Image Source: Realty Income Corporation – August 2021 IR Presentation

By Callum Turcan

Realty Income Corporation (O) is a real estate investment trust (‘REIT’) that is steadily recovering from the worst of the coronavirus (‘COVID-19’) pandemic. For reference, Realty Income focuses on freestanding singe-tenant commercial properties in the US and the UK. The financial health of the portions of its tenant base that were hit particularly hard by the pandemic, such as movie theater operators, has improved considerably of late.

Back during the second quarter of 2020, Realty Income collected 86.5% of its contractually owed rent across its entire portfolio as many of its movie theater and health & fitness tenants, and to a lesser extent its causal dinning tenants, either could not pay or refused to pay. However, a lot has changed since then.

Earnings Update and Guidance Boost

When Realty Income reported its second quarter 2021 earnings report on August 2, the REIT noted that it had collected 99.4% of the contractual rent it was owed during the quarter (including 98.9% of the rent owed from its movie theater tenants), enabling it to beat both consensus top- and bottom-line estimates. Furthermore, Realty Income raised its full-year guidance for 2021 in conjunction with its earnings update which we really appreciate.

Now, the REIT is targeting $3.53-$3.59 in adjusted funds from operations per share (‘AFFO’), non-GAAP metric used in the REIT industry to gauge the trajectory of a firm’s financial performance, up from previous guidance calling for $3.44-$3.49 in AFFO per share. Realty Income expects to post 1.5%-2.0% same-store rent growth this year (up from 0.5%-1.0% previously) and to post an occupancy rate north of 98% (versus approximately 98% previously). The REIT also boosted its expected acquisition volume for 2021 and adjusted other aspects of its guidance, which on the net indicated that Realty Income’s outlook is bright and getting brighter.

As of the end of June 2021, Realty Income’s occupancy rate stood at 98.5%, up from 98.0% at the end of March 2021. Realty Income has been firing on all-cylinders of late with room for upside over the long haul, though the “delta” variant of the COVID-19 pandemic could create short-term headwinds for its business.

Transformative Deal Update

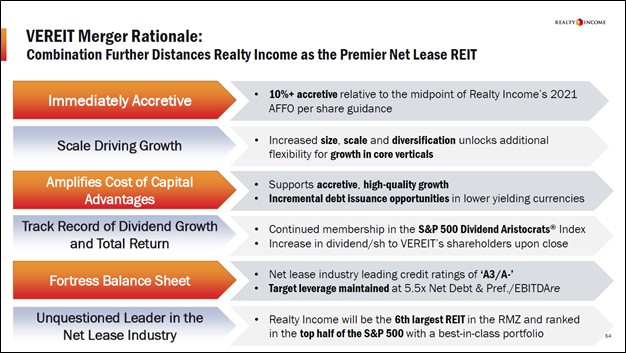

Realty Income is getting closer to completing its all-stock merger with VEREIT Inc (VER) which was announced back in April 2021. We covered our thoughts on this transformative deal back in May 2021 (article link here) which is expected to generate sizable synergies and be highly accretive to AFFO per share for Realty Income. Part of this strategy involves combining then spinning off the office properties of both REITs into a new publicly traded firm that will be distributed to shareholders. The upcoming graphic down below provides an overview of the rationale behind the merger.

Image Shown: Realty Income is merging with VEREIT. Image Source: Realty Income – August 2021 IR Presentation

Shareholders of Realty Income will own ~70% of both entities and shareholders of VEREIT will own the remaining ~30% of both entities on a pro forma basis, assuming everything goes as planned. During Realty Income’s second quarter earnings call, management noted the deal remains on-track to close by the fourth quarter of 2021 and we continue to view the transaction quite favorably. Realty Income expects to retain its rock-solid ‘A-rated’ investment grade credit rating after these deals close.

International Expansion

Realty Income first expanded internationally in 2019 through a sale-leaseback transaction in the UK that covered a dozen properties worth a bit over GBP£0.4 billion (roughly USD$0.6 billion at current foreign exchange rates). Since then, Realty Income has aggressively expanded its presence in the country. Please note that before this deal, Realty Income was solely focused on the US (including Puerto Rico, a US territory). Management had this to say on Realty Income’s international growth strategy during the REIT’s latest earnings call (emphasis added, lightly edited):

“Our international investment activities continue to support our growth outlook, and our UK portfolio has now grown to over $2.7 billion. This quarter, the UK accounted for over 50% of the $1.1 billion of total acquisitions only. Year-to-date, we’ve added approximately $1 billion in high-quality real estate in the UK across 41 properties. And of the more than $21 billion in acquisitions opportunity that we sourced, approximately 31% is related to international markets.

As we continue to expand our international platform, we will look for additional geographies that offer opportunities similar to that of the UK. We seek to acquire real estate in markets where opportunities are abundant. There is considerable demand for sale-leaseback transactions from industry-leading operators, and the local real estate can generate long-term IRRs in excess of our long-term cost of [capital].” — Sumit Roy, President and CEO of Realty Income

Management also noted during Realty Income’s latest earnings call that competition for UK properties was increasing, though the REIT is undeterred. Given the sizable opportunities in the UK and the US, the REIT felt confident in increasing its full-year acquisition volume guidance up to ~$4.5 billion from $3.25 billion previously during its latest earnings update. We view Realty Income’s growth outlook quite favorably.

Capital Market Access

Realty Income noted that it retained solid access to capital markets at attractive in recent months within its latest earnings press release, raising ~$0.45 billion through its at-the-market (‘ATM’) equity issuance program in the second quarter of this year and an additional $0.6 billion in July 2021 through a secondary offering. Additionally, Realty Income recently completed its debut green bond offering at attractive rates and had this to say in its earnings press release:

In July 2021, we issued £400 million of 1.125% senior unsecured notes due 2027 (the “2027” Notes) and £350 million of 1.750% senior unsecured notes due 2033 (the “2033” Notes). The public offering price for the 2027 Notes was 99.305% of the principal amount, for an effective semi-annual yield to maturity of 1.242%, and the public offering price for the 2033 Notes was 99.842% of the principal amount, for an effective semi-annual yield to maturity of 1.757%. Combined, the new issues of the 2027 Notes and 2033 Notes have a weighted average term of 8.8 years and a weighted average effective semi-annual yield to maturity of 1.48%. The issuances represented our debut green bond offering.

The REIT also has revolving credit lines to help cover its near-term funding needs. Given Realty Income’s large net debt load (common in the REIT industry) and sizable negative free cash flows (a product of its hefty capital expenditure expectations), the REIT needs to retain access constant access to capital markets to refinance maturing debt, cover its payout obligations, and invest in the business. That appears to be the case.

Concluding Thoughts

Realty Income, “The Monthly Dividend Company,” has paid out a dividend over the past 610+ consecutive months and shares of O yield a nice ~4.0% as of this writing. We are big fans of its pending merger with VEREIT and its international expansion plans as these endeavors will significantly improve both Realty Income’s growth runway and the resilience of its business model going forward.

We continue to like Realty Income as an idea in the Dividend Growth Newsletter portfolio and appreciate the REIT’s latest guidance boost. On a final note, we are keeping an eye on its pending merger with VEREIT.

—–

Real Estate Investment Trust Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Other: VNQ, KIM, NNN, PLD, DRE, REXR, FR, EGP, CBRE, JLL, XLRE

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. CubeSmart (CUBE), CyrusOne Inc (CONE), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust Inc and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.