Image Source: BP plc – Third quarter 2019 earnings infographic

If you may wish to add the High Yield Dividend Newsletter to your membership, please click here.

By Callum Turcan

On October 29, BP plc (BP) reported third-quarter 2019 earnings, and shares of BP have since climbed higher due in part to the energy giant’s nice cash flow profile and likely due to the improving outlook for a narrow US-China trade deal. We include BP in our High Yield Dividend Newsletter portfolio as a way to play the raw energy resource market and generate sizable income streams while taking advantage of the protection its large midstream (pipelines, storage facilities, etc.), downstream (refineries and petrochemical plants), and retail (gas stations/convenience stores) operations provide. Additionally, we like BP’s growing upstream oil & gas production base, a product of stellar operational execution of late. Shares of BP yield 6.3% as of this writing.

Cash Flow and Gearing Update

BP’s gearing ratio has moved up over its long-term target of 20%-30%, hitting 31.7% in the third quarter of 2019. Management expects BP’s gearing ratio will come down over time due in part to the expected cash proceeds from BP exiting Alaska. In August 2019, after operating for sixty years in the state, BP sold its remaining Alaskan assets to privately-held Hilcorp for $5.6 billion in total consideration ($4.0 billion in near-term payables, $1.6 billion in earnouts). The deal is expected to close in 2020 and will help pare down BP’s net debt load.

Management expects BP will divest $5.0-$10.0 billion worth of assets in 2019 and 2020, with the Alaskan sale representing a large part of that. In August, we published a note covering this transaction that members can check out here.

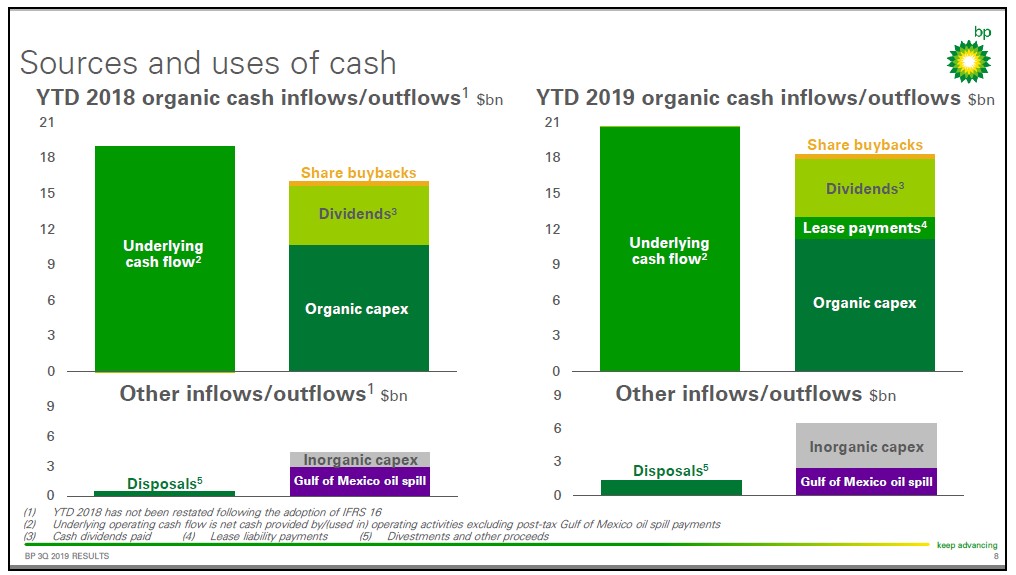

In the graphic below, note BP’s strong underlying cash flows relative to its dividend payments and organic capital expenditures. Looking ahead, BP’s Gulf of Mexico oil spill payments should continue to shift lower once most of the remaining payments are predominantly (if not entirely) from BP’s 2015 settlement with the US and five Gulf Coast states. BP paid $2.5 billion towards its spill-related settlements during the first three quarters of 2019 and expects to pay about that amount for the full-year (indicating minimal fourth quarter spill-related payments are expected to be made).

Image Shown: BP’s cash flow profile remains strong. Image Source: BP – Third quarter 2019 earnings presentation

Within its fourth-quarter 2017 earnings report, BP noted that by 2021, its annual Gulf of Mexico oil spill-related payments would hit ~$1 billion. That being said, these payments have often exceeded expectations, but the trend still holds (that payments are shifting lower as BP settles the remaining private-party agreements, keeping in mind the company’s Gulf of Mexico oil spill-related payments totaled $5.3 billion in 2017). Reduced oil spill-related payments will go a long way in bolstering BP’s cash flow profile.

Russian Holdings

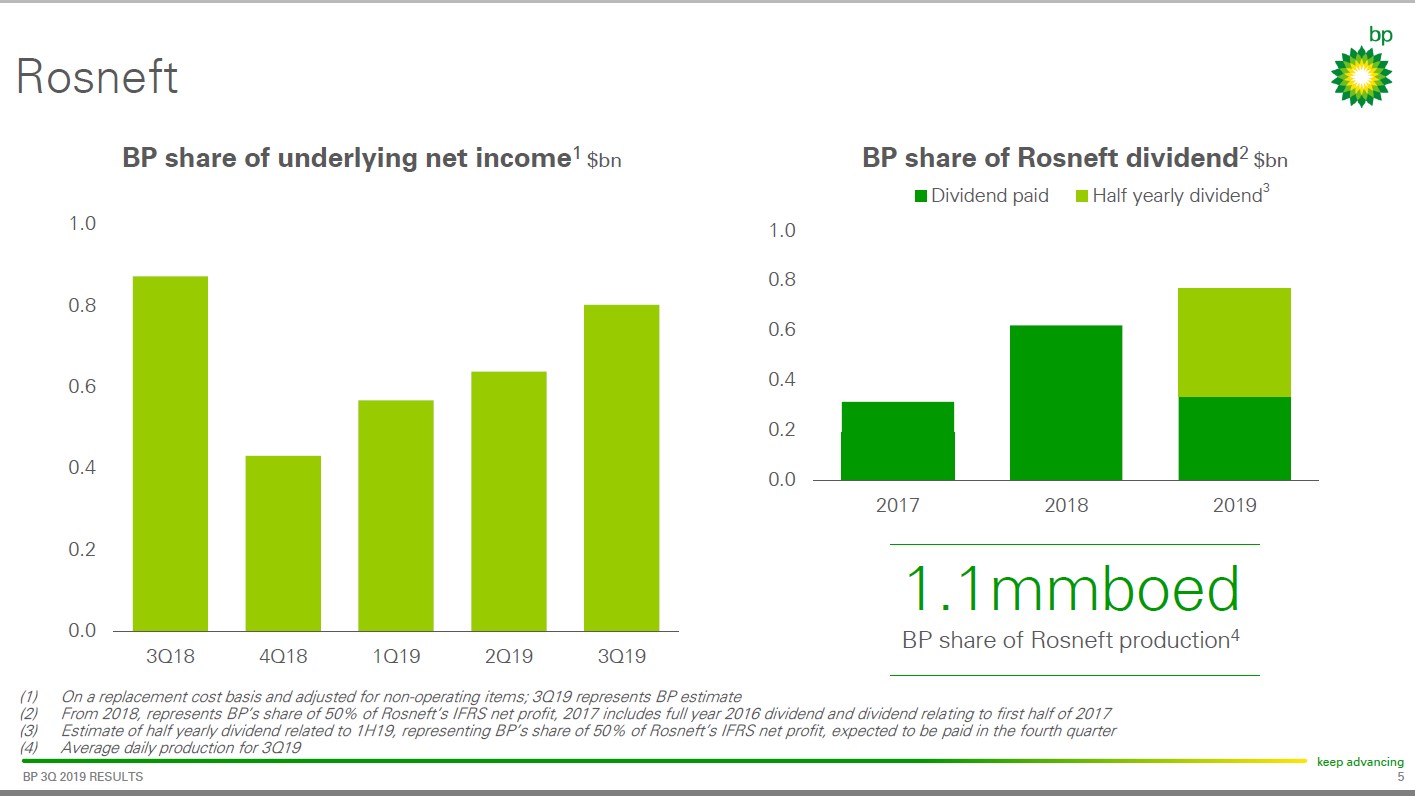

Please note BP owns just under 20% of Russian energy giant Rosneft’s (OJSCY) equity, which is very material given the sheer size of Rosneft’s upstream oil and gas output. In the graphic down below, BP highlights the significance of its equity stake in Rosneft to its own financials. As an aside, BP has a seat on Rosneft’s board (keeping in mind the Russian government generally has an outsized influence on the country’s energy policy). Rosneft is majority-owned by the Russian government. Going forward, Rosneft is investing in building out its own refining capacity while boosting its upstream production levels as best it can given the ongoing OPEC+ production limits in place that are curbing Russian oil output.

Image Shown: BP receives a material amount from Rosneft each year in the form of dividends paid to equity holders, a figure that has grown materially since 2017 due largely to oil prices stabilizing relatively speaking. Image Source: BP – Third quarter 2019 earnings presentation

Looking Ahead

Large energy companies like BP will always be at the mercy of market forces, with pricing for raw energy resources and refined products having an outsized influence on its financial performance regardless of how well its operating performance goes. While its downstream operations, such as its Whiting Refinery in Indiana, Cherry Point Refinery in Washington State, and BP Rotterdam Refinery in the Netherlands, helps mitigate the worst of a crash in raw energy resource prices (refining margins tend to rise when crude oil and natural gas prices fall), those assets can only do so much when upstream financials falter.

BP’s Whiting Refinery is particularly noteworthy as that facility directly capitalizes on the yawning spread between Brent, the world’s international benchmark that sets most gasoline and diesel prices (to a degree), and Western Canadian Select, the benchmark for heavy sour oil supplies namely from Alberta. Management seeks to continue expanding the facility going forward, building on past upgrades that turned out to be huge successes given the economics of refining heavy sour oil supplies in the US Midwest.

Additionally, BP has substantial petrochemical assets in the US, Germany, China, Taiwan, and elsewhere, which produce anything from plastics to lubricants. Those operations also tend to benefit from lower raw energy resource prices.

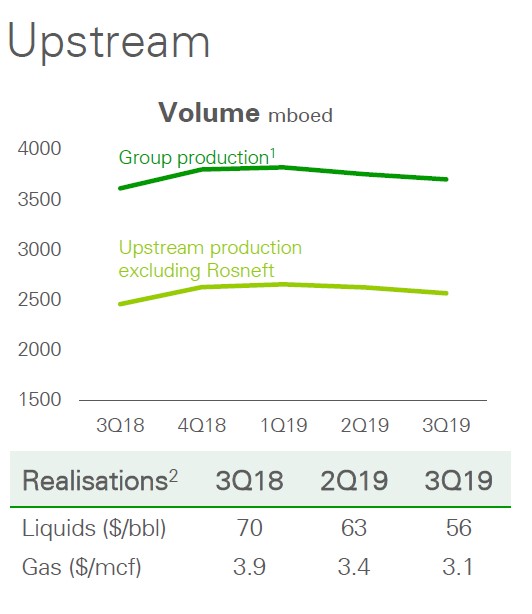

On the upstream front, BP has brought 23 of 35 planned major developments online since 2016 including; the Juniper project in Trinidad and Tobago (brought online on-time and under budget), Khazzan Phase One project in Oman (brought online ahead of schedule and under budget), the Thunder Horse Northwest Expansion project in the US Gulf of Mexico (brought online ahead of schedule and under budget), and much more.

Looking ahead, BP has upstream endeavors in Oman, the US Gulf of Mexico, Azerbaijan, and elsewhere that are slated to become operational over the coming years. The goal is to bring an additional 900,000 barrels of oil equivalent per day of upstream output online by the end of 2021 (from key projects completed in 2016-2021). We really appreciate BP’s stellar operational execution of late, subdued raw energy resource pricing aside.

Image Shown: BP’s realizations have weakened materially over the past year due to raw energy resource prices deteriorating in the face of a tsunami of oil, gas, natural gas liquids, and liquified natural gas supplies coming online in North America, Australia, and elsewhere. Image Source: BP – Third quarter 2019 earnings presentation

Concluding Thoughts

We continue to like BP as a holding in the High Yield Dividend Newsletter portfolio. Rising upstream production levels, a quality downstream footprint, and reduced Gulf of Mexico oil spill-related payments will go a long way in enhancing BP’s cash flow position. Raw energy resource prices remained subdued around the globe, but that isn’t stopping BP from fully covering its organic capital expenditures and dividend payments with underlying cash flows. We would like to see BP’s gearing ratios move lower, which is the stated goal.

Oil & Gas (Majors Industry) – BP COP CVX RDS.A RDS.B TOT XOM

Refining Industry – HES HFC MPC PSX VLO

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. BP plc (BP), Magellan Midstream Partners L.P. (MMP), and Enterprise Products Partners L.P. (EPD) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.