Image Shown: Dividend growth idea Realty Income Corporation is acquiring its first real estate property in the gaming realm through a sale-leaseback transaction with Wynn Resorts Limited. Image Source: Realty Income Corporation – February 2022 IR Presentation

By Callum Turcan

On February 15, dividend growth idea Realty Income Corp (O) announced its 620th consecutive monthly dividend. Since going public in 1994, Realty Income has increased its monthly payout over 110 times. Realty Income is a real estate investment trust (‘REIT’) focused on single-tenant commercial properties. We include the REIT as an idea in our Dividend Growth Newsletter portfolio and continue to be big fans of Realty Income. Shares of O yield ~4.4% as of this writing.

Recent Acquisition

Realty Income recently made a big announcement that caught our eye. Also on February 15, the REIT announced that it was acquiring the Encore Boston Harbor Resort and Casino (in Massachusetts) from Wynn Resorts Limited (WYNN) for $1.7 billion through a sale-leaseback transaction.

Image Shown: An overview of the Encore gaming property. Image Source: Realty Income – February 2022 IR Presentation

This marks the first time Realty Income has acquired real estate in the gaming industry, and the transaction is expected to close in the final quarter of 2022. Realty Income’s press release noted that “the sale-leaseback transaction with Wynn Resorts is expected to be executed at a 5.9% initial cap rate” and “is expected to generate immediate earnings accretion, healthy contractual rent growth, and long-term returns at favorable spreads to Realty Income’s cost of capital.” The press release from Wynn Resorts offered additional information on the transaction (lightly edited, emphasis added):

Simultaneous with the closing of the transaction, we will enter into a triple-net lease agreement for Encore Boston Harbor with Realty Income. The lease will have an initial total annual rent of $100.0 million and an initial term of 30 years, with one thirty-year tenant renewal option. Rent under the lease will escalate at 1.75% for the first ten years of the lease and the greater of 1.75% and the CPI increase during the prior year (capped at 2.50%) over the remainder of the lease term.

Wynn [Resorts] will retain its 13-acre developable land assemblage on the east side of Broadway in Everett, MA, on a portion of which, [Wynn Resorts] plans to construct an expansion that is expected to include additional covered parking along with other non-gaming amenities. [Wynn Resorts] has secured an option to sell the related land and real estate assets of such expansion to Realty Income for up to $20 million of additional rent, at a specified cap rate, for up to six years following the closing of the transaction.

What makes this particular asset intriguing is that it “is uniquely positioned as the only integrated resort and casino located in the Boston metropolitan area. Additionally, Encore holds one of only two Class I gaming licenses that have been granted in Massachusetts” according to a recent press release. We like the deal as it expands Realty Income into an attractive space and Wynn Resorts is a top-notch operator. Casino operators of top tier properties rarely want to shut down shop as building new casinos, especially in a major metropolitan region like Boston, is incredibly expense. Realty Income should pocket rent checks from Wynn Resorts over the decades to come.

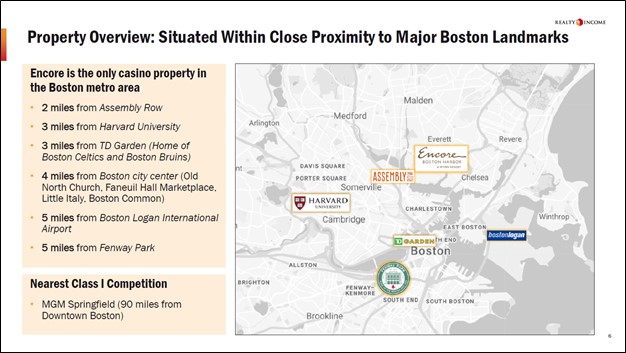

Image Shown: The Encore property is in the Boston metropolitan region. Image Source: Realty Income – February 2022 IR Presentation

The Encore property is located less than five miles away from downtown Boston and was built in 2019 for a total cost of $2.6 billion. Obtaining a Leadership in Energy and Environmental Design (‘LEED’) certification from the non-profit US Green Building Council can be important for certain real estate holdings in the US. The Encore property is LEED Platinum certified (the highest ranking). On the gaming front, the Encore property is home to slot machines, gaming tables, and poker tables. Additionally, it is home to over 670 luxury hotel rooms and suites along with numerous food and beverage outlets.

Realty Income expects that the Encore property will represent less than 4% of its annualized contractual rent when the deal closes. According to the REIT, there are roughly 5.6 million gaming aged adults within a 90-mintue drive of the Encore property. The revenue and adjusted EBITDA of the Encore gaming and related operations are expected to grow robustly over the coming years as the gaming industry in Massachusetts recovers from the coronavirus (‘COVID-19’) pandemic and related economic lockdowns.

Attractive Growth Opportunities

One of the biggest casino and gaming REITs out there is VICI Properties Inc (VICI), which has been incredibly successful at growing its asset base in recent years. Back in 2017, VICI Properties was spun out of then-Caesars Entertainment Corporation, which was later acquired by then-Eldorado Resorts Inc in 2020, which subsequently rebranded as Caesars Entertainment Inc (CZR).

As of February 2022, VICI Properties owned 27 gaming properties (home to numerous retail outlets, bars, clubs, restaurants, and hotel rooms), four golf courses, and undeveloped land in Las Vegas near some of its existing properties. When VICI Properties was originally spun off in 2017, it owned 19 gaming properties along with the four golf courses (clearly the REIT has grown its asset base meaningfully over the past five years). VICI Properties remains an acquisitive entity and, in our view, will likely continue to buy up gaming properties to grow its asset base over the coming years.

Gaming real estate assets generate stable cash flows through long-term contracts with built in annual rent growth components (and occasionally rent escalator provisions as well), allowing REITs like Realty Income and VICI Properties to organically grow over time. We are intrigued by Realty Income’s intensions with its recent acquisition (for instance, is gaming-related real estate going to represent a major growth opportunity) and will be looking out for commentary from management on the issue going forward.

There is an expansion of the broader Encore operation underway at Wynn Resorts that Realty Income has the option to purchase for up to six years after the transaction closes. The upcoming graphic down below provides an overview of Wynn Resorts’ expansion plans in the region. One of the reasons Wynn Resorts pursued the sale-leaseback transaction was to raise funds to invest in future developments and to potentially retire debt as well.

Image Shown: Wynn Resorts is expanding the broader Encore operation and Realty Income has the option to acquire the related land and real estate from this expansion for up to six-years after the transaction closes. Image Source: Realty Income – February 2022 IR Presentation

Concluding Thoughts

We like this deal as it moves Realty Income into a novel though attractive side of the real estate market. Realty Income’s outlook is quite bright, and we expect the REIT will continue to grow its monthly dividend going forward. Moving deeper into the gaming space could significantly improve Realty Income’s cash flow profile over time by diversifying its tenant base.

On a final note, Realty Income noted that there may be potential upside from online sports betting getting legalized in Massachusetts, though it is hard to see how that would directly impact its financials. Currently, online sports betting is not allowed in Massachusetts, though it is legal in numerous other US states.

Realty Income plans to report its fourth quarter 2021 earnings on February 22 after the market close and will host a conference call to discuss its results a day later. We intend to keep our members updated on Realty Income and its upcoming earnings report going forward, and will be looking out for commentary on its gaming real estate aspirations.

In November 2021, Realty Income completed the spinoff of Orion Office REIT Inc (ONL) after completing its big merger with VEREIT that same month, which we covered in detail in this article here. We encourage our members that have not read that article to do so to get an idea of why we are fans of Realty Income.

—-

Real Estate Investment Trusts (REITs) Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Related: VNQ, VICI, CZR, WYNN, ONL

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. CubeSmart (CUBE), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.