Image: Facebook continues to put up impressive levels of free cash flow generation. We remain huge fans of the stock. Image Source: Facebook

By Brian Nelson, CFA

Expectations were low for Facebook’s (FB) third-quarter 2021 results, released October 25, following a read-through from news in recent weeks, including Snapchat’s (SNAP) weak third-quarter performance due to Apple’s (AAPL) iOS 14 changes and supply chain issues that may be slowing ad growth.

Though Facebook’s third-quarter results still felt an impact from Apple’s iOS 14 changes and perhaps advertisers slowing some spending due to reduced product availability, the social media giant revealed that it remains a net-cash-rich, free cash flow generating powerhouse that continues to benefit from secular ad growth trends, and one that continues to take advantage of its own cheap stock by buying back shares.

Facebook’s total revenue advanced 35% during the third quarter, while income from operations leapt 30%, helping to drive a 19% increase in earnings per share, to $3.22, which came in slightly better than consensus forecasts. The company’s pace of revenue growth was a little light in the period, but we can’t really complain about a company of Facebook’s size that is growing its sales at a huge double-digit clip.

Importantly, to arrive at our $515 per share fair value estimate of Facebook, we’re modeling in a revenue CAGR of 18.4% over the next five years, so the social media giant remains on track to achieve, and likely beat, our projections that drive our above-market valuation. With a company of Facebook’s size, we’re less and less concerned about its ability to grow daily or monthly active users than we are about its ability to monetize them.

Still, both daily active users and monthly active users advanced 6% on a year-over-year basis in the quarter, with growth occurring across all its major geographical regions (‘Rest of World,’ ‘Asia Pacific,’ ‘Europe,’ US & Canada.’). It’s clear that, despite the concerns many have that Facebook is losing relevance, perhaps with the younger generation that is turning to TikTok, Snapchat, or Twitter (TWTR), the social media giant continues a nice pace of user expansion, regardless.

Facebook’s operating margin came in at a robust 36% during the third quarter. Though we’re modeling an average operating (“EBIT %”) margin of 40.1% over the next five years, Facebook continues to invest aggressively in augmented and virtual reality related hardware and software through its new reporting segment Facebook Reality Labs (“FRL”), and while investments in this area will continue to grow, we expect Facebook’s overall operating margin to hover around the 40% range for the foreseeable future, roughly in line with its quarterly average of 39.2% from Q3’19-Q3’21.

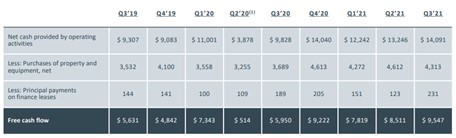

Third-quarter 2021 marked Facebook’s best performance with respect to free cash flow generation, with the mark coming in at $9.55 billion, up more than 60% on a year-over-year basis. The social media behemoth ended the quarter with $58.08 billion in cash and cash equivalents and marketable securities, simply a war chest to use to buy back its cheap stock, of which $14.37 billion was repurchased during the third quarter. Facebook also announced that it would increase its share repurchase authorization by $50 billion, a move that we applaud given the large price-to-fair value disconnect with respect to shares.

Looking ahead, Facebook expects fourth-quarter revenue to be in a range of $31.5-$34 billion after factoring in anticipated “headwinds from Applies iOS 14 changes.” Supporting improved margin expectations, Facebook expects total expenses for 2021 to come in the range of $70-$71 billion (was $70-$73 billion) and capital expenditures to come in at ~$19 billion (was $19-$21 billion). Capital spending of $29-$34 billion for 2022 primarily for “data centers, servers, network infrastructure and office facilities” will come in a bit higher than our expectations, but we’re still expecting tremendous free cash flow generation next year.

Concluding Thoughts

Facebook showed what it means to have a wide economic moat when it reported its third-quarter 2021 results. Robust revenue growth in the face of disruptive Apple iOS 14 privacy changes, impressive operating-income expansion in the face of considerable expense growth to build out the ‘metaverse,’ and cultural resilience in the face on a slew of media attacks on its business practices reveal that Facebook may be near-invincible.

We’re huge fans of Facebook’s free cash flow generation capacity and its attractive net-cash-rich balance sheet, and we expect more good things to come from this top-weighted idea in the Best Ideas Newsletter portfolio. A huge new buyback authorization that we thought was in the cards in the wake of share-price weakness has arrived, and we love that Facebook is scooping up its undervalued stock. We’re maintaining our 10 rating on the VBI and $515 fair value estimate for shares.

Facebook’s 16-page Stock Report >>

—–

Image Source: Value Trap

Tickerized for FB, SNAP, TWTR, GOOG, GOOGL, PINS, CRTO, MTCH, BMBL, DWAC, ANGI, IAC, MGNI, SOCL, MILN, VPOP

———-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.