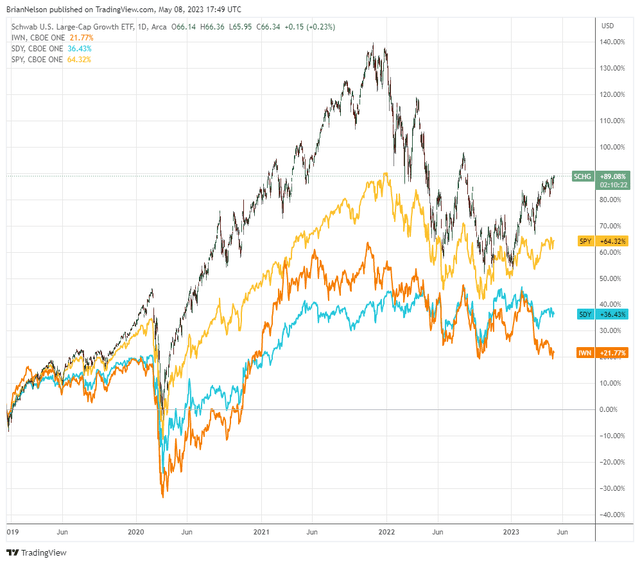

Image: Since the release of the book Value Trap in December 2018, an ETF that tracks large cap growth (SCHG) has outperformed not only the S&P 500 (SPY), but also the areas of dividend growth (SDY) and small cap value (IWN) by sizable margins.

By Brian Nelson, CFA

We explained in part why we don’t like the dividends of banking firms in this note here, and we’re starting to see dividend cuts in the regional banking space, with PacWest Bancorp (PACW) as the latest banking entity to slash its quarterly payout. Right now, executives in the regional bank arena seem to be like deer caught in headlights, and we’re even seeing banking deals fall apart. The proposed deal between Toronto-Dominion Bank (TD) and First Horizon Corp (FHN), for example, was recently scrapped due to uncertainties over getting the required regulatory approvals, but we’re not so sure that’s the full reason. We think it probably made the most sense to put things on hold until ripples in the banking sector fade away.

A lot of people have been blaming bank executives for mismanagement during the regional bank crisis, and while a case can be made that there is always some managerial reason why banks eventually fail, the reality is that it is not entirely bank management’s fault. Certainly, there are some cases where management teams make egregious errors leading to failures, but the bank business model is just not a good one, “4 Very Good Reasons Why We Don’t Like Dividends of Bank Stocks.” At face value, the banking industry is simply an interest-rate spread game with service fees layered on, but what many often forget is that it is a balance-sheet game, too. When interest rates rise, the value of a bank’s assets fall, whether they are residential mortgages, commercial real estate, or in the case of the recent regional bank failures, government-backed long-dated Treasury securities.

No matter the reason why the value of a bank’s assets could fall, the risks to bank balance sheets (and their solvency) will always remain, and the rapidity at which deposits can flee is unprecedented in this day and age. Decades ago, tellers would be able to process withdrawals at a measured and slow pace to stem bank runs. Today, however, withdrawals can be made in a matter of seconds, and news spreads even faster this day and age given social media proliferation. Despite a small “position” in the Financial Select Sector SPDR (XLF) in the Best Ideas Newsletter portfolio, we just don’t see any reason to own banking stocks. We may have dabbled in a TBTF (Too-Big-to-Fail) bank or two in the past, but the sector is just not a good one, and any new regulations will only continue to clamp down on their net interest margins and their ability to drive meaningful ROE expansion, in our view.

Over the weekend (May 6-7, 2023), Berkshire Hathaway (BRK.A) (BRK.B) hosted its 2023 Annual Meeting. Warren Buffett and Charlie Munger didn’t say much about regional banks, but the duo’s lack of action across the regional banking arena may be telling, as Buffett has stayed largely on the sidelines. That could change, of course, as Buffett has had a habit of dabbling in banks in the past, but any activity by Berkshire won’t change our negative opinion of the banking sector, more generally. They’re just bad businesses, in our view, and very little could ever change that. During the Berkshire annual meeting, the corporate star of the show was actually Apple Inc. (AAPL), receiving praise by the Oracle, and we continue to like shares of the iPhone maker, “Apple’s Second-Quarter Fiscal 2023 Results Were Good Enough.”

Here’s what Warren Buffett had to say about Apple at Berkshire’s annual event:

The good thing about Apple is (Berkshire) can go up (in our ownership stake). They keep buying their stock; instead of our owning 5.6%, if they get down to…15.25 billion of shares outstanding, without our doing anything we got 6%. Our criteria for Apple isn’t different than the other businesses we own; it just happens to be a better business than any we own. And we put a fair amount of money in it…and our railroad business is a very good business, but it is not remotely as good as Apple’s business. Apple has a position with consumers where they are paying $1,500 or whatever it may be for a phone, and these same people pay $35,000 for having a second car, and if they had to give up their second car or give up their iPhone, they’d give up their second car. I mean it’s an extraordinary (product). We don’t have anything like that that we own 100% of…but we’re very, very, very, happy to have 5.6% or whatever it may be percent (of Apple), and we’re delighted every tenth of a percent that it goes up.

In a world where monetary policy is tightening and regional banks are failing, we maintain our long-held view that big cap tech and large cap growth are the places to be. Since the release of the book Value Trap in December 2018, an ETF that tracks the area of large cap growth (SCHG) has not only outperformed the S&P 500 (SPY), but also the areas of dividend growth (SDY) and small cap value (IWN) by sizable margins. We love the net cash rich balance sheets and strong expected future free cash flow generators within the area of large cap growth, and Apple remains one of our very favorites that fits the mold. Apple is included in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

NOW READ: Apple’s Second-Quarter Fiscal 2023 Results Were Good Enough

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.