We remain impressed with the depth of research conducted over a wide host of disease states. Though a molecule may appear to hold significant promise in the pre-clinical phase, we have often witnessed the unique ability of the human body to react to various treatments. Often an unwanted side effect can torpedo a treatment, thus relegating millions of dollars of research obsolete. However, if a promising molecule is brought to market, the payoff is often well worth the effort. Our goal is to sift through the various clinical data to unearth the most promising treatments with the understanding that nothing is assured until the FDA authorizes the product for marketing in the US. We believe we have identified a promising junior biotech in the rare drug field with a promising treatment for sickle-cell anemia.

By Alexander J. Poulos

Sickle Cell Disease

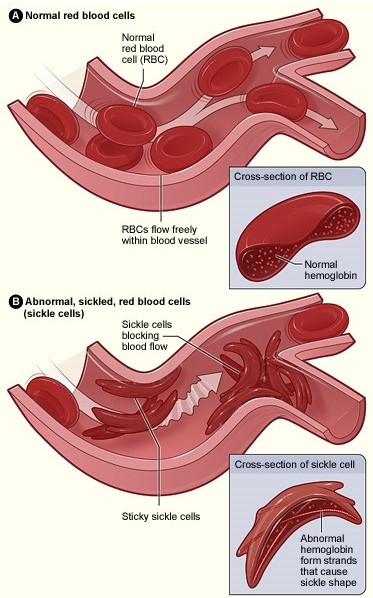

Image Source: National Institute for Health

Sickle Cell Disease (SCD) is an inherited genetic abnormality where the Red Blood Cells (RBC) of the patient lose their normal elasticity, thus forming a curved or “sickle” shape. The abnormal shape of the RBC reduces the oxygen-carrying capacity along with the expected lifespan of the RBC. A sickle cell will last from 10-20 days, a far cry from the 3-4 month lifespan of a normal RBC–thus the patient’s body will constantly need to replace the cells at a much faster clip than the norm. The patient’s body is often not up to the task leading to anemia (the lack of RBC’s leads to a sharp drop in the oxygen levels of the patient—in essence, the patient will suffer from chronic fatigue).

In addition to the lack of oxygen, the abnormal shape of the RBC will often lead to the cells becoming “stuck” in the patient’s veins and capillaries which can be very painful. SCD is considered a rare disease with approximately 100k patients afflicted in the US and 60k in Europe. In addition to the decrease in the quality of life, patients with SCD will suffer from a reduction in life expectancy, to 40-60 years of age. We feel the marketplace of potential patients is robust, and a critical need for new therapies exists. The current gold standard is the utilization of Hydroxyurea for the treatment of SCD—Hydroxyurea belongs to the antineoplastic category with a litany of unwanted side effects such as bone marrow suppression and increasing the patients risk for developing certain cancers.

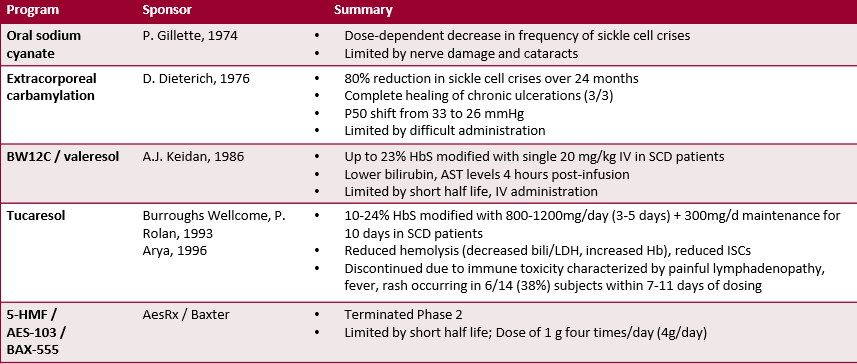

Image Source: Global Blood Therapeutics Corporate Presentation

Global Blood Therapeutics

Global Blood Therapeutics (GBT) is a junior biotech with two compounds in the various stages of clinical testing. Global’s lead compound is GBT 440 for the treatment of SCD in adults and children. GBT 440 is a unique product which aims at addressing the root cause of SCD by increasing hemoglobin’s ability to bind to oxygen. The goal is by adding oxygen to sickled hemoglobin, it will prevent the cell from polymerizing thus preventing the RBC’s from deforming.

The scientific concept underpinning GBT440 is well-founded in past research with numerous companies attempting to bring a similar treatment to market with limited success–due to either an unwieldy dosing regimen or unwanted side effects. For example, Extracorporeal Carbamylation was a promising area of research in the 1970s with favorable results, but the frequent need for infusion limited the treatment’s effectiveness. We are impressed with the initial clinical results posted by GBT 440, which we feel may validate the thesis. The most impressive portion of the recent study is the relative absence of the side-effect cascade that has torpedoed similar treatments in the past.

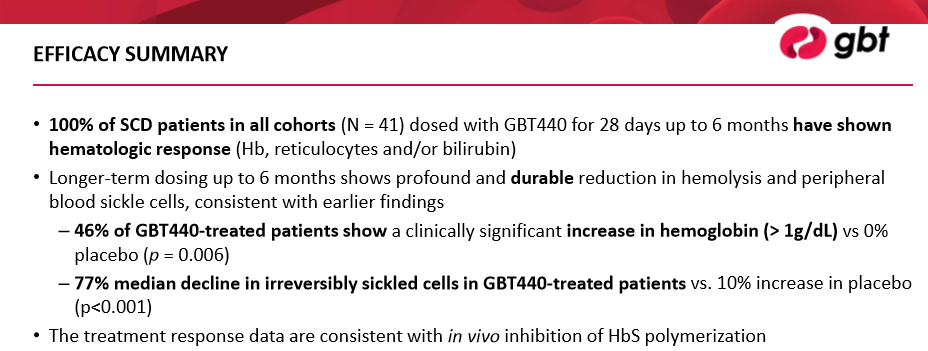

Image Source: Global Blood Therapeutics Corporate Presentation

We remain highly impressed with the data released from Phase 2 testing of GBT 440. We would like to highlight two distinct portions of the study that we feel underscore the potential of GBT440. The 46% of patients treated with GBT 440 that registered an increase in Hemoglobin of greater than 1g/dl augurs well for the overall success of the product, in our opinion. By selectively attacking SCD at the cause well before the cells will sickle, Global is able to generate a similar jump in hemoglobin levels (protein in RBC’s used to transport oxygen in the body) that is witnessed when a patient receives a blood transfusion. The frequent need for blood transfusions is one of the costs associated with the disease. Generating a level akin to a transfusion will go a long way towards improving the quality of a patient’s life in addition to reducing payors reluctance to pay for the therapy. With SCD considered a rare disease, we expect the price tag for the treatment to be hefty, thus payor acceptance is crucial for the ultimate commercial success of the product.

We believe the dramatic drop in irreversibly sickled cells bodes well for the ultimate commercial potential of the product in our opinion. The stunning drop in sickled cells of 77% at the median versus a 9.7% increase in the placebo arm indicates, in our view, the product is highly effective thus far. Based on the initial data reads, the FDA has designated GBT440 Fast Track, Orphan Drug, and Rare Pediatric Designations. The Rare Pediatric designation is particularly valuable as viable options for children remains scarce. The European Medicines Agency added GBT440 in its Priority Medicines (PRIME) program and declared GBT440 an orphan medicinal product for the treatment of patients with SCD. While designation is not an assurance of commercial success, we are comforted by the FDA’s and its European counterpart’s designations as it enhances the product’s potential for approval–as regulators are keenly interested in accelerating the product’s path to market (due to a significant unmet need). Assuming final testing parallels the results shown thus far, we feel a clear path to market is established.

Patent Life and Competitive Landscape

The IP estate that protects GBT440 is valid through 2032, and more impressively from an investment perspective, Global exclusively owns the rights to the molecule. We feel the patent estate is solid as the extensive life on the patent bodes well as it will take a few years post a successful commercial launch to hit peak sales. Global does not run the risk of its patent life falling short before it can reap the full benefits if GBT is a success, from our perspective. European powerhouse Novartis (NVS) has entered the fray with a recent acquisition of Selexys for its lead compound Crizanlizumab a humanized P-selective monoclonal antibody utilized to reduce the pain associated with SCD. Novartis is a deep-pocketed formidable opponent with an expected phase 3 completion in 2018 for Crizanlizumab. While we feel Global’s oral small molecule is a superior treatment due to its ability to prevent sickeling versus Crizanlizumab’s ability to decrease pain only, Novartis will have a crucial head-start to market.

The second competitor of note is a procedure that utilizes gene editing therapy being conducted by bluebird bio (BLUE). The only known cure for SCD is through a bone marrow transplant, but the vast majority of those afflicted with SCD do not have a sibling marrow match thus precluding the treatment. For those fortunate enough to have a sibling match, the procedure is fraught with peril as the potential for death can occur. bluebird is hoping that its therapy will improve patient’s lives, but the product remains mired in phase 1/2 testing. We remain impressed with bluebird and will patiently wait for its results, but until phase 2 testing results are released, it is diffiuclt for us at this time to form an opinion on the treatment.

From our perch, the ultimate victory will be the therapy that is effective with the most favorable side-effect profile. In our opinion, if GBT440 can duplicate its impressive results in a larger scale phase 3 trial, it may become the therapy of choice due to its once a day oral dosing form and thus far benign side effect profile.

Risk Factors

A few noteworthy caveats need to be highlighted to paint a more comprehensive portrait of the opportunity in SCD. While we are highly impressed with Global’s data, the sample size of 41 patients with some arms of the study consisting of 6 or 7 patients is a very small sample size. While we feel the initial results largely validate the thesis, a significantly larger sample size is necessary. Global is conducting phase 3 trials with an expected data read in early 2019 that will incorporate a much wider sample size. The Phase 3 trials are a two-part design with the first part intended to address the optimal dosing regimen for GBT 440. Management has remained very coy as to when we will have an interim data read; we feel this is a 2018 event.

GBT440 is the central star of Global Blood Therapeutics clinical pipeline. A failure to launch would have a negative material impact on the valuation of the equity. While Global does have an additional compound in phase 1 testing, if GBT440 fails in Phase 3, we feel the company will face a cash crunch. The executive team has stated the company is well funded through 2019, but a failure will severely diminish the company’s potential to support additional trials.

Concluding Thoughts

We remain impressed with the possibility of GBT440 to alter the treatment paradigm of Sickle Cell Disease radically. With over 100k patients afflicted in the US alone, we estimate the product, if commercially approved, will surpass over $1 billion in sales. We do suspect upon approval that Global will need to raise additional funds to build out a sales force to promote the product. One way to achieve this goal is through a strategic partnership, which thus far Global has resisted. We view the lack of a strategic partner as a positive, as it leaves all options on the table including an outright sale of the company to big pharma with an in-house sales force ready to promote the product. We view the potential of a deal to acquire the company in its entirety will diminish if GBT440 were partnered with a deep-pocketed established pharma entity. We will continue to monitor the events at Global with a keen eye for additional data from the ongoing clinical trials. This one is most certainly for your radar, but it the idea comes with tremendous risk.

Independent healthcare and biotech contributor Alexander J. Poulos is long Global Blood Therapeutics.

Note tickerized for stocks in the IBB.