bringing spare capacity back online and realizing incremental upside via its ‘Next Generation Potash program’ could help Nutrien capitalize on favorable pricing seen of late without embarking on expensive greenfield developments.

This is what Nutrien’s 2020 Annual Report had to say regarding the firm’s potash assets and spare capacity (emphasis added):

We operate the most reliable, safe, and efficient Potash assets as part of a diverse and flexible mine network. This allows us to position the right tonnes at the right time and to minimize risk. We are unique and advantaged, with 5 million tonnes [metric tons] of incremental available capacity and with the option to build an additional 5 million tonnes in brownfield expansion as needed – significantly more quickly and at a lower cost than any greenfield projects.

We are progressing our Next Generation Potash program, which is focused on using the latest mining automation and digital technologies from the mine face right through to the mill. This is expected to further lower our production cost per tonne [metric ton] and improve safety performance.

Nutrien has a meaningful amount of spare potash production capacity and has ample room to increase the production capacity of its producing assets. The firm’s interim CEO noted that Nutrien would be able to add meaningful amounts of incremental potash production to the market by the second half of this year when talking to Reuters. Here, we would like to stress that the goal, at least for now, is to not pursue major expansion projects given the industry’s past problems with oversupply issues.

The company is steadily working towards completing nitrogen-related expansion developments. When combined with the potential upside bringing its idle potash production facilities back online could generate, Nutrien’s outlook starts to look quite promising. In its third quarter 2021 earnings press release, Nutrien noted:

In the third quarter of 2021, we completed phase 1 of our nitrogen brownfield expansion projects and anticipate to fully benefit from this expanded capacity in 2022, which is expected to generate attractive returns on investment. We also started a second phase of brownfield projects that is expected to add approximately 500,000 tonnes of annualized, low-cost and environmentally efficient production capacity over the next few years. We progressed previously announced decarbonization projects that are expected to reduce CO2 equivalent emissions by approximately one million tonnes by the end of 2023.

According to its 2020 Annual Report, Nutrien bills itself as “one of the largest producers of blue/low carbon ammonia in the world.” The “blue” side of this involves carbon capture and storage operations, while the “low” side of this can include anything from utilizing less polluting sources of energy to placing a great emphasis on water and power efficiency. In a world increasingly focused on sustainability, Nutrien is doing what it can.

Guidance

During its third quarter of 2021 earnings report, Nutrien raised its full-year guidance for 2021 and indicated that it expected its strong performance would continue into 2022. Please note Nutrien also raised its 2021 guidance during its first and second earnings updates as well.

The upcoming graphic down below highlights Nutrien’s guidance for 2021 as of the third quarter of last year. Nutrien forecasts that its financial performance staged an impressive rebound last year over 2020 levels