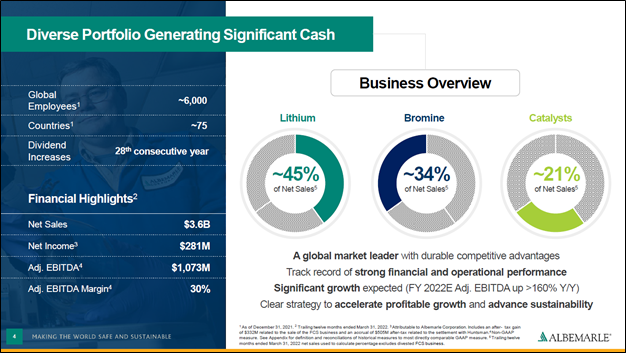

Image Shown: An overview of Albemarle Corporation’s business profile. We include Albemarle as an idea in our ESG Newsletter portfolio. Image Source: Albemarle Corporation – May 2022 IR Presentation

By Callum Turcan

When the specialty chemicals company Albemarle Corporation (ALB) published its first quarter 2022 earnings report on May 4, the firm boosted its full-year guidance in a big way. That guidance boost was attributed to outperformance at its lithium operations and to a lesser extent, its bromine operations, which offset major inflationary headwinds facing its refining catalysts operations. In the wake of favorable contract negotiations covering sales of lithium derivatives and related products, Albemarle further boosted its full-year guidance in late May (on May 23).

Two favorable guidance increases in one month, especially in the current environment, is a welcome sign. We include Albemarle in our ESG Newsletter portfolio (more on that publication here) and appreciate the company’s confidence in its near term performance.

Latest Guidance Boost

Here is what Albemarle had to say regarding its near term outlook within its May 23 press release (emphasis added):

Lithium adjusted EBITDA for the full year 2022 is now expected to grow approximately 300% year over year, up from [our] previous outlook. Average realized pricing is now expected to be up approximately 140% year over year resulting from the implementation of index-referenced, variable-price contracts and increased market pricing. Full-year 2022 volume is expected to be up 20-30% year over year primarily due to new capacity coming online (unchanged from [our] previous outlook).

Revised Lithium outlook assumes the company’s updated second-quarter 2022 realized selling price remains constant for the remainder of the year. There is potential upside if market pricing remains at historically strong levels or if current fixed contract renegotiations result in additional index-referenced, variable-price contracts. There is potential downside in the event of a material correction in lithium market pricing or potential volume shortfalls (e.g., delays in acquisitions or expansion projects).

Stronger than expected realized pricing for its lithium product sales was due to favorable contract negotiations, as its revised contracts better enable Albemarle to capitalize on surging lithium derivatives pricing seen over the past 18 months. When combined with expected output growth this year, that dynamic created a powerful source of upside for Albemarle’s financial performance. The potential for downward movements in lithium product pricing and delays in its growth endeavors (both organic and inorganic) represent potential hurdles for Albemarle, though conversely, there is also room for additional upside as well. Management noted in the May 23 press release that Albemarle left its guidance for its bromine and refining catalysts businesses unchanged during its latest forecast revision.

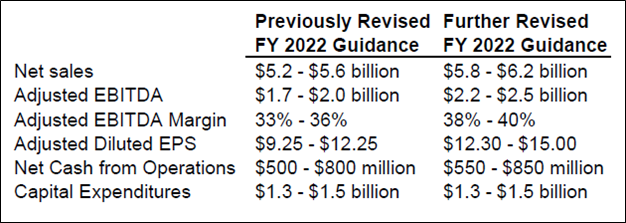

Albemarle is now forecasting it will generate $6.0 billion in net sales this year at the midpoint, up meaningfully from its previous guidance (issued on May 4) which called for $5.4 billion in net sales at the midpoint. Furthermore, that is sharply higher than the midpoint of guidance Albemarle issued on February 16 in conjunction with its fourth quarter 2021 earnings report, which called for $4.35 billion in net sales in 2022.

Pivoting to Albemarle’s expected non-GAAP adjusted diluted EPS performance, the midpoint of its current guidance stands at $13.65, up substantially from $10.75 billion previously and up sharply from the $6.15 guidance midpoint issued in February 2022. The company also increased its forecasted net cash from operations, non-GAAP adjusted EBITDA, and non-GAAP adjusted EBITDA margin for 2022 during its latest guidance revision while leaving its capital expenditure expectations unchanged.

Image Shown: Albemarle’s latest guidance boost highlights the immense amount of confidence management has in the company’s near term performance. The firm has increased its full-year guidance for 2022 multiple times, and farther out, its booming lithium operations underpin its incredibly promising longer term growth runway. Image Source: Albemarle – May 2022 Press Release

On a year-over-year basis and at the midpoint of its latest guidance, Albemarle is now guiding to generate ~80% net sales growth, ~170% adjusted EBITDA growth, and its adjusted diluted EPS is expected to more than triple. Additionally, Albemarle forecasts its adjusted EBITDA margin will grow by ~1,280 basis points year-over-year in 2022 at the midpoint. The company still expects it will generate sizable negative free cash flows this year as it invests heavily in growing its lithium operations, though in our view, Albemarle should continue to retain access to capital markets at attractive rates to meet its funding needs going forward.

Concluding Thoughts

We are impressed with Albemarle’s performance of late. On a price-only basis, shares of ALB are up approximately 44% over the past year as of early June 2022. The company is a Dividend Aristocrat and remains committed to rewarding income seeking investors, with shares of ALB yielding ~0.7% as of this writing. Payout growth in the medium-term will likely be modest given Albemarle’s desire to invest heavily in the business, though we expect that management will strive to maintain the firm’s coveted Dividend Aristocrat status. There is a lot to like about Albemarle and we continue to like the name in our ESG Newsletter portfolio.

Members interested in reading more about Albemarle are strongly encouraged to check out our ESG Newsletter Portfolio Idea Albemarle Beats Consensus Estimates and Raises Guidance article (link here) published in May 2022. The article covers Albemarle’s first quarter earnings report, previous guidance boosts, financing considerations, and digs deep into the company’s plans to scale up its lithium operations.

—–

Mining & Chemicals Industry – APD, DD, EMN, ECL, LYB, PPG, BHP, FCX, NEM, RIO, VALE, WPM, CMP, AA, KALU, MLM, VMC, NUE, CSL, SON, ALB, FUL, ATR, GGG, SHW

Related: MALRF, SOUHY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Albemarle Corporation (ALB) and South32 (SOUHY) are both included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.