Image Source: Digital Realty Trust Inc – September 2021 IR Presentation

By Callum Turcan

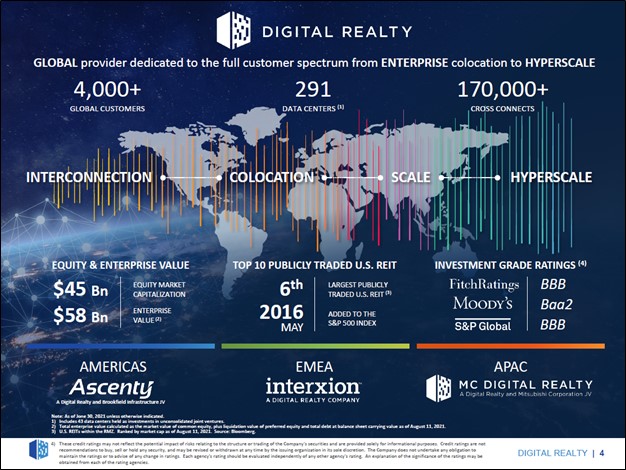

Digital Realty Trust Inc (DLR) is a carrier-neutral data center real estate investment trust (‘REIT’) that provides co-location and interconnection services. The REIT has grown its annual dividend over the past 15+ consecutive years, and we view Digital Realty as a stellar income-generation idea. As of this writing, shares of DLR yield ~2.8%.

We include shares of DLR as an idea in both the Dividend Growth Newsletter and High Yield Dividend Newsletter portfolios. Investors have been steadily warming up to Digital Realty this year, with shares of DLR up ~23% year-to-date as of the end of normal trading hours on September 8 (before announcing its latest secondary equity offering), and we see room for additional upside as the top end of our fair value estimate range sits at $186 per share of Digital Realty.

Financial Update

When Digital Realty reported its second-quarter 2021 earnings, the firm missed bottom-line consensus estimates but beat top-line consensus estimates. Recent changes in the UK corporate tax rate (which incurred $0.12 per share non-cash charge at Digital Realty) prompted Digital Realty to lower its core funds from operations (‘FFO’) per share guidance for 2021 down to $6.45-$6.50 from $6.50-$6.55 previously during the report. However, shares of DLR maintained their upward climb in the wake of the REIT’s earnings update as investors looked towards the future. For reference, the UK is set to increase its corporate tax rate to 25% from 19% starting in April 2023 after the country spent and borrowed heavily to support its economy and workforce during the worst of the coronavirus (‘COVID-19’) pandemic.

As a relevant aside, Digital Realty raised its revenue and non-GAAP adjusted EBITDA guidance during its second quarter earnings report after also boosting its guidance on this front during its first quarter earnings report. The REIT’s financial performance is steadily improving, and when removing the headwind created by the UK corporate tax rate change, Digital Realty’s recent core FFO per share guidance revision would have shifted the midpoint of its forecast upwards by $0.07 per share.

In 2020, Digital Realty reported $6.22 in core FFO per share, indicating the REIT’s financial performance is still set to post a nice recovery this year under its revised guidance even after taking the UK tax charge into account. Furthermore, when Digital Realty reported its fourth-quarter 2020 earnings report, the firm was guiding to generate $6.40-$6.50 in core FFO per share this year, indicating its current guidance is still up from initial estimates.

While FFO is an imperfect metric, it provides a nice snapshot of the trajectory of a REIT’s financial performance. Our adjusted Dividend Cushion ratio for Digital Realty, taking its ability to tap capital markets into account (we will cover this in greater detail in just a moment), sits just below parity (at 0.7), and we rate its Dividend Strength as “GOOD” given the high-quality nature of its earnings profile. Please note that our Dividend Cushion ratio assumes Digital Realty steadily grows its per share payout over the coming years, and we rate the REIT’s Dividend Growth rating as “GOOD” as well.

During the first half of 2021, Digital Realty generated $3.21 per share in core FFO, up 5% from year-ago levels. The firm paid out $2.32 per share in dividends during this period, resulting in a payout ratio (dividends per share divided by core FFO per share) of ~72%. On an adjusted FFO (‘AFFO’) per share basis (a metric than uses similar calculations as its core FFO per share metric with some modest differences), Digital Realty’s payout ratio still stood at ~72% (the REIT industry is full of non-GAAP industry-specific adjusted metrics) during the first half of 2021.

