Image Source: Apache Corporation – November 2019 IR Presentation

By Callum Turcan

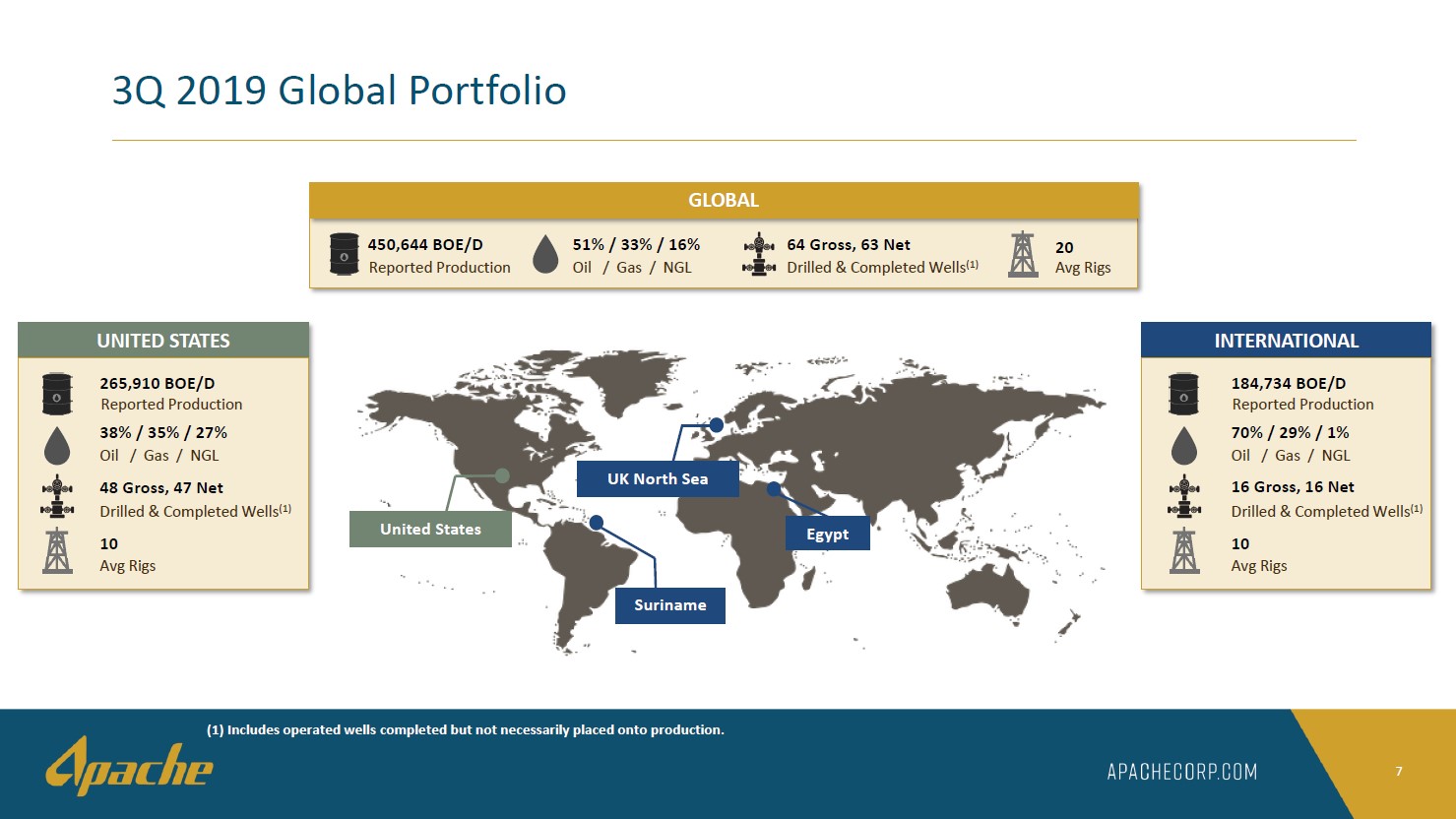

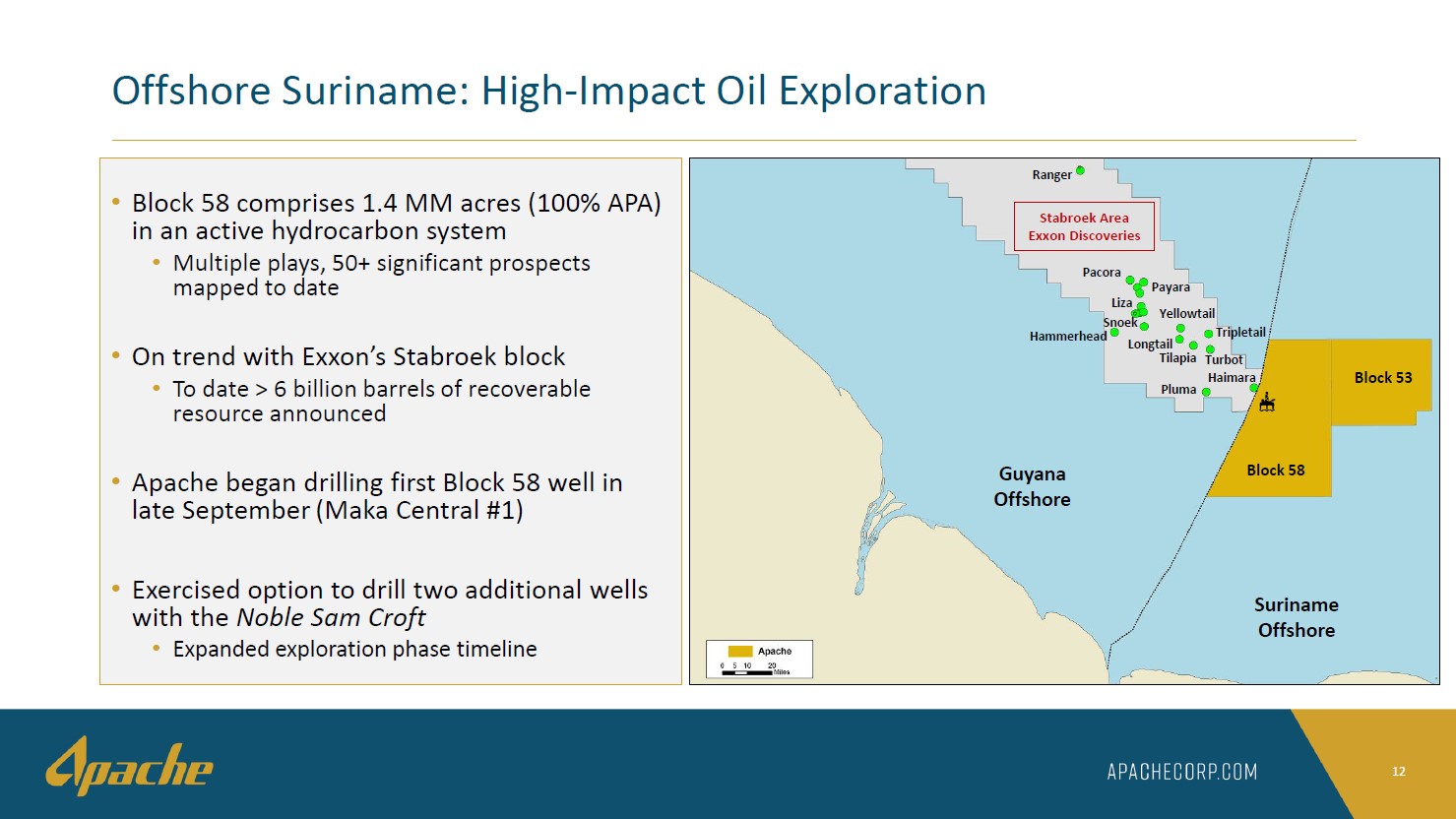

On December 2, Apache Corporation (APA) announced that its first exploration well off the coast of Suriname (a small nation in northern South America) was a dud. The Maka Central-1 well was drilled to a total depth of 6,200 meters (~20,300 feet) in Block 58 and drilling activities commenced in late-September. While the well was testing two Upper Cretaceous plays, neither play appeared to have commercial level of hydrocarbons (more information will be provided by management on this issue in the near future) so Apache opted to drill down to a total depth of 6,900 meters (~22,600 feet) to test a third Cretaceous play. This news sent shares of APA down by double-digits on December 2 as of this writing for reasons we’ll cover in this article. While shares of APA yield ~5.2% as of this writing, that payout isn’t sustainable in our view.

A Dud

Image Shown: An overview of Apache’s exploration blocks in offshore Suriname. While management has touted the exploration successes of other upstream operators in the region to the west of Apache’s exploration footprint, the company has yet to replicate that success. Image Source: Apache – November 2019 IR Presentation

Please note that conventional upstream exploration activities are far different than unconventional upstream exploration activities. By that we mean unconventional upstream efforts (combining hydraulic fracturing and horizontal drilling to unlock raw energy resources from shale, chalk, limestone, and other formations) generally allows for producing wells to come online with ease (there are rarely “dry holes” in this space), however, the economics of those wells are often challenged by very high production decline rates. High water cuts are another consideration (wells that yield a lot of produced water tend to be very uneconomical). Production from unconventional wells drops off precipitously, usually by 45-80% within the first year of the well coming online (depending on the play and the type of choke management schemes being used), so near-term raw energy resource prices have an outsized impact on unconventional well economics. If raw energy resource prices are low, these unconventional wells simply aren’t economical.

As an aside, there are example of unconventional plays being duds. We covered ConocoPhillips’ (COP) failure in Louisiana’s Austin Chalk play (a much different play than the prolific Eagle Ford Shale/Austin Chalk play in Texas) in this article here. The problems at that once emerging play include high water cuts and low productivity levels (when it comes to recovering raw energy resources), which means weak revenue generation and high operating expenses during a potential well’s lifecycle. Sure, raw energy resources can be recovered through unconventional wells tapping into the Louisiana Austin Chalk play, but those resources come with a cost of supply that would require raw energy resource prices to rise to levels not seen in years.

Conversely, conventional wells come with substantially lower decline rates but there are often dry holes in this space. If exploration efforts come up empty, there’s not much the operator can do but take the newfound data under advisement. Generally speaking, output from conventional wells ramps up over a 12 – 24 month period after coming online, plateaus for a few years, then slowly declines assuming the operator invests in base maintenance efforts (i.e. water or gas injection infrastructure to maintain reservoir pressure). The economics of conventional wells tend to be much stronger than unconventional wells (save for offshore conventional wells in the Artic), but first the upstream operator needs to locate significant recoverable resources to extract (as compared to simply acquiring acreage leaseholds in a known unconventional play, where almost any operator can quickly begin turning producing wells online).

Apache seeks to replicate the enormous success Exxon Mobil Corporation (XOM) has had in locating substantial offshore oil resources in Guyana, which borders Suriname to the west. Exxon Mobil discovered billions of barrels of recoverable oil supplies in the area over the past few years (these are low-cost raw energy resources) and the energy giant is moving forward with several upstream developments to commercialize those successes. That includes bringing several floating production storage offloading (‘FPSO’) vessels online in the region, including the Liza Phase 1 project which is set to reach first-oil by early-2020. Exxon Mobil’s partners Hess Corporation (HES) and CNOOC Ltd (CEO) are along for the ride as Exxon Mobil aims to produce ~750,000 barrels of crude oil per day on a gross basis from Guyana by the middle of the next decade.

For Apache, the dud in Suriname is particularly bad news. While management has plans to drill additional exploration wells in the area (which if successful, are then followed up by appraisal wells before even considering moving forward with production projects), Apache is running out of economical resources to develop. Its big bold bet on the domestic ‘Alpine High’ play on the periphery of the Permian Basin (please note the Alpine High is an unconventional play) was a complete bust as high natural gas production cuts and other factors yielded wells with terrible economics, especially after factoring in the hefty infrastructure investments made to support this strategy.

Apache’s more economical international production base (which comes from conventional upstream operations) has been sliding lower over the years, and the firm has yet to locate the kinds of discoveries needed to turn that picture around. As Apache’s international output moves lower, that will put tremendous pressure on its ability to generate free cash flows in the future. On the domestic unconventional front, Apache’s Tier 1 acreage position is relatively limited to just portions of the Delaware and Midland sub-basins within the Permian Basin.

Terrible Financials

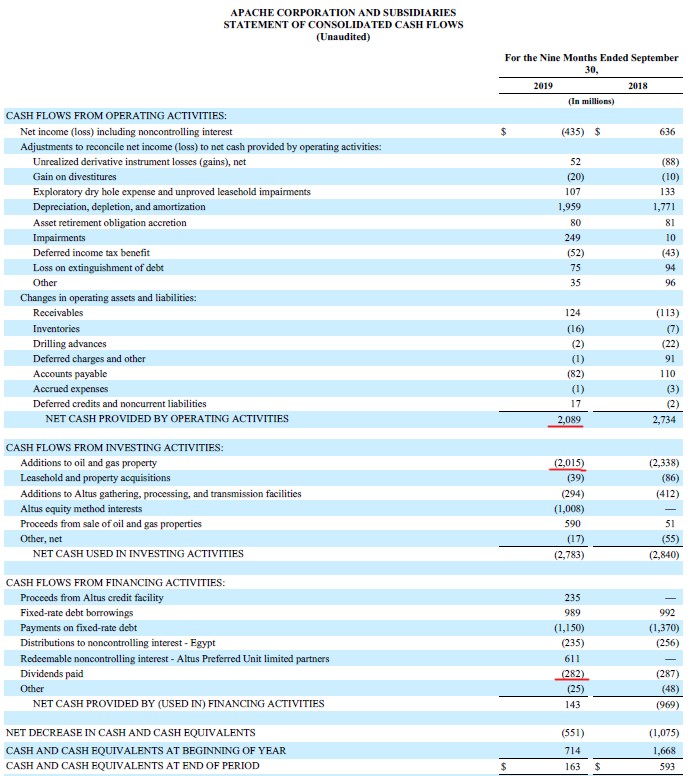

Domestic natural gas and natural gas liquids prices are very low right now, and oil prices aren’t doing much better relatively speaking. Apache has a lot of acreage in the Permian Basin at-large, but a good chunk of that is outside of core Tier 1 development regions (meaning the economics of those Tier 2 or worse well locations aren’t viable in the current pricing environment). Management is scaling back Apache’s Alpine High development activity in a bid to cut capital expenditures as meaningful free cash flow remains exclusive (the company was only marginally free cash flow positive during the first three quarters of 2019 on a consolidated basis). Apache’s dividend payouts have been funded by the balance sheet so far this year as you can see in the upcoming graphic.

Image Shown: Due to Apache’s need to invest heavily in its unconventional operations to maintain its production base, the upstream company was only marginally free cash flow positive during the first nine months of 2019. Image Source: Apache – Third Quarter 2019 10-Q Filing with additions from the author.

As an aside, please keep in mind Apache has a midstream spin-off Altus Midstream Company (ALTM), which Apache owns a material economic stake in. Due to Apache’s failure at Alpine High, the outlook for Altus Midstream looks bleak. At the end of the third quarter of 2019, Altus Midstream carried a net debt load of ~$0.25 billion.

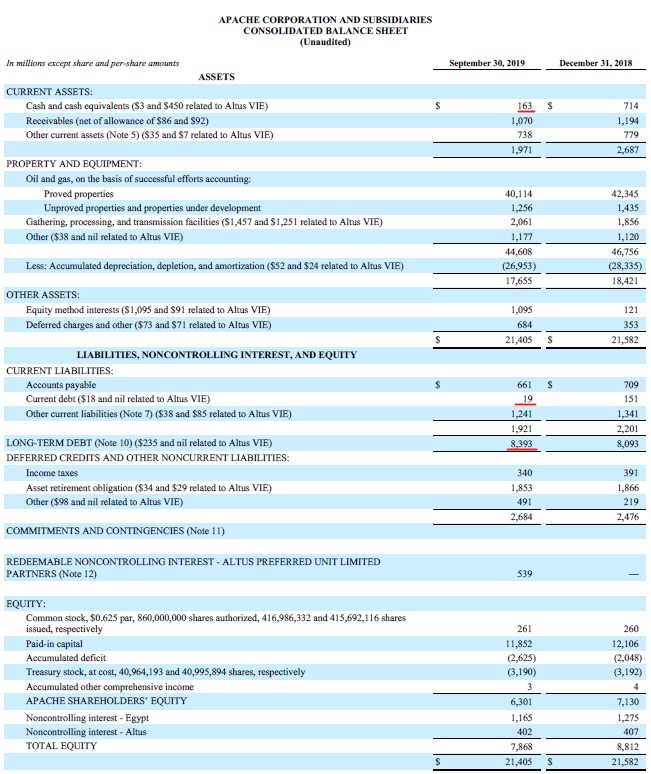

Making matters worse, Apache exited the third quarter of 2019 with $8.4 billion in total debt (short-term debt was negligible) versus just $0.2 billion in cash and cash equivalents on hand on a consolidated basis. The company’s free cash flows of late haven’t been large enough to cover its dividend obligations, let alone its massive net debt load, which is why we view Apache’s relatively high yield as a warning sign (not an opportunity). Apache’s Dividend Cushion ratio sits at -1.7x (negative 1.7x), and we caution that a payout cut may materialize over the medium-term if raw energy resource prices don’t improve considerably.

Image Shown: Apache carries an enormous net debt load on a consolidated basis. Image Source: Apache – Third Quarter 2019 10-Q Filing with additions from the author

What We Think

We recently updated our reports covering the independent upstream space (which can be accessed here). In the excerpt down below, we highlight what we view as Apache’s strengths as it relates to its dividend coverage (from our two-page Dividend Report that can be accessed here):

“Apache generates meaningful free cash flows from its international operations in Egypt and the North Sea, both of which are home to conventional oil-rich production streams. However, production from those regions has been in decline since 2015, and Apache sought to replace those volumes with output from the Permian Basin. Due to the capital intensive nature of unconventional upstream operations, Apache’s domestic free cash flows are non-existent when raw energy resource prices are low. That stresses its dividend coverage immensely, and we aren’t convinced of the safety of the payout.”

On the flip side, here’s what we view as potential weaknesses to Apache’s dividend coverage (also from our two-page Dividend Report):

“Apache’s ability to keep making good on its dividend obligations is highly dependent on future movements in raw energy resource prices. The company’s big bet on the Alpine High play did not go well, hurting its cash flow prospects in both the near- and medium-term. Declining international production levels and a hefty total debt load further stresses Apache’s medium-term outlook. The company is scaling back its capital expenditures in 2020 from 2019 levels in order to adjust, but we still aren’t convinced in the safety of Apache’s dividend coverage.”

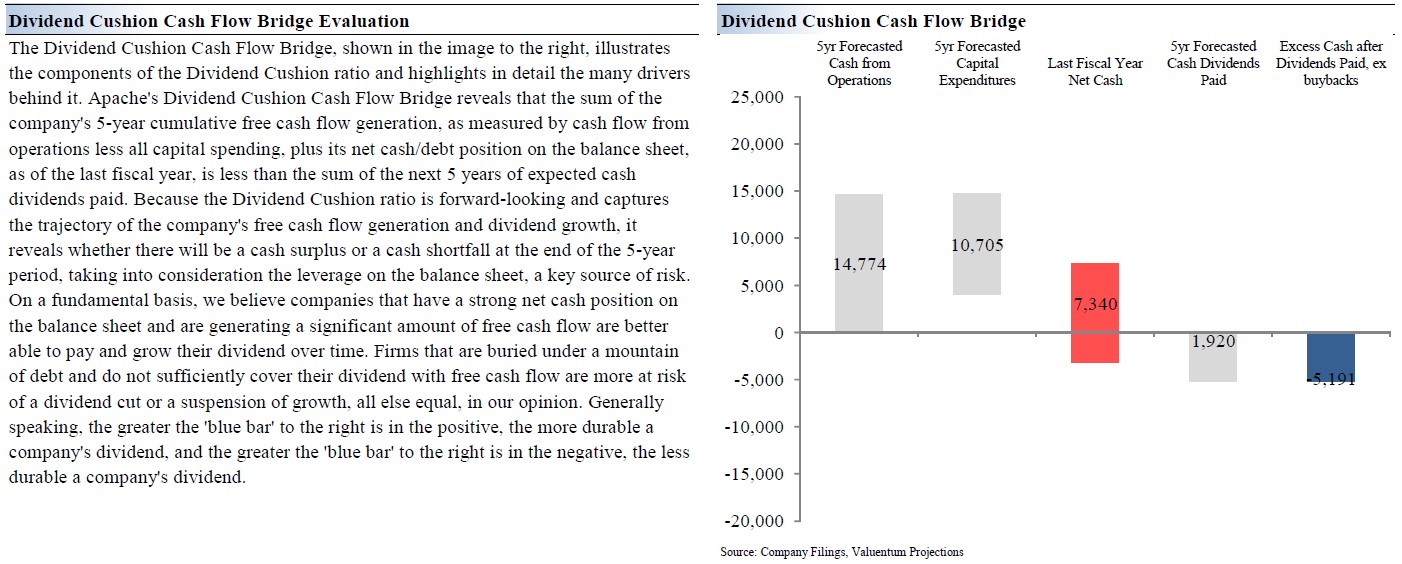

In the upcoming graphic (also from our two-page Dividend Report), we provide a visual breakdown of Apache’s weak Dividend Cushion ratio and the problems the firm will face when attempting to make good on its future dividend obligations. Management has communicated to investors that the plan is to reduce Apache’s capital expenditures by 10%-20% in 2020 versus 2019 levels; however, any reduction in capital investment will likely be met by a commensurate drop in the firm’s unconventional upstream output which will further stress Apache’s ability to generate cash flow. In other words, Apache and the rest of the unconventional upstream industry are stuck between a rock and a hard place.

Image Shown: Apache’s expected future free cash flows aren’t strong enough to cover its hefty net debt load and substantial expected future dividend obligations. The company may be forced to cut its payout in the medium-term if raw energy resource prices don’t improve considerably. Please note any recovery in raw energy resource prices, particularly global prices for crude oil, must be sustained in order to truly have a positive impact on Apache’s outlook.

Concluding Thoughts

We are staying far away from Apache and other independent upstream companies given the monstrous headwinds the industry faces. The “shale treadmill” forces companies like Apache to continue running elevated capital expenditure budgets in order to preserve their production bases, making positive free cash flow hard to come by when raw energy resource prices aren’t cooperating. If capital investment drops off, so does the firm’s oil and gas production. That’s on top of the enormous net debt positions most companies in the industry are contending with.

If Apache can’t locate material recoverable resources off the coast of Suriname (with an eye towards crude oil discoveries as the world is swimming in natural gas right now), its outlook will deteriorate further as the firm’s resource base is incredibly weak. As the company’s core Tier 1 Permian Basin acreage is relatively small, Apache doesn’t have any levers to pull to generate meaningful production growth to offset steep unconventional production declines. While Apache can attempt to locate significant discoveries in Egypt and the North Sea, most of its exploration successes of late in both regions have been marginal (not needle moving). Apache is now shifting its development focus to the core of the Permian Basin, but that strategy will simply buy the company time as its free cash flow outlook remains bleak.

Members interested is reading about a top quality energy/oil & gas company should check out why we like BP plc (BP) in this article here. Downstream operations, such as oil refineries and petrochemical plants, are required to maintain stable cash flow profiles during the entire business cycle. Shares of BP yield 6.6% as of this writing.

If you may wish to add the High Yield Dividend Newsletter to your membership, please click here.

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Oil & Gas Majors Industry – BP COP CVX TOT RDS.A/RDS.B XOM

Refining Industry – HES HFC MPC PSX VLO

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Related ETFs: XLE VDE IEO OIH PXI

Related – ALTM CEO

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. BP plc (BP), Enterprise Products Partners L.P. (EPD), and Magellan Midstream Partners L.P. (MMP) are all included in Valuentum’s simulated High Yield Dividend Newsletter. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.