Member LoginDividend CushionValue Trap |

Congress Seeks to Strike a Deal

publication date: Dec 16, 2020

|

author/source: Callum Turcan and Brian Nelson, CFA

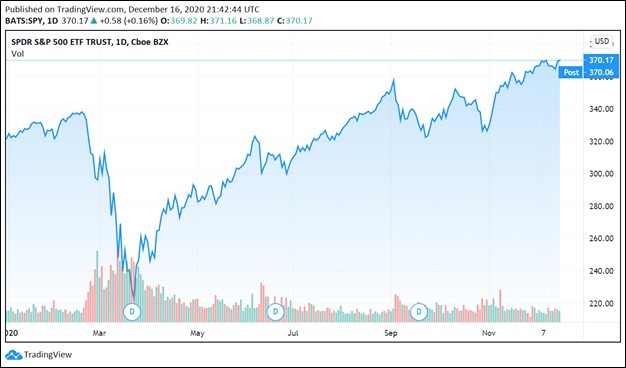

Image Shown: The S&P 500 (SPY) is trading near all-time highs as of December 16, but political risk could cause some choppiness in the near term. The potential for yet another government shutdown is upon us, but according to key leaders on both sides of the aisle, a deal appears to be within reach. Certain provisions may be left out in order to reach an accord sooner rather than later, however. In any case, we remain bullish long term, as the world continues to work to put the COVID-19 pandemic behind it. By Callum Turcan and Brian Nelson, CFA Funding for most US federal government agencies may run out by the end of this week if both sides of the aisle in Congress do not reach an agreement over a potential omnibus bill. A federal government shutdown amid the ongoing coronavirus (‘COVID-19’) pandemic might hinder the nation’s effectiveness at managing the COVID-19 pandemic and additionally, might hurt the pace of the recovering US economy. In our view, the odds of some deal happening soon are very high, however, and just like the 2018-2019 government shutdown (and those before it), if some form of a shutdown does happen, we don’t think long-term investors have much to worry about. The stock market is certainly not the economy, but we’d also like to note the US economic rebound had been losing some steam heading into December, which is why Congress has also been working toward passing additional emergency fiscal stimulus measures alongside US federal government funding measures for fiscal 2021 as part of an omnibus bill. We like that agencies of government remain focused on tackling both the health and economic challenges at hand. The US federal government’s fiscal year ends on September 30, though short-term funding bills have been utilized to keep the federal government open so far during the latter part of calendar year 2020. Many pockets of the ‘old’ economy remain weak (e.g. airlines, brick-and-mortar retail/restaurants, and the like), but others are performing wonderfully (digital advertising, online retail, payment processing, cloud-based services, and many more). We remain well-positioned in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, and High Yield Dividend Newsletter portfolio. Now 10-rated on the VBI, Facebook (FB), and significantly undervalued Alphabet (GOOG, GOOGL) remain two of our favorite capital appreciation ideas, in particular. In light of the tremendous efforts by the Fed/Treasury to support both the economy and the financial markets since the initial outbreak of COVID-19 to date, we don’t think Congress will do harm by not stepping up to the plate during the biggest global health crisis in the past 100 years. Still, we wanted to keep this news in front of you, as a prolonged shutdown presents a “fat-tail (low probability) risk” to the equity markets, particularly with respect to sentiment and momentum and especially with respect to any legal delays related to President Donald Trump leaving office in the coming weeks. We’re not making any changes to the newsletter portfolios at this time, however. The Economic Dichotomy Continues We continue to monitor the dichotomy in the economy. According to data from Adobe Analytics, “consumers spent a record $10.8 billion online on (November 30) Cyber Monday (up 15.1% year over year), which is now the largest shopping day in the history of U.S. e-commerce.” Online sales on Thanksgiving, Black Friday (November 27), Small Business Saturday, and November 29 all registered year-over-year growth rates north of 20% (30.2% on Small Business Saturday). We’re viewing these numbers very positively given that online holiday sales were likely pulled forward due to the pandemic, and we continue to point to our payment-processing ideas, Visa (V) and PayPal (PYPL), in the Best Ideas Newsletter portfolio as ways to play e-commerce proliferation. On the other hand, overall US consumer spending dropped by a seasonally adjusted 1.1% in November 2020 versus the previous month according to the US Census Bureau. Furthermore, seasonally adjusted consumer spending fell by a revised 0.1% in October 2020 versus the previous month, compared to a previously reported 0.3% gain. While the CARES Act (passed in March 2020) initially provided a significant amount of support to US household incomes, it now appears that this tailwind is fading. Weakening consumer spending levels in the US is partially due to additional quarantine efforts that have recently been enacted to contain the COVID-19 pandemic in certain states and localities, though elevated levels of unemployment are another key factor. In November 2020, the official US unemployment rate stood at 6.7% according to the US Bureau of Labor Statistics (‘BLS’), above the ~5% level that is usually understood to be considered the benchmark for “full employment.” Additionally, before the COVID-19 pandemic hit the US, the official unemployment rate was well below that ~5% benchmark. It appears that the total spending power of US consumers may start to face some headwinds now that the enhanced unemployment benefits provided by the CARES Act has ended and considering the tailwind from the one-time direct payments has likely faded. That said, the wealth effect from the equity markets being at all-time highs may more than offset such headwinds--which is why the Fed/Treasury continue to view stock market health as an integral part of US economic policy. People have been using their time out of the office to make improvements within their homes, too. We covered Home Depot’s (HD) and Lowe’s (LOW) tremendous same-store sales growth in this note here, and housing demand has “been off the charts” recently, according to RE/Max (RMAX), with Redfin (RDFN) also reporting some very strong housing price gains in recent months. The median home sale price was the highest on record in the week ending October 18, showing evidence that the value of the other big household asset--the home itself--is also advancing alongside the market. There have been winners and losers all across retail. Several mall-based retailers have filed for bankruptcy, but other omni-channel retailers are doing great, with Walmart’s (WMT) digital strategy paying off, and Target’s (TGT) digital comparable sales up a whopping 155% during the period ending October 30. Shopify’s (SHOP) recent holiday results of its merchants, released December 1, also showed the “resilience of small and independent business,” with sales increasing 84% year-over-year from November 23-November 30 (the week prior to Cyber Monday, inclusive). We recently added Home Depot and Dick’s Sporting Goods (DKS) to the Dividend Growth Newsletter portfolio to capture strength across the housing market, home improvement space and resilience across omni-channel retail, more generally. Congress May Be Close to Reaching a Deal Both sides of the aisle in the US Congress continue to work toward what could be dubbed a “CARES Act 2” deal, though the cost of this fiscal stimulus program is expected to come in significantly below levels seen in the CARES Act. The CARES Act involved providing ~$2 trillion in fiscal support to the US economy according to the Congressional Budget Office (‘CBO’), though some of that included loan guarantees. According to The Hill, the size of the fiscal stimulus package under discussion currently is around $0.9 trillion and could reportedly include direct payments to US households (likely to households under a certain income threshold who meet other criteria) of $600-$700 per person and $300 per week (per eligible person) in supplemental unemployment benefits through March (presumably March 2021). Other potential bills under discussion generally do not include these types of direct stimulus payments to US households. Please note that both the direct payments and the weekly unemployment benefits are about half the amount per person of that provided by the CARES Act. The various provisions in this potential “CARES Act 2” fiscal package are reportedly going to be added to spending legislation (an omnibus bill) to fund the US government through its fiscal 2021. According to Roll Call, the proposed omnibus bill would reportedly include around ~$1.4 trillion in discretionary spending for fiscal 2021 along with up to an additional $1.0 trillion in emergency spending provisions related to dealing with the COVID-19 pandemic. As noted, funding for most US federal government agencies will expire December 18 after a one-week stopgap bill passed and signed into law to provide Congress with more time to reach a deal. If no deal is reached in time, the US federal government would start shutting down this upcoming Saturday (December 19). Such an event might hinder the nation’s ability to deal with the ongoing COVID-19 pandemic and could impair the trajectory of the recovering US economy as well. According to key leaders on both sides of the aisle, a deal appears to be within reach, though certain provisions may be left out in order to reach a deal sooner rather than later. Concluding Thoughts What will ultimately be included in the omnibus bill, should a compromise emerge, remains to be seen, though it does appear that both sides of the aisle are eager to get a lasting deal done before Christmas. Additional stopgap funding measures may be required to keep the US federal government open past this upcoming Friday, though key leaders in Congress have made it clear that they want to fund the federal government through fiscal 2021 while also providing additional fiscal and other forms of relief to US households with the potential omnibus bill. The two most contentious issues revolve around additional emergency funding for state and local governments, and special liability protections for businesses, government entities, and individuals as it concerns potential future lawsuits that involve COVID-19. Reportedly, offers have been made that include setting those two issues aside to allow both sides of the aisle to reach a deal relatively soon. We are keeping a close eye on this front and will update our members as the story develops further. We’re not making any changes to the newsletter portfolios at this time. Related: SPY, DIA, QQQ ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Brian Nelson owns shares in SPY, SCHG, DIA, VOT, and QQQ. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment