Member LoginDividend CushionValue Trap |

Innovative Fuel Cell Company Ceres Power Has a Stellar Growth Outlook

publication date: Feb 23, 2021

|

author/source: Callum Turcan

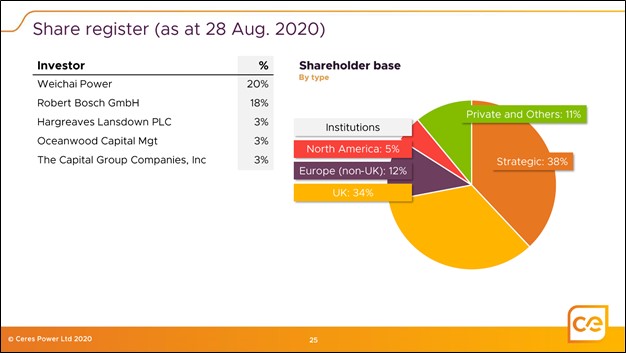

Image Source: Ceres Power Holdings plc – Interim 2020 Results IR Presentation Executive Summary: UK-based Ceres Power is a pioneer in the fuel cell industry, with its SteelCell technology leading the way. The company has historically been unprofitable, though it aims to create a sizable high-margin licensing business over the coming years. Ceres Power is working with its strategic partners on pilot projects that aim to prove the viability of its technology. This past December, Bosch, one of Ceres Power’s strategic partners and largest shareholders, announced that starting in 2024, it would commence commercial-level production of fuel cells utilizing Ceres Power’s technology. Shares of Ceres Power are on a powerful upward trend of late as its cash flow growth trajectory is now quite promising. The firm’s net cash position (at the end of June 2020) will help the company cover its cash flow outspend as Ceres Power scales up its licensing business while continuing to make major R&D investments. Current and future support from national governments worldwide underpins the promising outlook for the fuel cell industry. Capital appreciation seeking investors should keep Ceres Power on their radar. By Callum Turcan A pioneer in solid oxide fuel cell (‘SOFC’) technology, Ceres Power Holdings plc (CPWHF) is steadily working towards commercializing its intellectual property (‘IP’) portfolio primarily through licensing agreements. Though Ceres Power has historically been unprofitable and that will likely remain the case in the medium term, things have been going in the right direction recently. Ceres Power is headquartered in the UK and is registered on the London Stock Exchange Alternative Investment Market. Additionally, Ceres Power trades over-the-counter in the US, and we caution that these listings come with additional risks. Please note that Ceres Power announced it had changed the end of its fiscal year to December 31 from June 30 back in calendar year 2020. Overview Securing strategic partnerships with major engineering companies enabled Ceres Power to launch various pilot projects to test out the viability of its technology. Part of this strategy involved those companies taking strategic equity stakes in Ceres Power. Historically, Ceres Power has utilized equity issues to raise funds to cover its operating expenses and various growth endeavors as the company generated negative net operating cash flows in both its fiscal years that ended in June 2018 and June 2019. Weichai Power (WEICF), a state-run manufacturer of diesel engines based in China, and Robert Bosch, a giant engineering firm based in Germany, have significant equity stakes in Ceres Power. Furthermore, both are participating in pilot projects that utilize Ceres Power’s fuel cell technology, and both firms in recent quarters have made additional investments in Ceres Power’s equity, highlighting their confidence in the company.

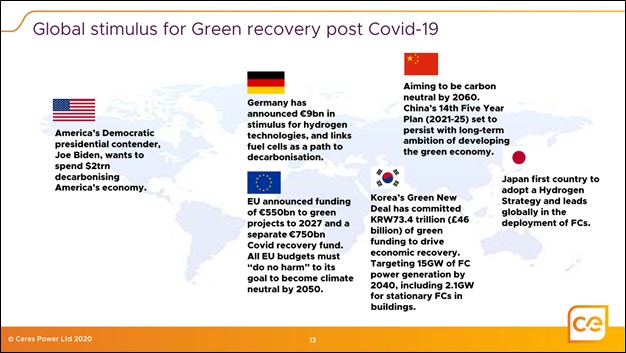

Image Shown: A large chunk of Ceres Power’s shareholder base is represented by its two major strategic partners, Weichai Power and Robert Bosch. Image Source: Ceres Power – Interim 2020 Results IR Presentation The core of Ceres Power’s business rests on its ‘SteelCell’ technology which according to its Fiscal 2019 Annual Report “is a perforated sheet of steel with special screen printed ceramic layers that convert fuel directly into electrical power at the point of use. This enables a switch from [centralized] to distributed energy generation for business, homes and transport.” According to Ceres Power’s website, its SteelCell technology “is inherently cost-effective, robust and scalable” and “is an ideal technology to tackle air pollution and climate change as it significantly lowers carbon emissions and pollutants, lowers running costs and can enable renewables.” Here is how the US Department of Energy (‘DOE’) defines fuel cells (more information on the subject here): Fuel cells use an electrochemical process to convert the chemical energy in a fuel to electricity. In contrast to reciprocating engines and gas turbines, fuel cells generate electricity without combusting the fuel. The first practical application for fuel cells emerged in the 1950s when fuel cells were used to provide onboard power for spacecraft. Fuel cells continue to be used in space exploration, but over the past few decades the technology has migrated to other applications, including vehicle transportation and stationary power generation. For stationary power, fuel cells are used for distributed generation (electricity only) and are also configured for combined heat and power (CHP). Ceres Power recently completed and turned online an “advanced manufacturing pilot facility” in Redhill, UK. This facility will assist in its efforts to transfer technology to its strategic partnerships while also enabling Ceres Power to deliver products to some of its customer’s programs. The goal is to increase the annual production capacity of this facility up to 3 MW from 2 MW sometime in 2021. National governments around the world have been quite supportive of the fuel cell and “green” hydrogen industries of late. Germany, Japan, and Korea have aggressively prompted development of these industries and other nations are now following suit. According to the US DOE, hydrogen electrolysis involves “using electricity to split water into hydrogen and oxygen” which would enable the production of hydrogen with minimal (or none) greenhouse gas emissions (i.e., if the electricity used during the hydrogen electrolysis process were to come from a wind turbine or solar plant). Ceres Power noted that its R&D efforts concerning hydrogen electrolysis were “delivering positive results” and that the firm would continue to invest in the technology back in September 2020.

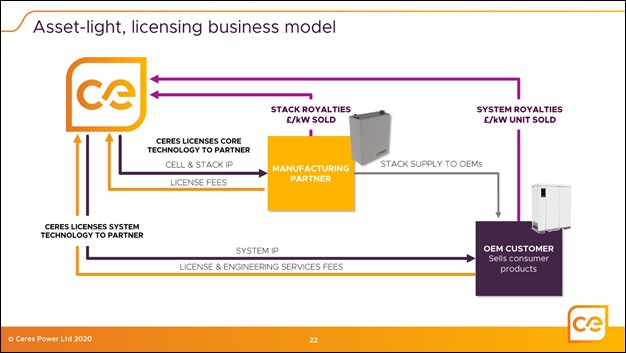

Image Shown: Ceres Power views the outlook for the fuel cell industry quite favorably, underpinned by support from national governments worldwide. Image Source: Ceres Power – Interim 2020 Results IR Presentation Scalable Business Model In the upcoming graphic down below, Ceres Power provides an overview of how its licensing business model functions in relation to its strategic partners and end customers. An asset-light business model with only modest capital expenditure requirements means Ceres Power could one day generate sizable free cash flows, though that will not be until fuel cells using its technology are built on a commercial level.

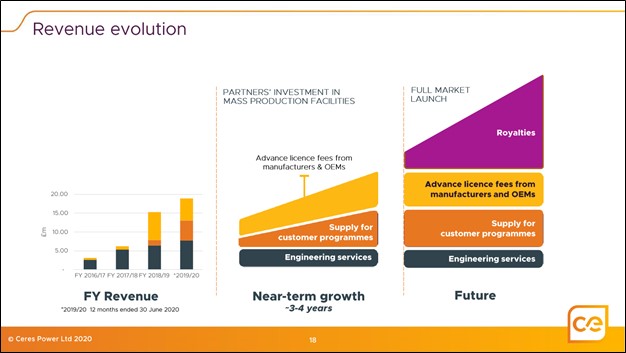

Image Shown: An overview of Ceres Power’s licensing business model. Image Source: Ceres Power – Interim 2020 Results IR Presentation Please be aware that Ceres Power reports on a semi-annual IFRS basis. During the twelve month period ended June 30, 2020, Ceres Power generated GBP£19 million in revenues, up 24% year-over-year. Ceres Power generated most of its revenues during this period from engineering services and sales from the provision of technology hardware, with licensing revenue representing almost one third of its sales during this period. Its gross margin stood at 73% during the twelve month period ended June 30, 2020, impressive performance though down modestly year-over-year. Ceres Power still generated a GBP£10 million operating loss during this period, up from GBP£8 million in the same period the prior year, as its operating expenses continue to grow. The company has also had to contend with headwinds arising from the coronavirus (‘COVID-19’) pandemic. The upcoming graphic down below provides an illustrative overview of how Ceres Power expects its financial performance will evolve over time. Once commercial-level production of fuel cells built with its technology begins, sizable royalty revenues are expected to result in material revenue growth and that growth runway has long legs. Economies of scale and the high-margin nature of its licensing business could allow Ceres Power to put up impressive operating margins down the road.

Image Shown: An illustrative overview of how Ceres Power views its financial performance evolving over time. The commencement of commercial levels of production of fuel cells built using its technology and the related royalty revenues underpins Ceres Power’s promising cash flow outlook. Image Source: Ceres Power – Interim 2020 Results IR Presentation Bosch is working with Ceres Power on a pilot project that can use hydrogen, biogas, or natural gas as a feedstock to produce electricity in Germany through a decentralized grid as part of the country’s broader green energy push. Last year, Germany allocated an additional EUR€9 billion towards developing its domestic hydrogen power generation capacity. By 2030, Bosch forecasts the market will be worth EUR€20 billion, aided by government support along with major private sector investments.

Image Shown: Ceres Power’s strategic partnership with Bosch is intriguing. Image Source: Ceres Power – Interim 2020 Results IR Presentation In December 2020, Bosch and Ceres Power announced that the partnership was kicking it up a notch. Starting in 2024, Bosch is going to begin commercial-level production volumes of fuel cells built on Ceres Power’s SteelCell technology after initial pilot projects proved to be successful. This is huge for Ceres Power because fuel cells built using its technology are currently being produced only in limited volumes. The December 2020 press release had this to say (lightly edited): In 2024, Bosch, the supplier of technology and services, intends to start full-scale production of distributed power stations based on solid oxide fuel-cell technology (SOFC) – hence the agreement to strengthen its alliance with Ceres Power. Following a successful prototype construction phase, the two companies now want to press ahead, initially with the pre-[commercialization] process for stationary fuel cells. For SOFC systems, Bosch is aiming for an annual production capacity of some 200 megawatts. This is enough to supply around 400,000 households with electricity. Bosch is planning to produce the stationary fuel-cell systems at its manufacturing sites in Bamberg, Wernau, and Homburg, as well as at its development sites in Stuttgart -Feuerbach and Renningen – and will invest hundreds of millions of euros by 2024. One intended application of SOFC technology is in small, distributed, connectivity-enabled power stations, which can then be used in cities, factories, trade and commerce, data [centers], and electric vehicle charging infrastructure. Bosch estimates that the market for [decentralized] power generation will reach a volume of 20 billion euros by 2030. A total of more than 250 Bosch associates are now working in this promising new field – 150 more than a year ago. Pivoting here, Ceres Power’s strategic partnership with Weichai Power was announced in December 2018 with the goal being to eventually develop a fuel cell manufacturing hub in China. The COVID-19 pandemic delayed the partnership’s efforts, which involves using Ceres Power’s fuel cell technology to develop range extender systems on electric busses. Ceres Power is working with Weichai Power to develop five electric busses with range extender systems built on its SteelCell technology. Field trials will help determine the next phase of development, which could see Ceres Power enter a JV with Weichai Power to create a fuel cell manufacturing hub in China. Those field trials are expected to be completed by the first half of 2021.

Image Shown: Ceres Power is working with Weichai Energy to develop range extender systems for electric busses. Image Source: Ceres Power – Interim 2020 Results IR Presentation At the end of June 30, 2020, Ceres Power had GBP£108 million in cash, cash equivalents, and short-term investments on hand and no debt on the books. During the twelve month period that ended on June 30, 2020, Ceres Power generated negative GBP£11 million in free cash flow after generating negative operating cash flows and spending a bit under GBP£6 million on its capital expenditures during this period (we are not including ‘investments in intangible assets’ in this figure as we view that as an acquisition activity). Ceres Power can cover its cash flow outspend for the foreseeable future by leaning on its pristine balance sheet. Ceres Power has other strategic partnerships to be aware of including its licensing deal with South Korea-based Doosan Corporation that was announced in July 2019. Doosan bills itself “as a world leader in the fuel cell industry” and in October 2020, Ceres Power and Doosan announced they were expanding their strategic partnership. South Korea aims to aggressively increase its fuel cell power generation capacity over the coming years (from 300 MW in 2019 to 15 GW by 2040 according to the July 2019 press release). Ceres Power’s management team stressed during a September 2020 investor call that they were limited to what they could share publicly due to the need to respect the confidentiality of the firm’s clients, though things appear to be progressing favorably on this front. Ceres Power also has a strategic partnership with Japan-based MIURA which saw MIURA launch a commercial fuel cell system in October 2019 (the product launch was announced in July 2019). During Ceres Power’s September 2020 investor call management noted: “And then with MIURA, in Japan, we now have the units on sale through – you know, in commercial products. The first units have been in operation now for over a year, delivering 90% efficiency, lowering the carbon footprint. And Miura are looking at expanding the support team to that to enable further deployment. So that's low volume to begin with, but it's been successful one year in and we're very pleased to be selling service technology into Japan.” --- Phil Caldwell, CEO of Ceres Power The upcoming graphic down below provides an overview of Ceres Power’s four core strategic partnerships and what each venture was focusing on as of September 2020. Ceres Power also has partnerships with Honda Motor (HMC) and Cummins (CMI). The Honda Motor deal involves using Ceres Power’s SteelCell technology in “a range of potential power equipment applications” and the Cummins deal involves developing fuel cells for data centers using Ceres Power’s SteelCell technology.

Image Shown: An overview of the four key strategic partnerships Ceres Power has secured with major industrial firms worldwide. Image Source: Ceres Power – Interim 2020 Results IR Presentation Concluding Thoughts Shares of Ceres Power are on an upward tear of late and in our view, this excitement is largely due to the company’s deal with Bosch playing out quite favorably. The news that Bosch will begin producing fuel cells using Ceres Power’s SteelCell technology at scale starting in 2024 provides Ceres Power with an incredibly powerful growth catalyst. Beforehand, progress at its other strategic partnerships, particularly with Weichai Power, could provide Ceres Power with additional lucrative growth opportunities. Longer term, Ceres Power aims to design fuel cells with significantly more capacity and a wider array of applications (the transportation, data center, and utility industries are all prime growth opportunities). Ceres Power possesses the financial capacity to cover its cash flow outspend while making the necessarily investments to support its growth trajectory over the coming years. We are intrigued by Ceres Power’s R&D efforts concerning hydrogen electrolysis and the potential for its SteelCell technology to help revolutionize the fuel cell industry worldwide. The fair value estimate range for Ceres Power is quite large, though the company’s growth outlook is quite promising. When the company provides its next semi-annual earnings update, Ceres Power may offer up more details on how the Bosch partnership will transition to commercial-level production activities in 2024 and what needs to be done to ensure that venture becomes a commercial success. Capital appreciation seeking investors should keep Ceres Power on their radar. ----- Industrial Leaders Industry - MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW Related: CPWHF, CMI, HMC, WEICF, EWG, DOOSF, EWY, EWJ, BE Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT) and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

1 Comments Posted Leave a comment