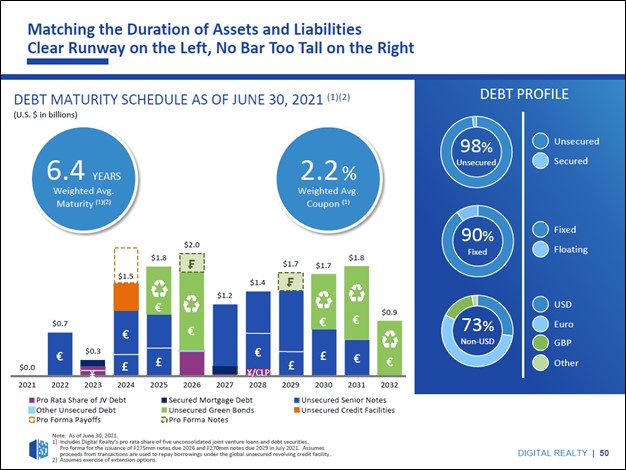

Payout ratios below 80% are considered healthy in the REIT industry, keeping in mind these entities must retain access to capital markets to manage their refinancing needs (given their large debt loads), invest in the business, and continue making good on their payout obligations. Digital Realty exited the second quarter of 2021 with $13.9 billion in total debt on hand (inclusive of short-term debt) and its net debt-to-adjusted EBITDA stood at 6.0x at the end of this period.

As one can see in the upcoming graphic down below, Digital Realty’s debt maturity schedule is well-staggered. Furthermore, 90% of its debt has a fixed interest rate, largely shielding the firm from the immediate impact higher interest rates would have on its financials (though a rising interest rate environment would still create headwinds for Digital Realty and the REIT industry at-large). We see Digital Realty being able to manage its total debt load going forward, aided by its rock-solid investment grade credit rating (BBB/Baa2/BBB).

Image Shown: Digital Realty’s debt load is manageable, in our view. Image Source: Digital Realty – September 2021 IR Presentation

In June 2021, Digital Realty raised a modest $0.1 billion in gross cash proceeds via its at-the-market (‘ATM’) equity issuance program. Subsequent to quarter-end, the REIT raised approximately USD$0.6 billion through a Swiss green bond issuance “with a weighted-average maturity of approximately 6.6 years and a weighted-average coupon of approximately 0.37%,” according to its second quarter earnings press release. Additionally, Digital Realty also liquidated its equity stake in Megaport Ltd (MGPPF) subsequent to quarter-end, raising a modest amount of proceeds in the process.

On September 8, Digital Realty announced a secondary equity offering and related forward sale agreements. Digital Realty noted in the press release that it would use the net proceeds to repay debt and for general corporate purposes. Given Digital Realty’s ability to tap debt markets at reasonable rates and its strong stock price performance of late, we see the REIT retaining quality access to capital markets at attractive rates going forward which in turn should enable it to stay on top of its total debt load and various financial obligations.

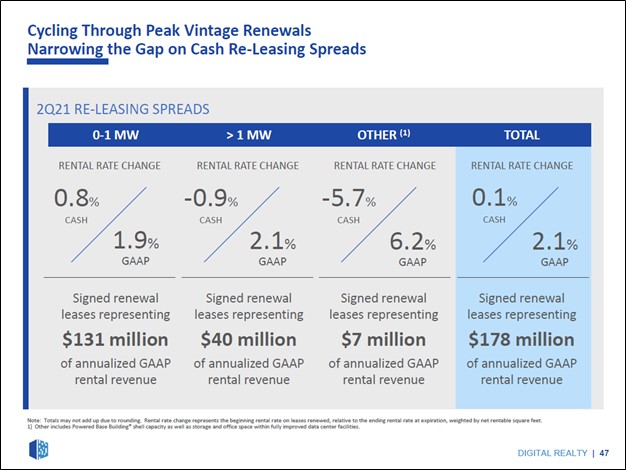

Rental Rates

As it concerns the trajectory of Digital Realty’s rental rates, the REIT is finally starting to turn a corner on this front after facing headwinds over the past couple of years due to the negative impact the expiration of legacy leases had on its financials (leases signed at times with much more favorable rates). The upcoming graphic down below highlights this positive change. Management noted during Digital Realty’s second-quarter 2021 earnings call that the REIT “retained 77% of expiring leases, while cash releasing spreads on renewals were slightly positive, also reflective of the greater mix of sub-1-megawatt renewals in the total.” However, the REIT’s occupancy rate moved modestly lower as Digital Realty brought additional capacity online, given that it can take some time to lease that capacity out.

Image Shown: Digital Realty’s rental rate trajectory is starting to turn a corner after facing headwinds over the past couple of years due to the expiration of legacy leases signed at favorable rates. Image Source: Digital Realty – September 2021 IR Presentation

ESG Update

Digital Realty was able to issue the relatively low-coupon Swiss “green” bonds due to the company’s commitment to renewable energy and environment, social, and governance (‘ESG’) issues. Management had this to say on the issue during the REIT’s second quarter of 2021 earnings call (emphasis added):

“In June, we were awarded the Green Lease Leader Gold Award from the Institute for Market Transformation and the U.S. Department of Energy for the third year. We remain the only data center provider to receive this award, which recognizes Digital Realty as a leader in the real estate industry that incorporates green leasing provisions to better align our interests with our customers and drive high performance and healthy buildings.

During the second quarter, we published our third Annual ESG Report, detailing our 2020 sustainability initiatives, including the utilization of renewable energy for 100% of our energy needs across our entire portfolio in Europe, as well as our U.S. colocation portfolio, and reaching 50% of our global needs.” — Bill Stein, CEO of Digital Realty

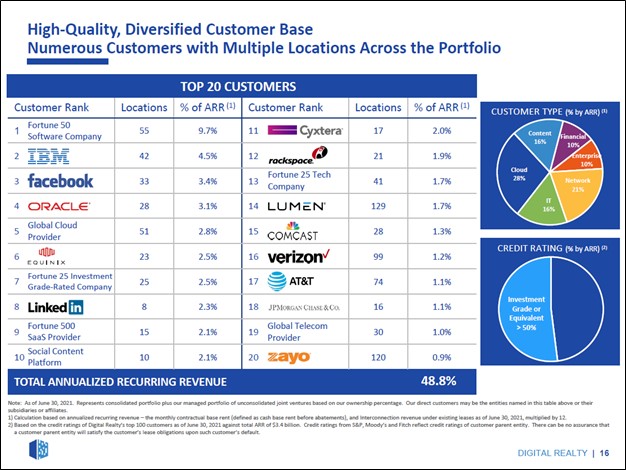

Many of Digital Realty’s hyperscale customers (i.e., massive tech giants) want to showcase their ESG and green energy credentials. Digital Realty is catering to that need, which in turn enhances its value proposition to its customer base, while also putting downward pressure on its cost of capital. We appreciate the REIT’s efforts on this front. Please note that Valuentum is getting ready to launch the inaugural addition of our ESG Newsletter this upcoming September 15 (more on that here).

Image Shown: A look at Digital Realty’s customer base. Image Source: Digital Realty – September 2021 IR Presentation

Operational Update and Growth Ambitions

Digital Realty is expanding aggressively in key markets across the globe to capitalize on surging demand for data and interconnection services. Management recently noted that in Europe, Digital Realty is expanding its operations in the metropolitan areas of Frankfurt, Marcé, Paris, and Zurich. In early-September 2021, Digital Realty announced the opening of a new data center facility to the east of Paris. Please note Digital Realty’s European growth ambitions really took off when it acquired InterXion through a deal with an enterprise value of $8.4 billion that closed in 2020, which expanded its presence in Europe beyond its existing hubs (at the time) in the UK and Ireland (something we covered in this article here back in April 2020).

In North America, the REIT is heavily focused on metropolitan regions in Portland and Toronto. Management recently noted that these are regions “that can sometimes be overlooked in favor of more traditional North American data center metros” though Digital Realty views its growth runway in both areas quite favorably. The REIT had a facility that as of late July 2021 was under construction in Hillsborough, which is in the Portland metropolitan area. Pivoting to Asia, Digital Realty recently opened its third data center in Singapore which had received the appropriate permits before a moratorium on new data center construction was imposed.

Looking ahead, Digital Realty plans to open additional data centers in Japan (through its MC Digital Realty joint venture) and its first data center in Seoul, South Korea, this year. To further grow its presence in South Korea, Digital Realty recently acquired a five-acre parcel of land in the country that will support additional data center developments. Digital Realty also recently acquired an 18.5-acre land parcel in Australia for the same purpose. Please note that in Japan, Digital Realty has a 50/50 joint venture with Mitsubishi Corporation (MSBHF) to provide data center solutions in the country that was established back in 2017.

In July 2021, Digital Realty and Brookfield Infrastructure Partners L.P. (BIP) announced that they had established a 50/50 joint venture to build data centers in India under the brand name BAM Digital Realty. We are intrigued by Digital Realty’s expansive growth runway as the firm continues to grow in established markets while expanding into new markets. Digital Realty did not have a physical data center in India as of the end of its second quarter of 2021.

As it concerns Digital Realty’s development portfolio, management noted that “we are continuing to invest in our global platform, with 39 projects underway around the world as of June 30th, totaling nearly 300 megawatts (‘MW’) of incremental capacity, most of which is scheduled for delivery over the next 12 months” during the REIT’s second quarter of 2021 earnings call. Management noted that 19 of those projects with over 150MW in capacity were in the Europe, Middle East, Africa (‘EMEA’) region, with a heavy focus on the aforementioned key metropolitan regions in Europe.

Digital Realty has also been divesting some of its non-core assets as part of its broader portfolio optimization process, and to raise funds to cover its growth ambitions. In March 2021, Digital Realty sold off 11 data centers in Europe for roughly USD$0.7 billion, which included operations in the UK, France, and the Netherlands. Most REITs are constantly modifying their asset bases and are highly active in the realms of acquisitions and divestments (‘A&D’) and mergers and acquisitions (‘M&A’). Given Digital Realty’s improving performance of late, we have confidence in the firm’s strategic initiatives. Some of Digital Realty’s recent deals (beyond its purchase of InterXion) include the acquisition of Croatia’s Altus IT (a data center firm) and a 49% stake in the Westin Building Exchange in Seattle, Washington, deals that were announced in 2020.

Managing Data

The cloud data integration company Talend defines the term data gravity as “the observed characteristic of large datasets that describes their tendency to attract smaller datasets, as well as relevant services and applications” and goes on further to compare large data sets to “planets” with the “moons” of these planets being represented by applications, services, and other data. As the dataset on the planet becomes larger and its “data gravity” grows, the planet attracts a greater number of moons in the form of services, applications, and other datasets. Data centers and cloud computing services make this possible.

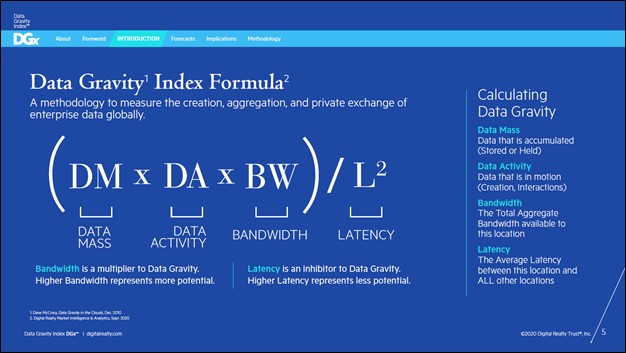

Digital Realty focuses extensively on the concept of data gravity and even created its own index, the ‘Data Gravity Index,’ to measure this observed characteristic. The REIT conducted a study from August 2019 to August 2020 researching this concept and released a report on its findings along with its forecasts highlighting Digital Realty’s expectations that its Data Gravity Index in key regions around the world will surge in the coming years. In the upcoming graphic down below, Digital Realty provides an overview of the formula used to create its Data Gravity Index along with a brief explanation of the concepts related to data gravity.

Image Shown: The formula behind Digital Realty’s Data Gravity Index. Image Source: Digital Realty – Data Gravity Report PDF

The upcoming graphic down below provides an overview of how this process unfolds concerning data creation, data processing, data analysis, and data gravity. Generally speaking, the idea is that the potential applications and insigh