Member LoginDividend CushionValue Trap |

ConocoPhillips Is Buying Concho Resources

publication date: Oct 20, 2020

|

author/source: Callum Turcan

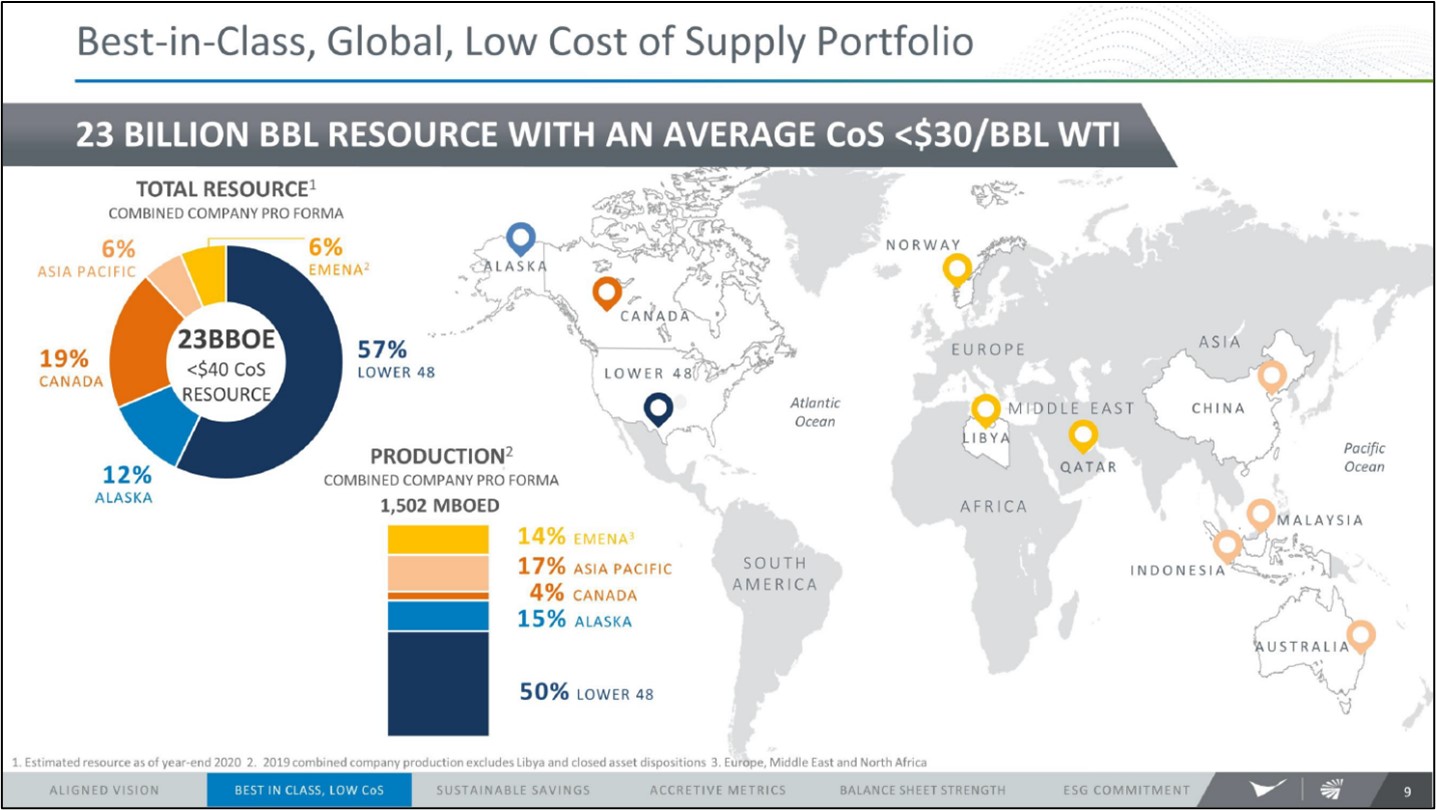

Image Shown: An overview of the pro forma asset base of ConocoPhillips and Concho Resources Inc. Please note that Concho Resources’ main operations are in the Permian Basin in West Texas and Southeastern New Mexico, a region that ConocoPhillips seeks to grow its exposure to. ConocoPhillips has an expansive upstream portfolio with operations worldwide, though its North American position is set to become a much larger part of its company-wide profile. Image Source: ConocoPhillips – ConocoPhillips & Concho Resources Transaction Announcement IR Presentation By Callum Turcan On October 19, ConocoPhillips (COP) announced it was acquiring Concho Resources Inc (CXO) through an all-stock deal. If the deal goes through as planned, each share of CXO will be exchanged for 1.46 shares of COP, and as the press release notes, this represents “a 15 percent premium to closing share prices on October 13.” However, please keep in mind shares of CXO have fallen by roughly two thirds since October 2018 as of this writing, indicating ConocoPhillips is really not paying much of a premium for Concho Resources.

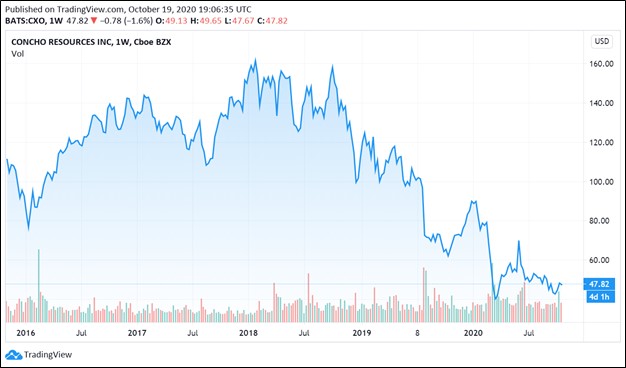

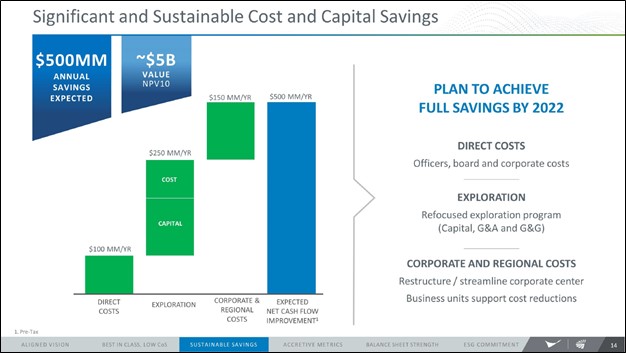

Image Shown: Even after the acquisition by ConocoPhillips was announced, shares of Concho Resources are still down materially from levels seen just a couple of years ago. In our October 15 piece covering this potential (at the time) deal, we noted that financial constraints and recent M&A activity in the oil patch would likely prompt ConocoPhillips to offer an all-stock deal with a relatively modest premium. That appears to be the case here, and members can read that note by clicking this link here. Key Updates Considering we have already covered ConocoPhillips’ reasoning behind the deal in our first article (to gain scale in the Delaware and Midland basins within the Permian Basin), let us now focus on the new information provided by both companies. The deal is expected to close in the first quarter of 2021, and ConocoPhillips sees itself sitting on a pro forma net debt load of ~$12 billion as of the end of June 2020 (when including Concho Resources net debt load). While management noted that on a pro forma basis the combined company will have “an attractive leverage ratio of 1.3 at 2021 consensus commodity prices,” please keep in mind that raw energy resources pricing is very volatile and subject to change at any moment. By 2022, ConocoPhillips aims to generate $500 million in annualized cost and capital savings. Cost savings are expected to come from a reduction in the combined firm’s pro forma G&A expenses, as we noted in our first article was likely to be the case, and from a reduction in ConocoPhillips’ exploration programs. However, please note that over the past few years, ConocoPhillips has already rationalized its exploration spend. That included exiting the deepwater exploration space (where upstream operators must drill through ~7,500-10,000 feet of water to explore for raw energy resources) and rationalizing its remaining deepwater appraisal programs. Additionally, Concho Resources does not spend a material amount on exploration-related activities (the firm spent $16 million on ‘exploration and abandonments’ expenses in the second quarter of 2020). Most of the forecasted cost savings are likely to come from G&A redundancies once the deal closes, in our view, given the limited amount of room to cut exploration spending while also maintaining a sizable resource base to develop. For instance, ConocoPhillips remains very active in Alaska’s upstream oil & gas industry. In 2018, ConocoPhillips purchased Anadarko Petroleum’s stake in its Alaskan operations for ~$0.4 billion in cash, keeping in mind Anadarko is now owned by Occidental Petroleum Corporation (OXY). ConocoPhillips also effectively traded some of its upstream operations in the UK for some of BP plc’s (BP) Alaskan upstream operations in 2018. Over the past several years, ConocoPhillips has brought numerous new upstream projects in Alaska online such as the DS2S, CD5, NEWS, and GMT1 projects that ConocoPhillips describes on its website. Going forward, the GMT2 project is expected to achieve first-oil in 2021 and the massive Willow oil discovery is expected to achieve first-oil by the mid-2020s. These projects were made possible through past exploration endeavors, and going forward, future producing projects will require ConocoPhillips to maintain its Alaskan exploration programs. We bring this up to highlight that ConocoPhillips needs to maintain a certain level of exploration spend so the company can continue to uncover new resources to develop. If new projects are not being brought online because exploration spending has been cut to the bone and there are no known economical deposits to tap (in the relevant region), upstream production in those regions will tank. Natural output declines from existing producing assets need to be offset with new upstream projects, and that holds true everywhere (even in the oil sands patch where output from those projects can carry flat production bases for roughly twenty years, eventually new upstream projects are required to maintain production levels).

Image Shown: An overview of the targeted cost savings ConocoPhillips aims to generate once the Concho Resources deal closes. Image Source: ConocoPhillips – ConocoPhillips & Concho Resources Transaction Announcement IR Presentation Though there is always the chance that some of ConocoPhillips’ sleepier Alaskan assets are divested, its Alaskan exploration, appraisal, and development spend will likely remain material going forward. If ConocoPhillips aggressively cuts its exploration spend, having already rationalized its exploration spend in the recent past, the company will find it tough to maintain its production base. Beyond cutting its deepwater exploration programs, ConocoPhillips has steadily sold off (including opportunities in Australia) or relinquished (such as its former operations in the Central Kalimantan Kualakurun area in Indonesia) various exploration opportunities worldwide over the past few years. Its remaining exploration programs are relatively modest, and in our view, there is not much meat here to cut without sacrificing its long-term production base in those regions. Acquiring Concho Resources will give ConocoPhillips additional resources to develop, but it is important to note that these unconventional assets require $50-$60 WTI pricing (versus ~$40 WTI currently) to generate shareholder value (ROIC ex-goodwill > estimated WACC). Horizontal drilling and hydraulic fracturing upstream operations, dubbed “fracking” and often referred to as unconventional upstream activities, are (generally speaking) not as lucrative as onshore conventional and many offshore conventional upstream activities. The conventional and oil-rich nature of its Alaskan upstream assets allows ConocoPhillips to generate stronger returns in this region compared to its unconventional upstream Permian Basin operations, especially when raw energy resources pricing is subdued. By this we mean that ConocoPhillips is unlikely to shun investments in lucrative conventional upstream projects going forward.

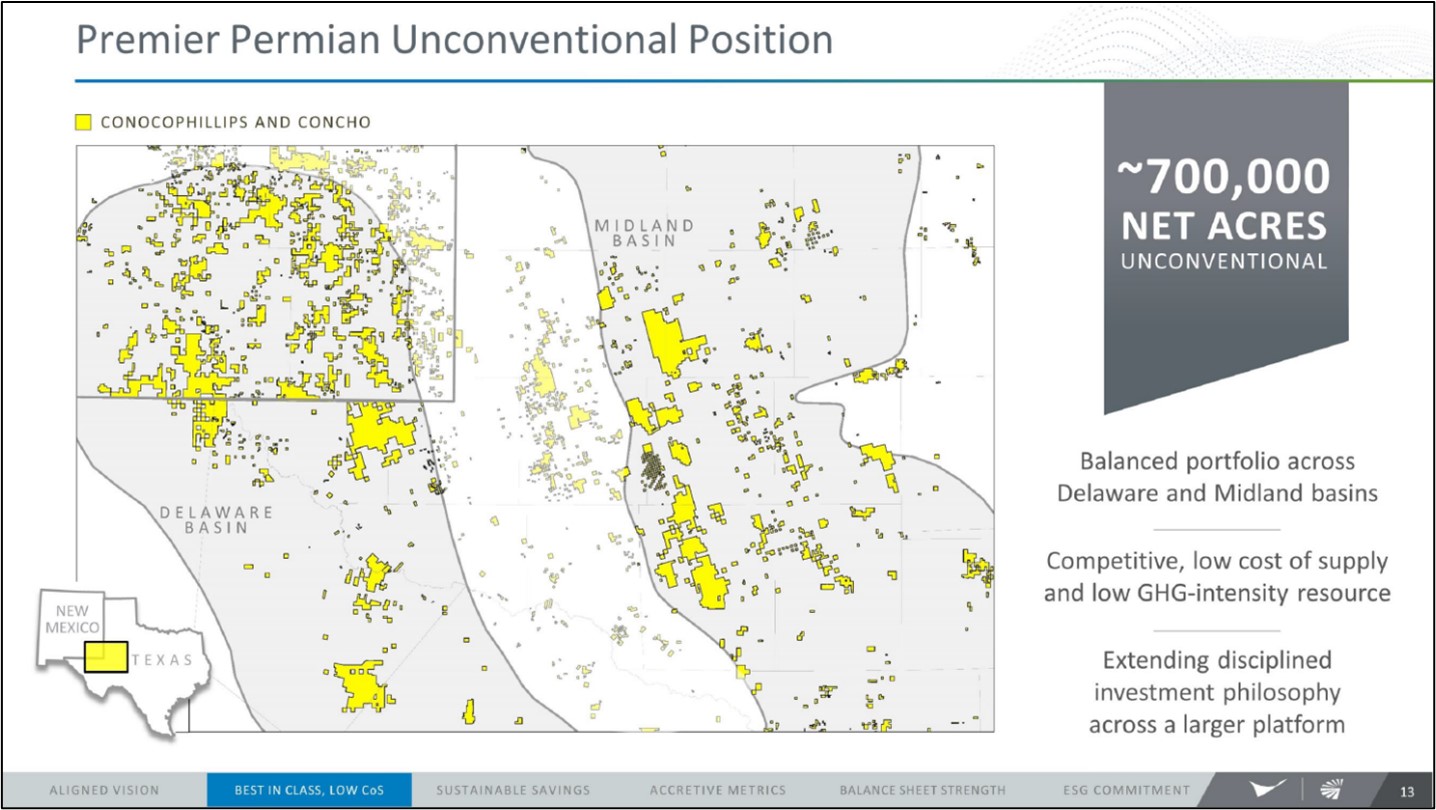

Image Shown: ConocoPhillips will have a large position in the key unconventional upstream regions within the Permian Basin once its acquisition of Concho Resources closes. Image Source: ConocoPhillips – ConocoPhillips & Concho Resources Transaction Announcement IR Presentation Pivoting now to the forecasted capital savings the ConocoPhillips-Concho Resources tie-up is expected to generate, that primarily involves centralizing midstream operations and integrating the two companies’ development programs in the Delaware and Midland basins within the Permian Basin (which stretches across West Texas and Southeastern New Mexico). For instance, centralizing oil & gas gathering networks and water gathering and disposal systems (reduces redundant energy infrastructure), and integrating development programs so drilling rigs and completion crews can move from site-to-site faster (thus reducing downtime and effectively cutting development costs per well). There are limits to this strategy given how important it is for raw energy resources pricing to cooperate. Concluding Thoughts Consolidation in the US upstream industry is required to ride out the storm caused by the prolonged period of subdued raw energy resources pricing the industry has had to endure over the past several years. By growing its position in the Delaware and Midland basins, ConocoPhillips will finally have the scale needed to make these assets needle-moving for the company as we mentioned in our first article. However, we caution that development activity in the region will remain subdued in the current environment. Its management team suspended ConocoPhillips’ share repurchasing program to put the company in a better financial position to handle the net debt load it will take on assuming the deal closes as envisioned. ----- Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD Industrial Minerals - ARLP, CCJ, CNX, HCR, NRP Refining Industry – HES HFC MPC PSX VLO Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP Energy Equipment & Services (Large) Industry – BKR HAL NBR NOV SLB FTI SI Related: CXO, XLE, XOP, BNO, USO, UNG ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment