Member LoginDividend CushionValue Trap |

Inflation! How to Think About Value Duration

publication date: May 10, 2021

|

author/source: Brian Nelson, CFA

By Brian Nelson, CFA Investors continue to focus on the prospects of rising inflation expectations, which are impacting Treasury bond yields. The 10-year Treasury note, which is used as the foundation for discount rates within most valuation constructs, now stands at ~1.61%, up meaningfully from the ~0.5% lows set in early August 2020. The Fed/Treasury continue to be highly accommodative, and the growing market capitalization of cryptocurrencies is adding even more “new money” to the system. Investors continue to discount the longer-duration free cash flow profiles of the most speculative technology companies more aggressively. For example, the ARK Innovation ETF (ARKK), which is full of speculative tech names, has fallen to ~$105 per share from a 52-week high of $159.70 set in February this year. Rising inflationary expectations, however, should not necessarily be viewed as a negative for most newsletter portfolio ideas and could be viewed as a positive, in some cases. As higher rates are factored into valuation constructs, there are both numerator and denominator effects on a company’s intrinsic value. The numerator effect is either good or bad depending on the company’s pricing power and its ability to drive free cash flows higher in the face of inflationary expenses. The denominator effect represents the higher discount rate that implicitly embeds higher inflationary expectations that is used to calculate the present value of those future free cash flows. For secular growth entities that 1) are competitively-advantaged 2) are currently generating strong and growing free cash flows 3) are expected to continue to do so, and 4) can price their products and services ahead of inflation, the (positive) numerator impact should very well overwhelm any negative impact from the denominator shift, causing values of such stocks to continue to advance in these cases. For example, we’d view rising inflationary expectations as a net positive for competitively-advantaged, strong and growing free cash flow generators that have substantial pricing power such as Facebook (FB), Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG) (GOOGL) – or large cap tech, more generally. On the other hand, for companies whose free cash flow profiles won’t fully develop for years into the future but have a decent competitive position, the net impact of both denominator and numerator effects might be mixed. For example, the impact of more cyclical recovery plays such as Airbnb (ABNB) and Penn National (PENN) might either be positive or negative depending on how future free cash flows are impacted in coming years. In other cases, companies may experience both negative numerator and negative denominator impacts, where market prices could face substantial pressure. This group might include the most speculative stocks on the market such as Virgin Galactic (SPCE), SmileDirectClub (SDC), Palantir Technologies (PLTR) and others that are burning through free cash flow and have yet to establish the solid financials we'd like to see in strong businesses.

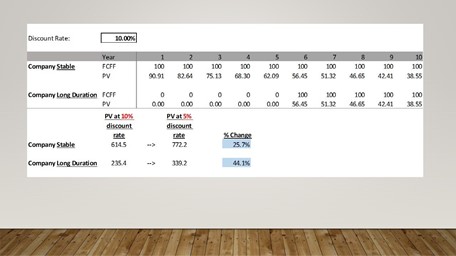

Image Shown: Longer-duration free cash flow stocks are more impacted by changes in inflationary expectations and interest rates (up or down) than stable and/or stable and growing free cash flow generators. This example shows the impact of falling interest rates (10%-->5%) on stable versus longer-duration hypothetical future free cash flow streams, all else equal (the opposite would be applicable in a rising interest rate environment). There's nothing all else equal in the real world though. In the event of rising inflationary expectations, we would still expect speculative technology stocks to take the biggest hit. On the other hand, we would expect strong and growing free cash flow powerhouses that can price ahead of inflation such as big cap tech to handle the environment well. We’ve been witnessing strength almost across the board of late with respect to copper (CPER), lumber prices, and other commodities. Metal and mining (XME) entities have been benefiting from the current environment. In the Dividend Growth Newsletter portfolio, we’d point to Newmont Mining (NEM) as one way to gain exposure to both the metals and mining arena while also gaining exposure to a traditional “inflation hedge” in gold (GLD). That said, we generally steer clear of commodity-driven equities as commodity prices are notoriously difficult to forecast, and this only makes their future free cash flows even more difficult to forecast. One only has to look at the dramatic fall out of the energy sector (XLE) in late 2015 to understand why. However, we continue to have modest exposure to energy in the Best Ideas Newsletter portfolio in the XLE and Berkshire Hathaway (BRK.A) (BRK.B). In addition to the market’s rotation into energy and metals and mining, investors are also warming up to the banking sector (XLF). Rising interest rates tend to offer banking entities a little more wiggle room to carve out higher net interest margins, and the demand for bigger houses and home remodels has been strong as consumers rethink their living arrangements following COVID-19. This has helped mortgage activity and fee revenue for banks. We include the XLF in the Best Ideas Newsletter portfolio. Concluding Thoughts Though banks, energy, and the metals and mining sectors may lead the market for some time, we still like large cap growth and big cap tech for the long run. What many may be overlooking is that, for those with pricing power, higher inflationary expectations translate into higher product and service prices, too. Big cap tech (and their pricing power) is well-positioned to handle such an environment. We’re not overreacting in any respect, and we’re not going to chase commodity prices or commodity producers higher. Commodity prices are simply too difficult to predict in almost all cases, and banking entities are far too susceptible to boom-and-bust shocks for us to get comfortable with their long-term investment profiles. All in, we’re sticking with companies with strong net cash positions and future expected free cash flows (and solid dividend health, where applicable). Some of the strongest companies that have these characteristics can be found in large cap growth and big cap tech. Facebook remains our top idea for long-term capital appreciation potential. In the meantime, we’re comfortable watching the market chase a rotation into more speculative areas that better fit the definition of speculation than investing. Related: KRE, KBE, AMLP, VDE, XOP, IYE, OIH This note was updated at 6:56CT May 10, 2021. ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, and IWM. Brian Nelson's household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment